The Bar Harbor Story is generously sponsored by Andy’s Home Improvement Inc.

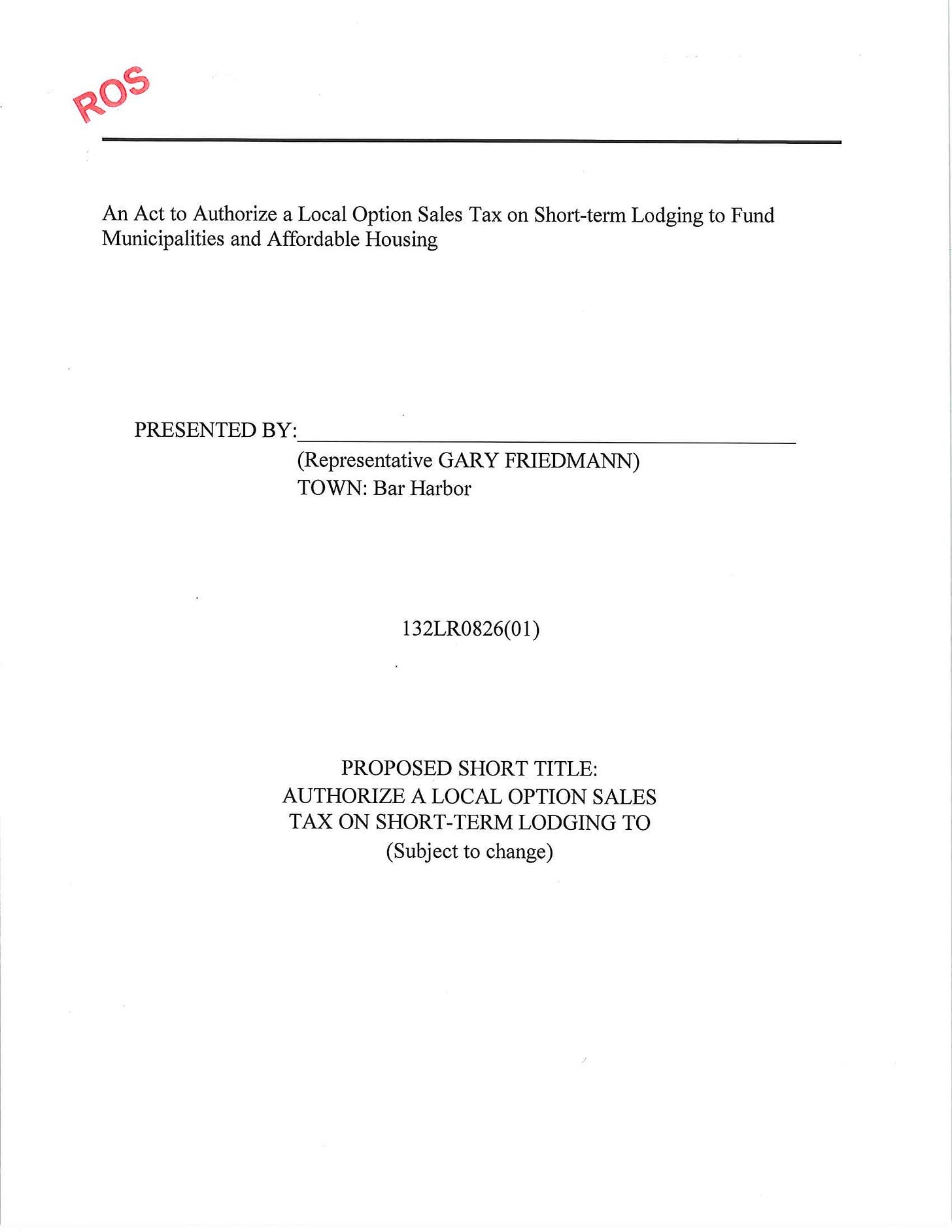

BAR HARBOR—Recently elected State Representative Gary Friedmann met with interested members of the Chamber of Commerce on Monday morning, January 27 to talk about the bill he has submitted and that if enacted would allow municipalities to add a 2% lodging tax within their city or town.

Rep. Friedmann said, “Ten months ago at the Jesup Library there was a forum.” There was pretty much consensus at that library meeting, he said. “A lot of people left that meeting thinking that it was a way that Bar Harbor could deal with its challenge.”

That challenge? How property owners in a community of just over 5,000 year-round residents can financially survive despite escalating infrastructure needs, school needs, salary needs, increasing water and sewer bills.

