Crowd Seems to Favor Local Options Lodging Tax

BAR HARBOR—Over fifty people gathered at the Jesup Memorial Library so that the Town Council, staff, and State Senator Nicole Grohoski (D-Ellsworth), co-chair of the state’s Senate Taxation Committee could get a feel about the town’s sentiment about a potential local option lodging tax.

It was resoundingly supported by most of the people there who spoke.

However, it’s not a new conversation. And for it to happen, the state legislature has to give the go-ahead, something it’s never done before.

Just in the last few decades, moderator Jill Goldthwait said there’s been at least 84 local option sales tax bills before the state legislature.

They’ve all failed.

A local options sales tax could be on lodging, food, and other things sold.

As explained by the Sales Tax Handbook, “A local option sales tax is a municipal sales tax administered by a local government body, often a county or city. Local option sales taxes can also be administered by local transportation districts, school districts, recreation districts, and other special local government divisions.

“Traditionally, municipal governments rely on personal property taxes for the majority of their tax revenue. However, local option sales taxes account for a bit over 11% of all municipal tax revenue nationwide. In certain states, especially in the south, municipal governments are more reliant on sales taxes for revenue and thus levy higher local-option tax rates.”

Bar Harbor is currently dealing with a potential 15.7% budget increase after an 8% increase this fiscal year. Property was also assessed at higher rates as mandated by the state. Sewer and water rates have also risen.

“The budget is going up. Tourism is going up,” Council Chair Valerie Peacock said. Residents, she added, are feeling that. Parking meters and cruise ship revenue are tourism-based revenue streams that are currently in the budget.

How a local options tax is collected, might be used, and other aspects of a potential change, and what to advocate for—and if to advocate for a change—are important things to hammer out, she said. The Council was looking for consensus in the room. Going to the state as a divided community, she said, is less effective.

“I think the devil is in the details of this,” she told those gathered.

HOW DOES IT USUALLY WORK?

In most other states, the person providing the service that collects current lodging tax (9%) or sales tax (5.5 %) would also collect the tax for the community. This is likely how it would happen in Maine, Grohoski said.

Any money raised would go first to the state. The state would then remit it back to the community where the tax was collected.

Once approved by the state, a local community, by majority vote, would have to vote in support of it in referendum.

Then, the state would give permission for a community to authorize the tax.

“The state does currently stand in the way of that,” Grohoski said.

A CURRENT BILL TO ALLOW LOCAL OPTION TAXES

A current bill before the legislature would allow municipalities that voted it in to levy a 1% tax on short-term rentals and other lodgings. That money, minus the state’s administrative fee (up to 2% of money taken in), would be returned to the municipality to deal with affordable housing.

It would not impose a local lodging tax on a few rooming houses, hotels or inns, but would cover most. That bill should come to the floor in the next couple of weeks, Grohoski said.

Many of the people at the Monday meeting said they would prefer for that money to also be used for failing infrastructure rather than just affordable housing.

Some believe that a local options sales tax could change things and relieve the tax payers’ burden, a burden that is overwhelming some locals who are currently facing a proposed 15.7% tax increase this upcoming fiscal year, which begins in July. That budget has to be approved by voters at the June town meeting. Changes can be made to some aspects of the budget on the floor. The Warrant Committee is still working through its recommendations for that budget.

HOW MUCH OF A DIFFERENCE COULD A LOCAL OPTION SALES TAX MAKE?

According to Grohoski, Bar Harbor’s budget in 2022 was $22.4 million and the taxable lodging taxes (for all lodging, not just short term rentals) were $143 million. One percent of that would be $1.4 million.

“Wow,” one person blurted.

That amount is more than what’s been cut in the proposed budget increase, but less than the town’s $3 million in parking revenues. Any revenue would help relieve the property tax burden.

According to Town Manager James Smith, “It helps diversify income streams to a town. Diversification of revenue streams helps stabilize a budget. I’m a huge proponent of the local options tax. It’s a bit of a mystery for me to understand what the hold-ups are.”

Ed Damm said he would prefer a 2% tax than the 1%. “We put on a summer camp for the world for six months of a year.” That cost and demand on infrastructure, he and others attending reasoned, should be defrayed by those same visitors.

