If Passed, School Construction Bond Would Have No Impact on Town’s Bond Rating

Bar Harbor's Bond Agent Since 1989 Says Town Is In Good Shape

BAR HARBOR—Suspenders, white shirt and tie, Joe Cuetara of Moors & Cabot was a bit like a magician as he sat before Town Council Chair Valerie Peacock, School Board Vice Chair Marie Yarborough, Interim Town Manager Sarah Gilbert, Councilor Joe Minutolo and Warrant Committee member Louise Lopez in a public meeting Thursday night. And the man who has been the town’s bond rating advisor since 1989 delivered interesting news for a town trying to decide if it should incur a construction bond to repair an aging, breaking school.

At the meeting, which was open to the public and televised, Cuetara said that if the school construction bond was voted in and taken out at the full $58 million, he wasn’t worried about it affecting the town’s bond rating or reputation at all. The town isn’t considered a frequent issuer of bonds.

“I see no impact on your bond rating whatsoever,” Cuetara said if the school bond goes through.

The economy, wealth and management of Bar Harbor has given the town a high rating. The incubator for the MDI Biological Laboratory, the MDI Hospital, and the Jackson Laboratory all help that reputation and create a multiplier effect.

“I don’t dictate right or wrong. I just price it,” he said.

Bar Harbor has an extremely diverse tax rate. This means there’s a good combination of commercial, industrial, and residential areas.