There is also $100 million in bonds that the town is maintaining and an expected decrease in cruise ship revenue, occurring with a simultaneous increase in parking revenue.

There are quite a few hurdles for bills like Friedmann’s to be enacted even when the goal is to create local property tax relief.

It’s not a new conversation. And for a local options sales tax to happen, Maine’s state legislature has to give the go-ahead, something it’s never done before.

Just in the last few decades, moderator Jill Goldthwait said at that meeting back in March that there’s been at least 84 local option sales tax bills before the state legislature.

They’ve all failed.

A local options sales tax could be on lodging, food, and other things sold.

“It isn’t going to be easy in the legislature,” Friedmann said.

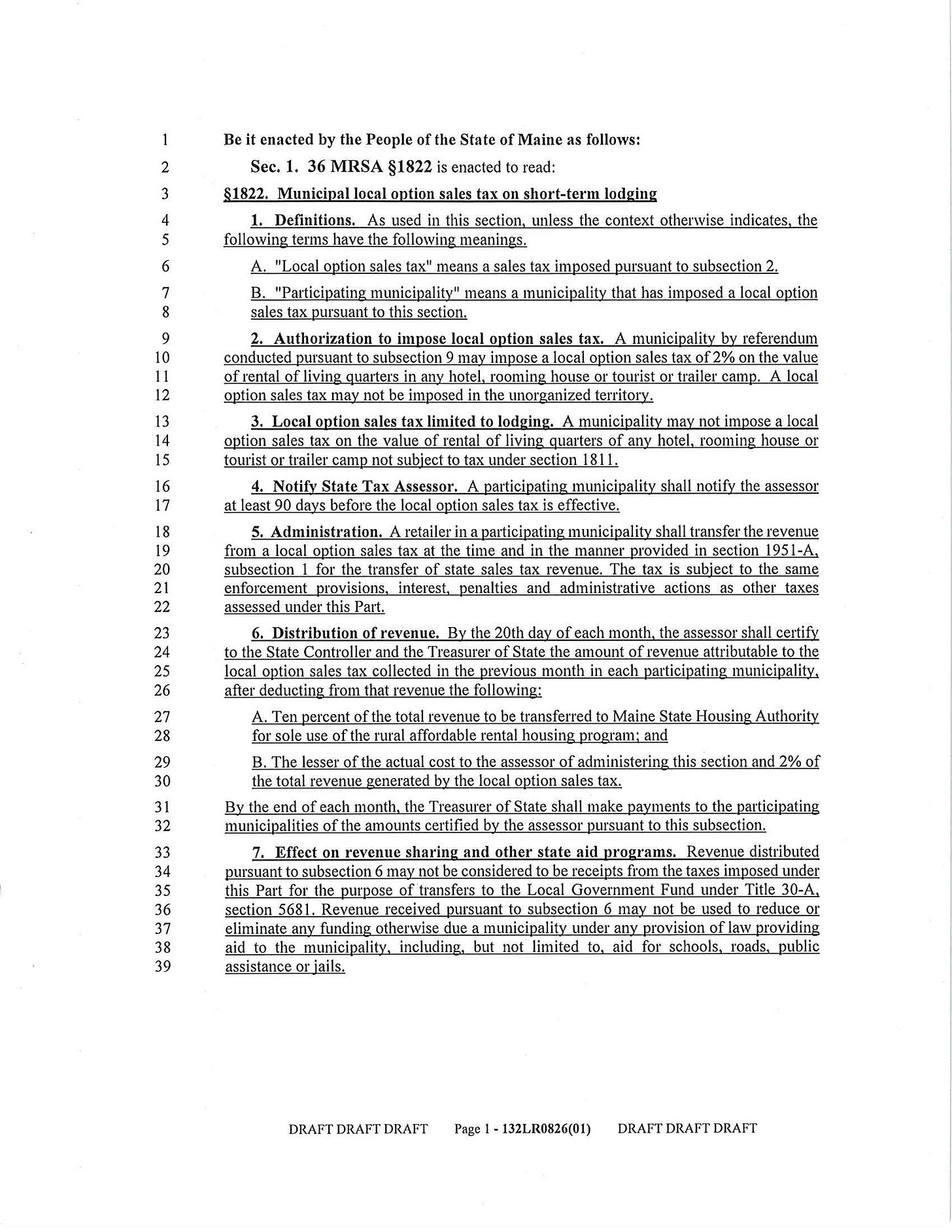

Friedmann’s plan would call for a 2% tax on short-term lodgings. As proposed, from that tax collected, 90% would go back to the city or town where it was collected and 10% would go to the state’s Maine State Housing Authority “for sole use of the rural affordable rental housing program; and the lesser of the actual cost to the assessor of administering this section.”