Austin Barry asked, “What is the tangible and intangible impact to tourism to BH?” He asked if 1% was even close to covering that impact and requested the town get some data to help understand.

Studies of communities that have successfully had local lodging taxes, joining with other coastal communities impacted in the state, and illustrating how the town’s property owners can’t match the infrastructure needs were all mentioned as potential next steps, as was forming an ad hoc committee.

ADVOCACY AND HISTORY

At the meeting, long-time resident Ellen Grover said that there has been talk about local option sales tax before.

“It never goes beyond our town. It never becomes a part of a greater conversation until now,” she said.

She suggested the town fill busses with people and bring them to Augusta in support of a local options tax.

“We all go and stand there and say that this is something that we need,” she said. “The people here are hurt by the amount of tourists that come here and the lack of infrastructure…. We, as a community, need to make noise.”

Back in 2007, Dick Cough, a member of the Local Sales Tax Option Committee in Bar Harbor held sessions and had an action plan intended to gather regional support for a local options sales tax. At one point, the committee had three alternative plans. Other efforts in the past fifty years have also not changed the state law.

Bar Harbor Chamber of Commerce Board President Bo Jennings said he’s in favor of a tax. “I’ve seen it work very very well.”

He also stressed that it’s important that the tax benefit people who currently live in Bar Harbor. “Let’s make it affordable for the people who are here.”

Local options taxes vary by state.

REVENUE SHARING

While the discussion was meant to be focused on local options sales tax, it often strayed into the area of revenue sharing. Revenue sharing is the policy where the state takes in taxes and then gives back that money to municipalities according to a formula.

According to the state’s website,

”Per Title 30-A, Subpart 9, Chapter 223, Subchapter 2, Section 5681, revenue sharing is distributed by the 20th of each month to each municipality based on a formula whose variables include municipal populations, state valuations and tax assessments. The monthly revenue sharing pool is funded by setting aside a percentage of the State Government's sales, service provider, personal and corporate income tax receipts for the month. For a detailed description of how the funds are calculated and distributed, please see the Calculate Revenue Sharing.”

Bar Harbor in 2021 generated $236 million in restaurant and lodging sales tax revenue for Maine, but less than 1% of that comes back to the town.

Typically, less than half of one percent is coming back to Bar Harbor, the community in which it was generated.

The revenues that are generated by the town are passed onto the state, but not the town itself for the infrastructure needs to support the tourism that creates the revenue.

“I’ve lived here for 40 years. My sidewalks haven’t been fixed. The sewer and water systems are defunct,” Grover said.

“I was talking to a Caribou resident the other day that said, ‘Bar Harbor has plenty of money,’” Jennings said. The town is low in the amount of money it receives from the state for revenue sharing and in the top three for bringing money into the state’s coffers.

“Bar Harbor’s funding Lewiston. Bar Harbor’s funding everyone else and what are we getting in return?” he asked.

Cara Ryan said, “The state is squeezing all that money out of us and we get nothing.”

She also thought a local options sales tax should be expanded beyond lodgings and for sales tax on non-essential items.

“It has to get challenged. We need to get really proactive and come together and work on this,” she said.

OPPOSITION TO LOCAL OPTION TAXES

Typically, opponents use logic similar to the Maine Center for Economic Policy’s Sarah Austin’s here:

“The ten municipalities with the highest meals and lodging sales in the state generate 45 percent of the state’s meals and lodging tax revenues. But those same ten municipalities are home to just 16 percent of the population. Similarly, the ten municipalities with the highest total taxable sales in our state generate 42 percent of all sales tax revenue but represent only 19 percent of the state’s population.”

What isn’t in that equation is how 5,000 residents in Bar Harbor, a town where a disproportionate amount of land is not taxable because it’s either owned by Acadia National Park or parceled off into conservation easements and nonprofits is expected to support the infrastructure needs of those tourists and consumers who generate the sales tax that benefits the state, proponents like Town Councilor Joe Minutolo and Goldthwait say.

The Maine Center for Economic Policy writes,

“By creating a new system of haves and have-nots, the local option sales tax would create even greater division between communities with means and those without. It would also be inadequate to meet our municipalities’ needs.”

