The Bar Harbor Story is generously sponsored by Acadia Shops.

BAR HARBOR—In a meeting that lasted just over an hour, Town Manager James Smith presented the budget to town councilors and warrant committee members, January 23, in a high-level overview. It’s a budget that he hopes will help the town deal with bond payments on school and infrastructure as well as inflation.

The goal, he said, is fiscal stability.

Smith hopes he and Finance Director Sarah Gilbert can help the taxpayers have that.

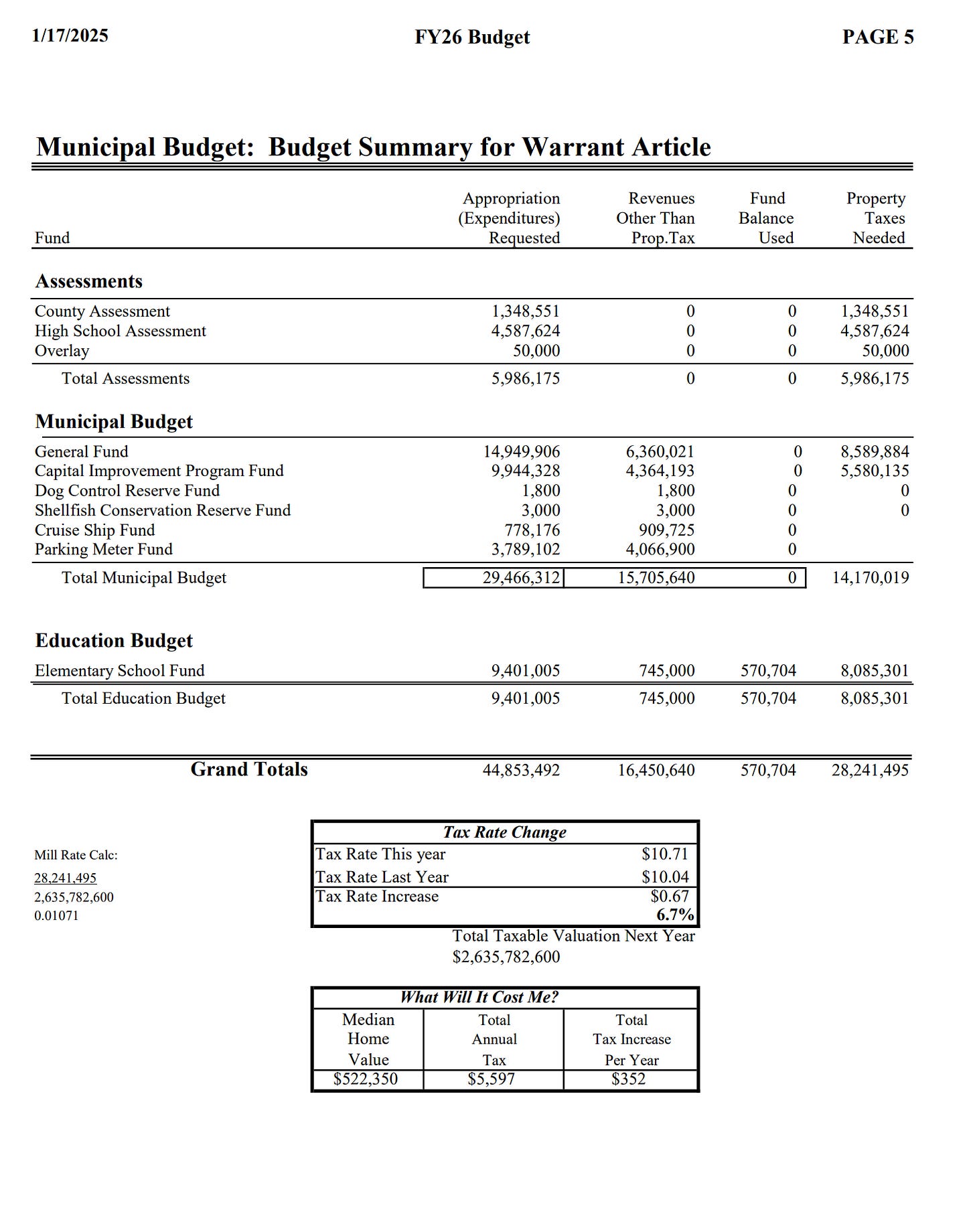

The current tax rate is $10.04. The proposed rate is $10.71. For a property owner with a median home value of $522,350, the total annual tax would be $5,597 a year. That is an increase of $352 this year.