“I don’t see this as a tax on hotels. I see this as a tax on our visitors,” Friedmann said. He envisions the tax as a way for visitors to help pay for their share of the use on the town’s public safety, roads, infrastructure, park upkeep, and other uses.

In material Friedmann passed out at the meeting with the Chamber members, it states, “Maine residents face the highest property tax burden in the U.S. with the average homeowner spending 4.86% of their income on property taxes—more than other states in the nation.”

It’s also one of just three states that do not allow local lodging taxes. The others are Connecticut, which has a 15% state lodging tax, and New Hampshire.

“Maine’s reliance on property taxes to fund essential services like public safety and sewer means homeowners are covering the costs for visitors who increase demands on these services,” the paper reads.

THE NUMBERS

Maine currently has a lodging tax of 9%. The average combined local and state tax paid by hotel guests across the country is 13.5%. However, Maine is the third highest lodging tax in the country, tied with Vermont. Connecticut and Hawaii are the only two with higher rates.

In Bar Harbor, Friedmann said, the lodging sales in 2023 were $141,629,456, a 270% increase since 2007. Bar Harbor is not alone in that increased lodging sales. Most towns see increases of over 100 and 200% in that time frame. Some towns, such as Dover-Foxcroft and Trenton have increases over 300%.

A 2% sales tax on Bar Harbor’s 2023 sales would be $2,832,589. Then, 90% of that number is $2,549,330, or as Friedmann said, enough to pay the school bond each year.

THE PAST AND THE PUSH FORWARD

The last attempt at a local options tax this spring failed by five votes in the state house, Friedmann said.

Friedmann and other supportive legislators have looked at the vote tally. They hope to have “one-on-one meetings with state reps we might be able to tell our story,” Friedmann said.

Because of the state-wide burden of property taxes, there might be more sympathy this time around. More towns in service centers and on the coast are interested in alternative streams.

“Whenever I share with a legislature how much they might get—especially if its six figures—it piques their interest,” Friedmann said Monday.

Back in 2007, Dick Cough, a member of the Local Sales Tax Option Committee in Bar Harbor held sessions and had an action plan intended to gather regional support for a local options sales tax. At one point, the committee had three alternative plans. Other efforts in the past fifty years have also not changed the state law.

On January 21, at Friedmann’s last meeting on the Bar Harbor Town Council, the councilors unanimously supported a resolve saying that they would support a local option lodging tax to reduce dependency on property taxes by municipalities.

HOW IT USUALLY WORKS

In most other states, the person providing the service that collects current lodging tax (9%) or sales tax (5.5 %) would also collect the tax for the community. This is likely how it would happen in Maine, Senator Nicole Grohoski said in March of the previously proposed bill, which failed.

Any money raised would go first to the state. The state would then remit it back to the community where the tax was collected.

Once approved by the state, a local community, by majority vote, would have to vote in support of it in referendum.

Then, the state would give permission for a community to authorize the tax.

THE CHAMBER EVENT

Bar Harbor Chamber Board Chairman Gary “Bo” Jennings introduced the event at the Machias Savings Bank. Eighteen people attended.

“This is an important conversation,” Jennings said, thanking the Chamber of Commerce team for making it happen. “Gary and I had a conversation a few weeks ago and he reached out and told me about the local options sales tax he was putting before the state.”

Jennings categorized the conversation as honest and tough. “Honest and tough conversations are okay as long as they end in results.”

Tone and rhetoric, solutions focused, not blaming, asking tough questions and being honest from all parties involved was what Jennings hoped for from Monday’s conversation.

“We may not agree on all things, but we all have to be respectful,” Jennings said. “You just being here means a lot.”

“We’re not enemies. We’re allies,” Jennings added.

During the discussion, Friedmann was questioned by restaurateur and hotelier Tom St.Germain about his support of a local moratorium on lodgings, which pauses all construction and enlargement, while at the same time championing the local options tax.

“How do you expect us to support your tax increase in light of your very strong support of the moratorium?” St.Germain asked.

Friedmann said the moratorium isn’t anti-hospitality.

St.Germain pushed back and said that Friedmann said that hotels ruin neighborhoods.

Friedmann said there is a strong desire of residents in the town to protect their neighborhoods. That, he said, isn’t anti-hotel. He said the moratorium is also about wanting to have a better definition of where those hotels are placed.