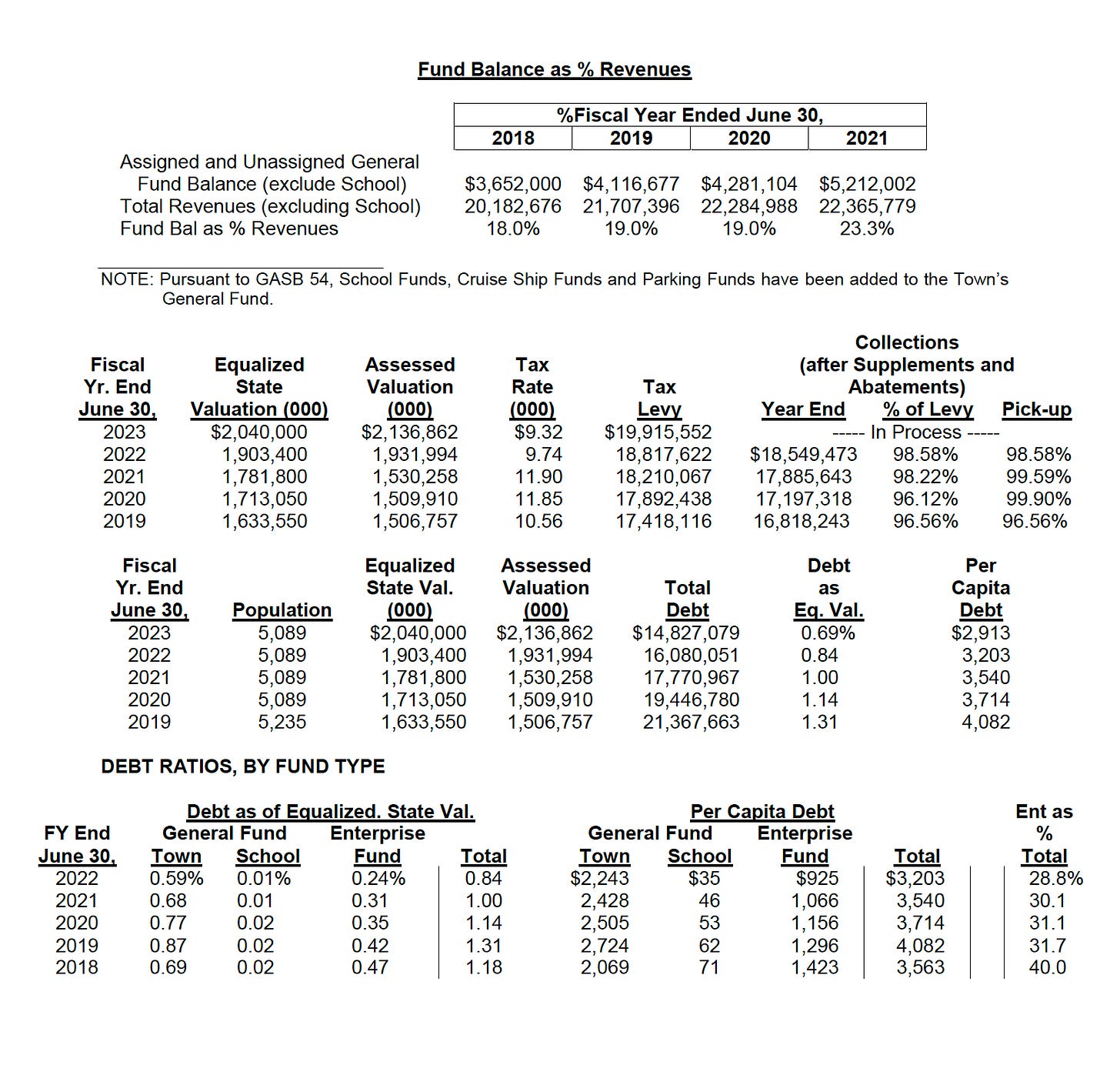

In Maine the average debt per capita is about $3,000. Fund balance policy requires a minimum 10% fund balance. Bar Harbor has been pretty constantly at one range until 2022 when it spiked, he said.

Part of the attraction of the town to incoming residents and industry is to provide a good infrastructure and the school is part of that infrastructure, he said. Two ways of funding a school’s construction is to bankroll money and to pay as you go. Another is a bond. He said there are multiple ways to structure spending to try to decrease the burden on taxpayers.

He said he’s seen municipalities in Maine create a $40 million school project and keep the tax rate/mil rate flat for five years. Towns can often delay the first principal payment for five years, he said.

Past projections about the cost of taking out the full $58 million is that it would equate to a projected increase of $109.58 per $100,000 of home value for property owners in Fiscal Year 2025 to 2026. Then, the increase from Fiscal Year 2026 and through the life of the bond, is projected at $216.96 per $100,000 of home value. These numbers assume a 25-year bond at a 4% rate. These are the numbers if there is no fundraising, no money taken from other revenue streams (such as parking), the interest rate does not drop, and no other options to decrease the bond are found.

Currently, Bar Harbor’s debt service as a component of operating expenses is $1.8 million. This fiscal year, it was $1.39 million as a component of operating expenses. The total bonded indebtedness was $21 million in 2019 and will be down to $14 million on June 30, 2023. Though those numbers have lowered, they will be increasing again in Fiscal Year 2023 because of the sewer structure, voter-approved bond.

The amount of debt in Bar Harbor’s budget is institutionalized, he told the officials attending. A town can borrow up to 15% of the town’s equalized state valuation. The town is currently borrowing at 0.4%. When he last checked those numbers in 2015, the town could borrow up to $210,615 million. Even with the school bond he saw no impact on the town’s bond rating at all.

Bar Harbor is not considered a frequent bond user. It has a good reputation. Cuetara also presented some similar material and numbers about the town’s economic characteristics that have been presented by the firm the town hired to do the comprehensive plan update, saying he did it out of kindness. The information compares Bar Harbor’s economic characteristics to Hancock County, Maine and the United States using census data.