Town Council Chair Valerie Peacock said she appreciated the work of the staff in keeping down costs that were within the municipal portion of the budget.

Smith thanked department heads for stepping up and said Gilbert’s work on the budget is invaluable.

“She’s the one who deserves all the credit for the good fiscal management,” Smith said. He also thanked Liz Graves, town clerk, for producing a consistent, accurate document. “She does a fantastic job of that.”

Warrant committee members and town councilors both recommend tweaks to the budget, but it is up to the voters at the town meeting to finalize and approve the budget. The budget can be tweaked during that meeting. The council and warrant committee’s recommended budgets and endorsement (or lack of endorsement) is also shown to voters.

THE BUDGET

In a January 17 memo addressed only to the town councilors, Smith wrote, “The FY2026 budget reflects the Town of Bar Harbor’s strategic commitment to balancing fiscal responsibility with the delivery of essential services and investment in critical infrastructure.”

It’s a message repeated throughout the budget documents, often called a “binder” because the hard paper copy is presented to councilors and warrant committee members in large plastic binders. The budget is also available online.

The voter-passed school bond and infrastructure bonds are impacting this year’s budget.

“In FY2026, the budget accounts for the full financial obligations of both bonds, principal and interest. To stabilize the tax mil rate amid these increased obligations, the FY2026 budget proposes utilizing parking revenues for property tax relief,” Smith wrote.

It’s a bit more than that, too.

“Additionally, we are recommending some use of the parking fund balance as a stopgap measure to further mitigate the tax burden on property owners. These measures are designed to provide immediate tax relief while supporting long-term fiscal sustainability,” Smith wrote.

He also said the budget “prioritizes operational efficiencies and the expansion of revenue streams to stabilize future tax rates.”

In the proposed budget, Smith advised increasing pay for senior employees (employees who have been there over ten years) for police and dispatch. Legal services is increased because of ongoing lawsuits. Employee benefit increases are mandatory employer contributions to the Maine Public Employees Retirement System (MPERS) and the increased cost of healthcare. Increases in the public works department stem from overtime, tree pruning, and culvert replacements.

Decreases in the solid waste come from realizing that there is more cushion there than needed.

Key projects, Smith pulled out for notice in his memo included:

Public safety enhancements:

Replacement of turnout gear for the Fire Department ($76,000)

Updated radio equipment for Dispatch ($56,000)

New FD command vehicle ($70,000)

PD cruiser replacements with equipment ($146,000)

Maine Public Employees Retirement System 3C funding ($84,000)

Infrastructure Improvements:

Road Improvements and Repairs ($1,400,000)

Sidewalk construction and maintenance ($300,000)

Heating system replacements municipal facilities ($300,000)

Gangway upgrades ($60,000)

Town Pier Fisherman’s hoist ($35,000)

Community and Recreation Investments:

Playground equipment upgrades ($20,000)

Restroom renovations across four facilities ($265,000)

Park fountains ($30,000)

Bikeway and pedestrian connections and improvements ($30,000)

Continuation of Safe Streets for All program ($50,000)

Sustainable tourism & resources planning ($140,000)

The tourism and resources planning is linked to the Sustainable Tourism Task Force, which was just created by the council, earlier this week.

POTENTIAL CHANGES

Councilor Matthew Hochman suggested looking into having higher fees for parking violations (such as parking in front of a fire hydrant) than the violation for parking at an overdue metered space.

The estimated appropriation for Mount Desert Island High School and the Hancock County portion could be changed because the high school budget hasn’t yet been voted on and Gilbert has not yet received Bar Harbor’s appropriation for the county budget.

The situation with Glen Mary is also a bit fluid, Smith said when asked by Peacock about why the item was showing no expenditures.

“Discussions are still ongoing,” Gilbert said.

“Glen Mary is private property owned by the VIA,” Smith said. “They have their own architects. They have their own engineers.”

The funds are still there, he said, but when the improvements happen are slightly outside of the town’s control. The process is complicated, he said. The town has proposed putting $27,000 into that budget line this year.