The potential local options bill would stabilize property taxes for hotel owners, Friedmann said. It shifts the burden from all property owners—residential and commercial—to visitors. It would also help the town provide for a better environment for all.

“I’ve always had issue with the drumbeat that hospitality is bad, tourism is bad,” Director of Operations for Bar Harbor Resorts Eben Salvatore said. He said he has worries about the perception that the hospitality industry has been getting a fair ride. “We’re generating millions of dollars as commercial property owners, an amount of $6 million in taxes.”

Witham hotels and Walsh hotels combined don’t generate the waste water that Jackson Lab does, he said. Where is that local options tax on the lab?

He worried that there is a focus on hospitality and demonization of those in the industry. He said that people put year-round residents and tourism industry workers in separate silos, however, they are often one-in-the same.

Bar Harbor’s 2022 Existing Conditions Report shows that 1,364 people employed in Bar Harbor are employed in accommodations and food services. The only higher sector is the category of professional, scientific, and technical services.

“It’s an extra added cost to someone who is already paying their fair share and then some,” Salvatore said of the tax.

Depending on where people live within the town, their taxes have increased by varying amounts, but some are a third higher, Friedmann said. Assessments for some downtown properties had increases by 50%, he said. Their taxes, as a result, went up much more than people in the outlying areas. How to keep retirees in their homes is part of his motivation for the tax.

“We all have heard stories of people who have moved off the island because they couldn’t afford to live here anymore,” Friedmann said.

Not all attending were unsupportive.

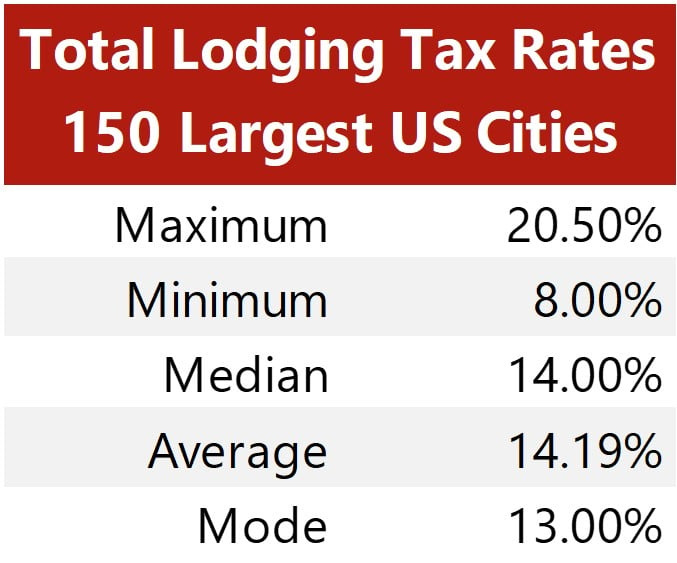

Bar Harbor Inn General Manager Jeremy Dougherty came to the meeting with pages of data and graphs. Each state has different ways of tax policies when they manage lodging taxes. In San Francisco, the state has no lodging tax, but the city has three taxes and assessments: transient occupancy tax (14%), tourism improvement district assessment (1%) and Moscone expansion district assessment (1%). Mystic, Connecticut visitors encounter a 15% state lodging tax and then a room occupancy tax.

“We’re one of the lowest tax burdens for visitors in the United States,” Dougherty said, saying that just comparing lodging tax on a state-by-state basis doesn’t tell a full tax story.

When looked at this way, Dougherty reasons, “Bar Harbor, Maine goes from being tied as the third highest with 9% tax to being tied for the second lowest.”

HVS, a global hospitality consulting firm that concentrates on that industry has similar research.

That research focuses on urban centers in the graphs below. Bar Harbor is not an urban center. When compared to those top total lodging rates of urban centers, Bar Harbor would be placed at 148, tied with Aurora, Illinois and Modesto, California.

“HVS researched the total tax rate applied to lodging accommodations in the 150 most populous US cities as projected from the 2010 census. The total tax rate comprises all state, county, city, and special district taxes levied on lodging facilities within the city's urban center, where the highest special district taxes may be applied. The following tables list the tax rate applied to overnight stays at lodging facilities at the state, county, city, and special district levels, as well as the total rate imposed on an overnight stay at a lodging facility in the urban center of each of the 150 largest cities in the United States,” according to HVS.

Source: Respective Jurisdictions

‘We’re not going to lose anybody in the Bar Harbor area if there’s an increase,” Dougherty said.