The center is also against a specific general local option sales tax, saying that it impacts poor Mainers more than property tax. The article does not speak to a local option lodging tax or fee.

“There are some concerns around will we be as competitive,” Goldthwait said of past oppositions. “There are concerns that ‘will the state just pocket the money.’”

“There were communities statewide who said they weren’t getting any of this,” Goldthwait said.

THE HOTELS AND TOURISM AND WORKING TOGETHER

Councilor Minutolo said that he’s been a part of the community since 1969 and is in favor of a local options tax. "When you look at the costs in BH. The costs of the police department, the fire department, the solid waste, fixing our roads.... We can't just keep hitting the same 5,000 people who live here." He sees the tax as pro tourism because infrastructure improvements, improvements to public spaces, roads, also benefit visitors.

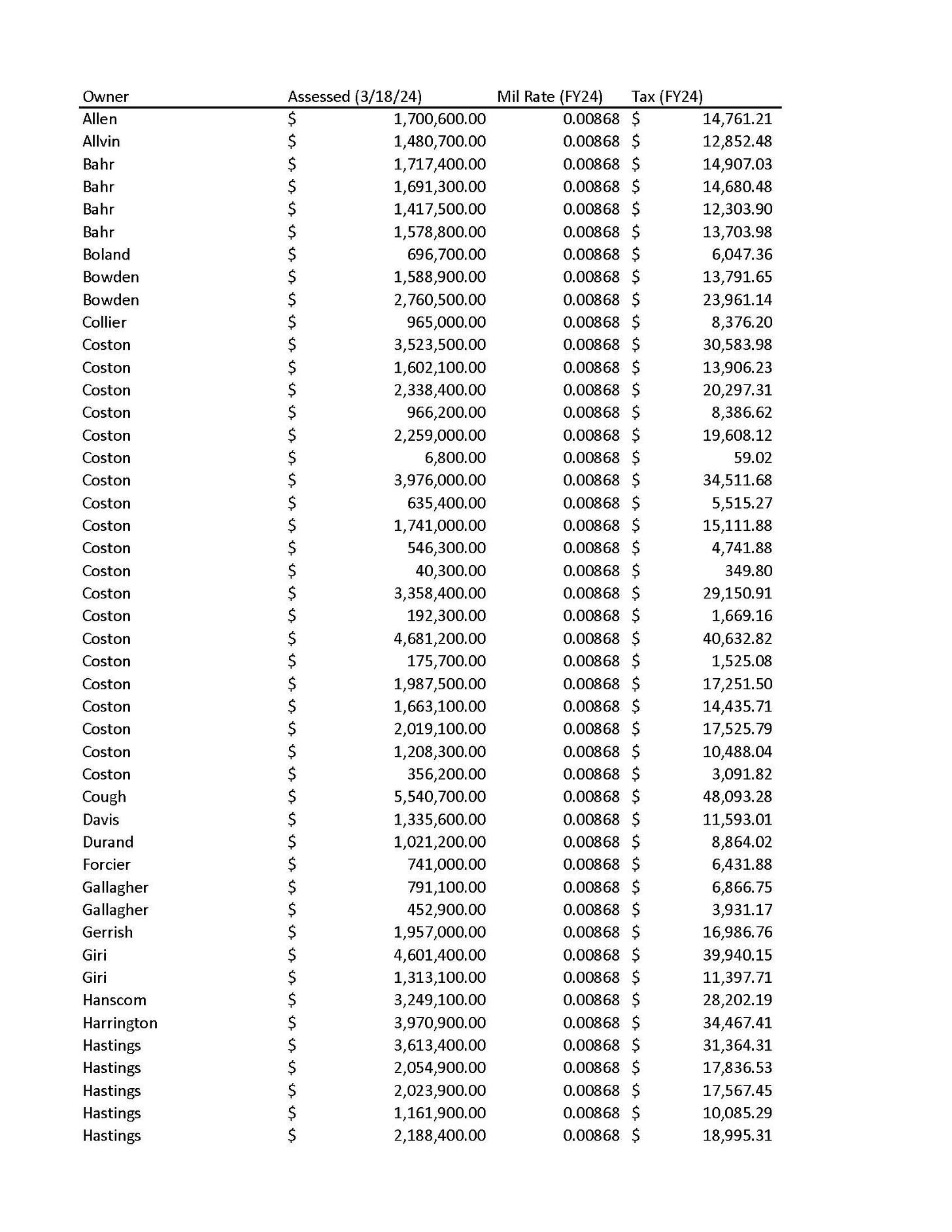

Stephen Coston, former town councilor, created a list of all property taxes paid by lodging properties in Bar Harbor to determine what percent of property taxes are paid by the lodging industry. He had some hard copies of that list during the listening session. He’d also sent the list to the Council March 22.