HIGGINS PIT MONEY

Councilor Earl Brechlin asked about where the Higgins Pit budget money was within the budget. Peacock said she’d like to see how that money is being used in one place would be helpful.

Warrant Committee Chair Christine Smith and committee member Eben Salvatore suggested using some of that money to offset the new school’s energy cost.

In November, voters agreed that the $4.35 million they had approved of originally to create the now-defunct Higgins Pit Solar Array Project, should now be used for capital improvements to town-owned properties that will be used to reduce carbon emissions, promote energy efficiency, and lower operating expenses

The Town Council decided in May 2024 to not go forward with the Higgins’ Pit solar array project and instead directed Smith to find other projects and ways of achieving the goals of that project.

The project was approved by voters in 2022, but since then, costs had risen beyond initial projections, prompting concerns for some. Because of the site of the town-owned property, for the project to go forward, wetland remediation would have to be done, a road would have to be built, and the project itself had been downsized before it was cancelled.

Proponents had said that even with those changes, the project was worth it for the carbon-offsets and climate-positive impacts. The town has already made one payment on the $4.35m bond, which was sold in August 2023.

PAYMENTS IN LIEU OF TAXES (PILOT)

The group briefly discussed payments in lieu of taxes (PILOTS). Nonprofits have the legal option not to pay property taxes unless the property is used for certain purposes. It is not an automatic process and applications must be completed to gain the exempt status. The State of Maine statute explains the property of institutions and organizations that is exempt from taxation.

“These payments in lieu of taxes are voluntarily made,” Smith said. Usually, it’s a gift to the town by that agency. The town has no legal ability to require it.

“There’s no leverage there?” warrant committee member Steven Boucher asked.

There is not, Smith agreed.

Newly appointed town councilor Randy Sprague said that when facilities are taking properties off tax rolls, the town should be asking them for help. When the costs of living goes up, the costs to taxpayers go up, then it would be honorable for the PILOTs that are given to increase as well.

“We can’t strong arm them,” Sprague said, “but we can request.”

Peacock said that she’s received feedback and that organizations are open to it if they aren’t singled out, but having a group conversation in public spaces.

Salvatore said two years ago the warrant committee asked the town to work with the nonprofits to give to the school.

“Collectively to put them all in a group sounds good, but you have nonprofits that struggle to make ends meet,” he said, while another makes almost a billion dollars in revenue.

Warrant committee member Julie Berberian suggested potentially creating something to help with property tax relief for those who are struggling and asking nonprofits to help with that, reasoning that it might be a potentially motivating and community-building reason to give.

Smith said he and Gilbert have had conversations about targeted programs already in the budget that a nonprofit might want to donate to.

“I think that’s a great idea and it’s a feather in their cap,” Sprague said.

The total taxable real estate value in 2022 for the Town of Bar Harbor was $2,119,689,500. Adding in the tax-exempt properties, that value goes up to $3,179,640,200. That means the Town of Bar Harbor has approximately $1,059,950,700 of property value that is claimed as tax exempt.

ISLAND EXPLORER

Councilor Maya Caines had reservations about decreasing the funding for the Island Explorer within the cruise ship budget.

That money is specifically for cruise ship passengers doing the Sand Beach run, Peacock said. Support for the free bus system is in other portions of the budget.

“I think it’s a really important,” Caines said of the bus system that residents also use.

CRUISE SHIPS

Town staff believes that there are no new cruise ship reservation requests after the Spring of 2026. Fees related to cruise ships are in the current budget.

“Obviously, there are a lot of things changing with cruise ships in Bar Harbor,” Smith said, “with the citizen’s initiative and the ballot questions.”

The town is proposing in its FY 2026 budget to increase passenger fees from $2.84 to $9.45 per passenger, and increasing the port development fee from $2.53 to $4.55. That is a total passenger fee of $14.

According to the budget packet the adjustment of those fees are “critical to maintaining the town’s ability to provide high-quality services while meeting financial obligations.”

At the same time, the town expects to have decreased direct expenses on operational demands. The proposed draft budget decreases those expenses from $349,863 to $250,109.