Others wondered about if that 2% proposed would be a static number.

“How do we prevent the 2% from growing?” Jennings asked. “What are the guardrails to prevent this thing from exploding.”

Friedmann said he couldn’t say what legislators in 2027 would do. However, the tax would have to go before voters in the individual towns thinking of using it and be approved by the town’s voters before it went into effect. Half of the legislature doesn’t want any new taxes currently, with the Democrats having a small majority, he said.

“There’s more people from the state of Maine who came to Bar Harbor than the year before,” Jennings said, referencing local data and a Bangor Daily News article that said the opposite. He wondered if there is a way to waive the proposed tax for Maine residents. Friedmann said that was an interesting idea.

“I don’t think we can underestimate the impact of the rhetoric,” hotelier, writer, and restaurant owner Nina St.Germain said. “I know from so many business members here that they love this town.”

They are committed and feel responsible, she said. The rhetoric has increased the polarization of the community, but felt that the discussion Monday was a wonderful conversation because it centered around how to solve the problem. In the past, the conversation has been that tourism is to blame.

“That’s been a real challenge for me,” St.Germain said. “We have worked really hard. Because we’re a prosperous area doesn’t mean that we haven’t worked really hard.”

She’d like work to depolarize the community.

“People respond to the rhetoric because it becomes an emotional charge,” she said.

However, she said, Bar Harbor is a community that relies on tourism. With a national park nearby drawing in visitors, it’s also something that the town or region can’t completely control itself.

“That is our economic driver here,” she said. “We need to see tourism as our opportunity” and see local business leaders as other opportunities to solve local problems rather than being the source of the problems. “We can imagine this town in a different way.”

Friedmann said that the sustainable tourism task force gives him hope and that Bar Harbor Town Council Chair Valerie Peacock is committed to de-escalating the conversation. He agreed that it’s important to transcend the us-vs-them mentality and said that he saw himself as an open-minded person.

REVENUE SHARING

While the earlier March 2024 discussion was meant to be focused on local options sales tax, it often strayed into the area of revenue sharing. Revenue sharing is the policy where the state takes in taxes and then gives back that money to municipalities according to a formula.

According to the state’s website,

”Per Title 30-A, Subpart 9, Chapter 223, Subchapter 2, Section 5681, revenue sharing is distributed by the 20th of each month to each municipality based on a formula whose variables include municipal populations, state valuations and tax assessments. The monthly revenue sharing pool is funded by setting aside a percentage of the State Government's sales, service provider, personal and corporate income tax receipts for the month. For a detailed description of how the funds are calculated and distributed, please see the Calculate Revenue Sharing.”

Bar Harbor in 2021 generated $236 million in restaurant and lodging sales tax revenue for Maine, but less than 1% of that comes back to the town.

Typically, less than half of one percent is coming back to Bar Harbor, the community in which it was generated.

The revenues that are generated by the town are passed onto the state, but not the town itself for the infrastructure needs to support the tourism that creates the revenue.

PAST OPPOSITION TO LOCAL OPTION TAXES

Typically, opponents to local options taxes use logic similar to the Maine Center for Economic Policy’s Sarah Austin’s here:

“The ten municipalities with the highest meals and lodging sales in the state generate 45 percent of the state’s meals and lodging tax revenues. But those same ten municipalities are home to just 16 percent of the population. Similarly, the ten municipalities with the highest total taxable sales in our state generate 42 percent of all sales tax revenue but represent only 19 percent of the state’s population.”

What isn’t in that equation is how 5,000 residents in Bar Harbor, a town where a disproportionate amount of land is not taxable because it’s either owned by Acadia National Park or parceled off into conservation easements and nonprofits is expected to support the infrastructure needs of those tourists and consumers who generate the sales tax that benefits the state, proponents like Bar Harbor Town Councilor Joe Minutolo and Goldthwait have said.

The Maine Center for Economic Policy writes, “By creating a new system of haves and have-nots, the local option sales tax would create even greater division between communities with means and those without. It would also be inadequate to meet our municipalities’ needs.”

The center is also against a specific general local option sales tax, saying that it impacts poor Mainers more than property tax. The article does not speak to a local option lodging tax or fee.

“There are some concerns around will we be as competitive,” Goldthwait said of past oppositions. “There are concerns that ‘will the state just pocket the money.’”

“There were communities statewide who said they weren’t getting any of this,” Goldthwait said.