“The reason I did this is because I am hearing repeatedly that, as one person put it at the last council meeting, ‘residents are subsidizing the tourism industry’,” he wrote in a letter to the Town Council. “To me, that claim seemed absurd on its face, seeing as my companies alone will pay over $300,000 in real estate taxes to Bar Harbor this year (not to mention water/sewer charges, building permits, donations to local nonprofits, Chamber dues that help pay for fireworks/parades/seaside cinema/etc., etc. etc. etc.).

“But I think, at this point, we owe it to the conversation to know the facts. So, here you go—the facts. To get 15% of real estate tax revenue from roughly 100 out of 3,800 parcels is a lot (3% of parcels paying 15% of the tax), and I think it’s plainly ridiculous to suggest those 100 parcels aren’t carrying their share of the fiscal weight, let alone that they are taking fiscal advantage of everyone else. If anything, based on this analysis and a little bit of common sense, it seems hotels are actually doing more than any other industry to help support this town and its residents fiscally.” (Italics are Coston’s)

In the letter, Coston also said he could “live with a local option sales tax on lodging as long as the town gets to keep the money, the tax is reasonable and doesn’t go up constantly, and the money is spent responsibly.”

Coston, Jennings, and multiple people not associated with the town’s business community, such as Sharon Knopp, said that they hoped they could all work together to get this accomplished. Jennings stressed that for this to happen there needed to be a spirit of courtesy throughout interactions and conversations.

“All of us deserve respect. When Steve is saying his comments, we can all listen,” Jennings said, referring to side conversations that occurred when Coston was talking Monday. “We just can’t disrespect each other.”

In his letter to councilors, Coston wrote, “But if we as a community could at least have an honest conversation built upon facts and basic principles of economics, that would certainly be a refreshing change of pace.”

Helping the community understand that the tax burden is also shared by commercial property owners is something he feels is being left out of the conversation.

COULD THE TIDES BE TURNING?

Grohoski said that during her first year in the legislature, there was a local options sale tax bill where 15% would have supported rural economic development. This was in 2019. Since then, she said, there have been AirBnBs built throughout the state. Now, every community does have lodging and could be helped by a local option lodging tax, especially one focused on short-term rentals. All communities, it’s reasoned, may not have a hotel or an inn, but they almost all have a vacation rental. In the past, there has been sentiment against the taxes because the perception was that it wasn’t fair if it only helped some communities.

Anna Durand asked if there could be changes to statutes governing the taxes after they passed.

"Absolutely. Everything in statute can be edited and refined in future legislation,” Grohoski said.

LINKS TO LEARN MORE

Amended

Original

https://legislature.maine.gov/LawMakerWeb/summary.asp?ID=280087958

Corrections/Updates: The wording in one of our lines should have read, “It would not impose a local lodging tax on some rooming houses, hotels or inns.” We’ve clarified that even further now. Similarly, the sub-head also did not hold a revision change initially and should have not read “just AirBnBs.” Nicole Grohoski is the co-chair, not the only chair. We apologize for the error.

Update: We’ve included the amendment for the bill, which is not currently online, but is public and was provided to us by Senator Grohoski.

According to Senator Grohoski, the original bill summary says, "This bill allows a municipality to impose a local option sales tax of 1% on short-term lodging that is subject to the state sales and use tax if approved by referendum of the voters in that municipality." The amendment corrected a drafting issue with the paragraph in question (the people who draft the original bills are not tax policy experts) and the summary of the amendment reads, "this amendment alights the rented living quarters subject to the local option sales tax with the rented living quarters subject to sales tax under current law..."