“These reductions include cuts to contingency funding, Island Explorer support, and operational costs such as administrative services, port security, comfort stations and public works,” Smith wrote. “Additionally, capital allocations have been reduced by $110,000. Even with these measures, fee adjustments are necessary to ensure fiscal sustainability.”

In the budget memo, Smith also writes of the town’s “strategic considerations.”

“As Bar Harbor adapts to the disembarkation limit, it must balance the need to honor pre-existing agreements with a forward-looking strategy. Ships that confirmed visitation before the March 2022 petition remain authorized, reflecting the town’s commitment to honoring prior arrangements,” Smith wrote. “However, this adjustment period also offers an opportunity to refine Bar Harbor’s approach to cruise tourism and position the community for long-term sustainability.”

Peacock asked if the fees are still based on lower berth capacity rather than disembarkation limits. They are. Conversations with American Cruise Lines, which may begin to disembark on the town’s pier could also create a totally different analysis and a totally different agreement, Smith said. Those potential landing/disembarkation fees are not in the budget.

The town has not talked to the cruise lines about any of the changes in the fees. He said the changes have been out in the public for two weeks and there has been no feedback or contact from the cruise lines. He also verified that the town has an analysis from the town attorney about the town’s ability to do that change.

“It’s a brave new world,” Smith said, “under these types of regulations. We’ll have to navigate that as we go through it.”

The fee changes would apply to all cruise ship visits, even those that reserved prior to the disembarkation limits going into effect, but the council would have to amend the fee schedule to charge those increased fees.

In the budget, as proposed, the cruise ship fund revenues estimate $321,296 in passenger fees for this year and the if the changes go through, $614,063 for next year.

Port development fees have dwindled from $620,632 in 2023 to an estimated $295,660 in the next fiscal year.

Total direct expenses are expected to increase to $250,109. That’s up from $205,777 in FY2023. Allocated expenses toward associated operations (such as administrative services, port security services, harbor management services, comfort station services, and public work services) have a proposed increase to $304,196. That’s an increase from 2023’s $238,656.

“Recalibrating the town’s approach to cruise tourism from large vessel visitations to small vessel visitation is critical. Smaller boutique cruise lines will align with the town’s capacity limits and offer high-value tourism opportunities. Attracting these smaller vessels will help ensure sustainable economic benefits under the new regulatory limits,” Smith writes.

Warrant committee member Shaun Farrar and Hochman both said that they were concerned about there being a place where foreign-flagged vessels could disembark passengers and how that could impact the budget that has that revenue coming in.

Smith said he was cautious to respond in the venue about communications they have had with ACL without having a tentative agreement. “I don’t think that’s going to be a problem.”

“I think there’s going to be a sort of max we can charge per passenger and a marked reduction for visitation,” Peacock said of the cruise ship budget and suggested that it will be the last year that town will see some of those numbers in the cruise ship budget.

THE PRESENTATION

LINKS TO LEARN MORE

Budget Workshops

Joint meetings of the Town Council and Warrant Committee for detailed presentation of the proposed budget, and opportunity to ask questions. All at 6:30 p.m. in the Municipal Building Council Chambers.

January 23 - Introduction of the municipal budget by Manager and Finance Director

January 28 - School Budget

January 30 - Discussion of outside agency requests

Disclosure: Shaun Farrar is an elected member of the warrant committee. Because of that, he hasn’t proofread this article. Please be kind if I have a lot of typos. We are just a team of two over here on the best of days. Also, let me add the disclosure that I did last year: Although we are married, we do not always think the same way on all things and we have entirely different brains.

All images are from the budget packets.

If you’d like to donate to help support us, you can, but no pressure! Just click here (about how you can give) or here (a direct link), which is the same as the button below. Our mailing address is 98 Ledgelawn Ave., Bar Harbor, Maine, 04609

If you’d like to sponsor the Bar Harbor Story, you can! Learn more here.

I'm wondering myself if the town should be giving the Island Explorer 95k a year for the sole purpose of shuttling cruise ship passengers to Sand Beach and back. Giving the Island Explorer money is something all the towns should be doing (looking at you Trenton) for the citizens and tourists but how we ended up giving away 95k for ship passengers to see ocean drive when they already have their own busses and Ollie's trolley seems wasteful. Does anyone know what the town gives the I.E. outside of the cruise ship fund?