ANOTHER BILL LOOKS TO TAXING LODGINGS

While not a local option sales tax, another bill before the legislature looks to add a 3% state-wide sales tax on hotel and lodging place rentals. The bill was introduced by Rep. Michael Brennan, D-Portland and is meant to offset school construction costs and education in K-12.

It would also review the state’s school funding formula.

The Maine Monitor’s Jacqueline Weaver explains, “In Maine, the state pays for 55 percent of the overall statewide cost of essential programs and services. The percentage it funds in each district is determined largely by that district’s property values and student enrollment, as well as factors including the number of economically disadvantaged students. Districts with higher property values typically get less help from the state in paying for public education.

“Once the state’s contribution is determined, the district is expected to raise the rest, which communities primarily accomplish through property taxes. It’s not uncommon for half of a municipality’s property tax revenue to go to funding its schools.”

MOST RECENT VERSION OF THE FRIEDMANN BILL

LINKS TO LEARN MORE

Bar Harbor Existing Conditions Analysis Report

Photos: Shaun Farrar/Bar Harbor Story

If you’d like to donate to help support us, you can, but no pressure! Just click here (about how you can give) or here (a direct link), which is the same as the button below.

If you’d like to sponsor the Bar Harbor Story, you can! Learn more here.

A local lodging tax makes perfect sense because Bar Harbor and many other tourist towns in Maine incur the costs of providing for and maintaining the larger infrastructure, including first responders, which are all needed to serve the large number of tourists, which can more than triple the population of these towns three seasons each year. The costs are mostly borne by each town's property owners.

The state benefits from the lodging and sales taxes currently paid by the tourists, but the state returns a pittance of the funds needed to adequately cover the costs each of these towns incurs to serve the tourists. Increasing property taxes will only drive out year-round residents. As that continues, Bar Harbor will become further commercialized and less livable, and if that continues, will the town eventually have no year-round families? Will the new elementary school be closed or be turned into another hotel? Will Bar Harbor not be a town, but instead Disneyland of New England?

A local lodging tax of 2 percent would hardly deter tourists. Double it and it would not deter tourists. Bar Harbor, MDI, Trenton, Ellsworth, Hancock County, offer a unique opportunity and experience: access to Acadia National Park.

Why would a local lodging tax not be applicable to other Mainers who travel as tourists to Bar Harbor or other tourist towns? Is not the purpose of a local lodging tax to defer some of the costs town property owners bear to provide for the infrastructure and first responders needed to keep all tourists (no matter where they come from) comfortable and safe?

What is this nonsense assertion about a local lodging tax creating a greater division between haves and have-not communities? The local lodging tax is intended to help cover the costs of the impact of tourists. A town that does not triple its population June through September does not need a water system, sewer system, trash disposal, traffic control, police department or fire department large enough to to provide for the impacts of such large numbers of tourists for three seasons. But Bar Harbor and other tourist destinations do.

The alternative is for Bar Harbor and other tourist destinations to reach a saturation point where the towns fail because they can no longer subsidize the costs of tourists from their property taxes. Could they go into default? Could water and sewer systems fail because the towns can't afford maintenance? How about cutting the police and fire department expenditures? Would tourists come if they can't shower or they don't feel safe? What would that portend for Maine State revenues?

Let's not let that happen. All Maine residents and representatives of Mainers, need to recognize that the purpose of a local lodging tax is to help cover the impact of tourism on a town's infrastructure and budget, that it is to ease the burden on property taxes which allows Mainers to stay in their homes, that it is needed to help preserve a town's year-round community and livability; not turn a town into some abstract land of "haves."

It is wonderful to see businesses and politicians getting together for frank discussions. Citizens, especially property owners and parents of school children should be part of those discussions.

I did not read the text of Friedman's bill, but all must understand that it will be amended before it passes, if it passes. For example, the state is trying to make up for the revenues lost pursuant to the decline of federal support for the Covid emergency, plus whatever Trump and Musk have in mind. Friedmann's 90% for the town might become 10% for the town.

Aren't the cruise ship and parking revenues required to be spent on benefits to cruise ship passengers and users of the downtown area's streets and sidewalks? On what would the lodging tax revenue be spent? It might be a good idea to use the revenue to ensure that there is sufficient funding to hire and support first responders and those who regulate and inspect lodgings.

Then there is the issue of tourism's impact on the rest of MDI and Hancock county. Should they get a share of the revenue, or should the tax apply to lodgings in those areas as well. Agreed that more must be done to tax visitors, and the lodging tax is one way to do that. Are there other ways as well?

Does not Jax pay for its water and sewer service? Why is that an issue?