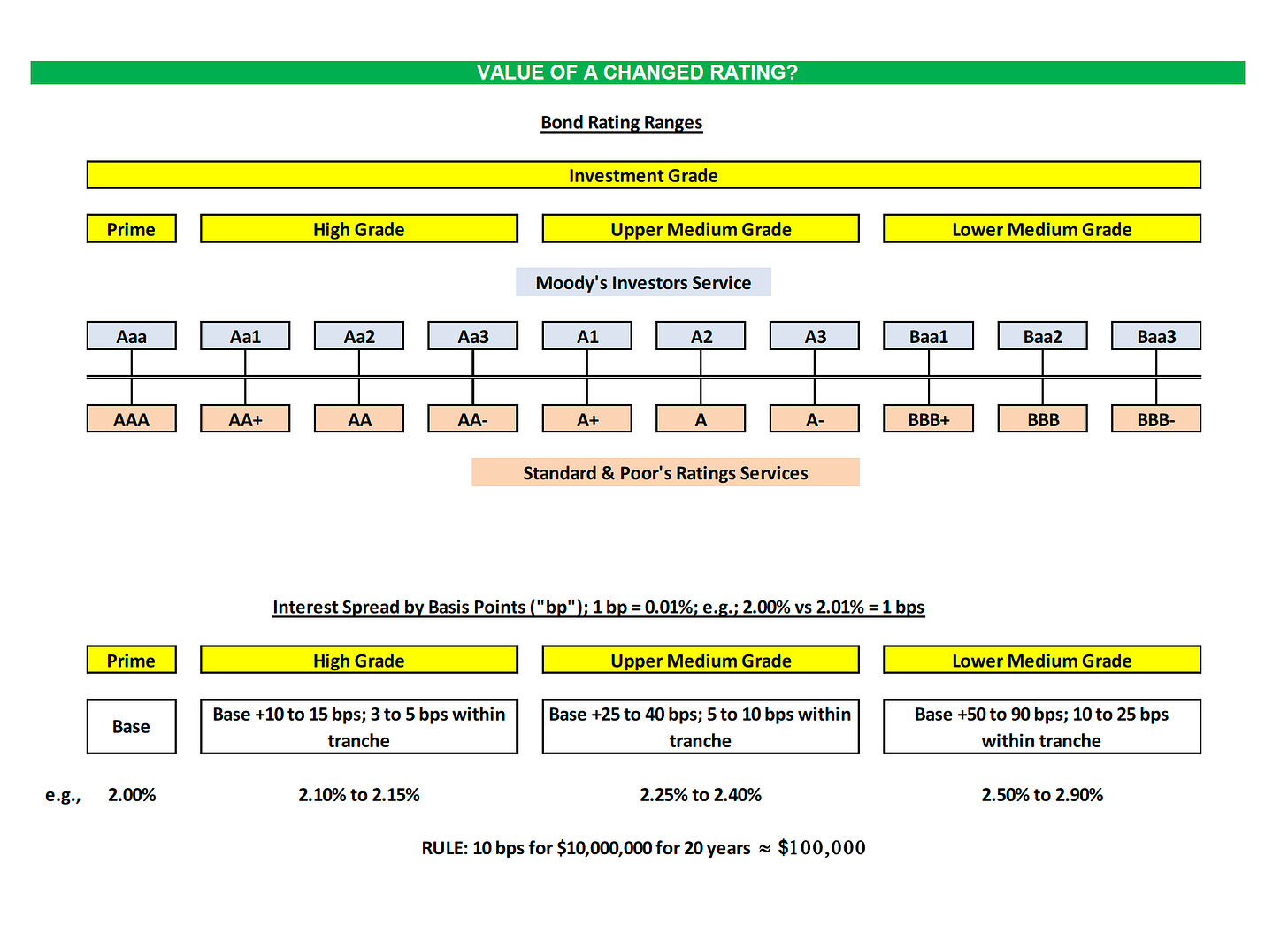

He also explained the value of a changed rating and why it’s important that Bar Harbor continue to maintain its high grade. To not have a high rating could translate to hundreds of thousands of dollars over the life of the bond.

Bonds are rated according to the economy, the town’s finances, current debt, management and legal security.

The town can have a year of fundraising before taking out the bond, he said, echoing a piece of a presentation before the school board earlier this week.

Cuetara is the bond advisor for 80% of the municipalities in Maine that don’t go to the bond bank. He grew up in Orono.

To watch the meeting, click here.