Just "Burying Money in the Backyard"

As tax rates and property values go up Bar Harbor Council talks alternative revenues & tax predictability, plus primary results.

BAR HARBOR—With a giant marker and a lot of white paper taped to the wall, Council Chair Valerie Peacock used her teaching skills Monday night during a workshop with the Town Council about alternative revenue and tax stabilization. Peacock facilitated the discussion in the third floor room of the Municipal Building that until recently had been rented to artists Liz Cutler and Jennifer Booher as councilors delved into not only what alternative revenue meant to them but also if they should be talking about ‘tax stabilization’ or if it should really be ‘ tax predictability.‘

The discussion was “pretty timely given the budget conversation,” Peacock said. The Council accepted a tentative $28 million budget at its meeting later that night. While the March 4 workshop wasn’t televised, the public was able to attend, though not participate, in the session.

What does it mean? How do we want it to change? Who does it impact? Peacock asked the councilors.

Much of the approximately one-hour discussion focused on two items: local options sales tax, a quest that requires state approval, and finding non-property tax revenue.

“The state is structurally biased against municipalities like ours,” Councilor Kyle Shank said. Wealth from coastal areas that’s collected via sales tax is used for non coastal areas. He advocated the town look toward more consumption-based revenue such as municipal waste.

Councilors touched on the town’s complicated situation as a community of approximately 5,000 year-round residents that supports a massive tourism industry that requires a full fire department and police department and additional infrastructure for hotels and roads and waterfront through property taxes.

Compounding that situation, a great deal of land in the town is part of Acadia National Park and not buildable or owned by nonprofits, and therefore can’t create more property taxes. The town’s land use ordinance controls what can be built, where, and the requirements for building properties.

A local options sales tax could change things and relieve the tax payers burden, a burden that is overwhelming some.

As explained by the Sales Tax Handbook, “A local option sales tax is a municipal sales tax administered by a local government body, often a county or city. Local option sales taxes can also be administered by local transportation districts, school districts, recreation districts, and other special local government divisions.

“Traditionally, municipal governments rely on personal property taxes for the majority of their tax revenue. However, local option sales taxes account for a bit over 11% of all municipal tax revenue nationwide. In certain states, especially in the south, municipal governments are more reliant on sales taxes for revenue and thus levy higher local-option tax rates.”

Maine does not currently allow local options sales tax.

Back in 2007, Dick Cough, a member of the Local Sales Tax Option Committee in Bar Harbor held sessions and had an action plan intended to gather regional support for a local options sales tax. At one point, the committee had three alternative plans. Other efforts in the past fifty years have also not changed the state law.

Bar Harbor in 2021 generated $236 million in restaurant and lodging sales tax revenue for Maine, but less than 1% of that comes back to the town.

Typically less than half of one percent is coming back to the community in which it was generated.

The revenues that are generated by the town are passed onto the state, but not the town itself for the infrastructure needs to support the tourism that creates the revenue.

Typically, opponents use logic similar to the Maine Center for Economic Policy’s Sarah Austin’s here:

“The ten municipalities with the highest meals and lodging sales in the state generate 45 percent of the state’s meals and lodging tax revenues. But those same ten municipalities are home to just 16 percent of the population. Similarly, the ten municipalities with the highest total taxable sales in our state generate 42 percent of all sales tax revenue but represent only 19 percent of the state’s population.”

What isn’t in that equation is how 5,000 residents in Bar Harbor, a town where a disproportionate amount of land is not taxable because it’s either owned by Acadia National Park or parceled off into conservation easements and nonprofits is expected to support the infrastructure needs of those tourists and consumers who generate the sales tax that benefits the state.

The Maine Center for Economic Policy writes,

“By creating a new system of haves and have-nots, the local option sales tax would create even greater division between communities with means and those without. It would also be inadequate to meet our municipalities’ needs.”

The center is also against a specific general local option sales tax, saying that it impacts poor Mainers more than property tax. The article does not speak to a local option lodging tax or fee.

OTHER DISCUSSIONS

Redesigning the water rates was important to Vice Chair Gary Friedmann. He spoke of this during the Council meeting following the workshop as well, advocating for a redesign of the rate system.

Councilor Maya Caines wanted to move away from depending on local option sales tax but focus instead on fees that the town can control.

Councilor Hochman said, “We are a tourism heavy community. Tourism itself doesn’t contribute to the municipality.” He added, “But it should.”

“Most of that flows right to Augusta and very little flows back to us,” he said.

“We’ve only got 5,000 people paying for the infrastructure that’s supporting many more than that,” Councilor Joe Minutolo said.

Councilor Earl Brechlin said he was in favor of a multi-pronged approach and believes that the state tax is more palatable for business than fees.

While Peacock stressed that the alternative revenue and tax predictability was a bucket of discussion, the councilors did speak to bigger overarching goals.

Brechlin said that a goal would be a bill in legislature at cloture this summer and for the town to be engaged at state level on everything that effects the finances of Bar Harbor. “We can’t just be passive.”

“I’m all for it, but we’ve done that,” Hochman said. “This is something we’ve done for years.”

Caines said, “Tax stabilization is a great long-term goal.” She worried that the town’s budget may rely too much on parking funds. Shank agreed and was nervous of it being used as something other than to smooth over bumps like this year where the current tax rate increase proposed is 20%.

“When have we ever not voted to approve a bond?” he asked, though he added he supported all the recent bonds.

Bonds (like for sewer improvements and the new school or road repair and design or the Higgins Pit solar array) are costs that stay within the budget. Hochman said that there are many aspects that are out of the town’s control once those pieces are approved by other entities such as the Hancock County Commissioners, AOS, or MDI High School budgets.

Town Manager James Smith said that the town should attach fiscal notes to major decisions such as bonds so that people can know and understand the impacts. “There’s real validity in being able to communicate that effectively.”

WHO IS CURRENTLY IMPACTED THE MOST BY THE POTENTIAL INCREASES

Shank said that fixed income households feel the highest impact to tax increases as do long-term renters because property owners often pass tax increases on to their tenants.

Hochman agreed, but added that many people in Bar Harbor, including himself and his wife, purchased homes that were assessed much lower 15 to 20 years ago, some were purchased at just $30,000 or $40,000. “And now they are sitting on a million dollar property,” he said.

That can cause problems because taxes paid are based on both the town’s mil rate and the value of the property. When it comes to who is impacted the most, he said, “the who is all the tax payers of Bar Harbor.”

A person who buys a home on Ledgelawn Ave in 2012 for $290,000 may not have planned for a tax bill on a house valued at $550,000 in 2024. That same house was purchased in 1996 for $83,500. Bar Harbor homeowners like this might be house rich, but that doesn’t necessarily equate to income rich or even income comfortable when all their equity is tied up in something that they would have to sell to get to.

“It’s like burying money in your backyard,” Councilor Joe Minutolo said of property ownership. When you’re trying to survive, he said, it’s not helpful. People sometimes have no choice but to sell their house and move away.

This might be especially true in downtown Bar Harbor, an area where many bemoan the demise of neighborhoods, but has had increasing property values, rising assessments, and water and sewer rates.

Bar Harbor’s mil rate is at the lower end of the scale, but home valuations are off the chart, Minutolo said. Incomes are still equal to surrounding areas.

“Things get tight when taxes come in,” he said.

“There is a demand that will force these things as long as there is a hot real estate market,” Shank said, meaning that assessments will increase as sale prices for homes increase.

Vice Chair Gary Friedmann said that he believes that in Bar Harbor everything is being commercialized and commoditized. The homeowners don’t have anywhere to pass those costs onto. He said that it was time to provide some relief and thought that there were some creative ways to do that.

“I don’t think we should let our members of the Chamber of Commerce off the hook for this,” he said.

BIG OVERARCHING GOALS

Caines hopes for a “one-year-goal adjusting fee structure for town of BH so that people who are consuming the majority of town resources are paying their share.”

Hochman and Brechlin also said they wanted the town to be more engaged in finding grants.

“I actually had a conversation with someone who specializes in grants,” Smith said.

Shank said that parking and solid waste were the only things in the Council’s control. Property tax pays solid waste costs. To change that as well as parking revenue could actually effect the tax rate, he said. “Those are the two things in our control and they are disproportionally used by visitors.”

Minutolo agreed about solid waste, comparing Bar Harbor to Ellsworth and each town’s budgets’ predictions for FY2025, where he said Bar Harbor has an estimated cost of $1.22 million while Ellsworth, which has a pay-as-you-throw program has a cost closer to $549,000.

Peacock said that tax predictability can have a lot to do with understanding what are the major expenses coming as well as understanding the long and near term forecasts of budgets.

Staff could take pieces of these things and work as they go.

PILOTS AND FORECLOSURES

The Council talked about payments in lieu of taxes (PILOTS), which are voluntary contributions by nonprofits. The Warrant Committee has recommended the Council try to gain more from those nonprofits that do not have to pay property tax. The committee also suggested this last year.

“I think I’m happy to reach out to the various entities that already contribute,” Smith said.

He stressed again that project specific asks tend to receive more contributions. In 2011, the Town Council voted 3-3 to not send out a letter asking for nonprofits to voluntarily contribute for services that they use (such as roads, fire suppression, ambulance and police). In 2004, the council sent out a letter.

Brechlin suggested the town try to find or keep track of tax-driven foreclosures on properties.

“It shows the number of people who are struggling for a variety of reasons,” Brechlin said.

The town’s 2022 Existing Conditions Report reads, “If property taxes keep rising it may have the effect of pricing out low to moderate income households, or seniors on a fixed income who can no longer afford the cost of housing and taxes in Bar Harbor.

“Eight of the top ten largest taxpayers in Bar Harbor are either hotels or restaurants and comprise nearly 7% of the town’s total tax levy. The town’s reliance on tourism and hospitality as a source of revenue to pay for capital and operational expenses poses a potential risk if future public health or public safety issues arise, or future environmental risks and climate change impact the natural environment which draws visitors to Bar Harbor.”

BAR HARBOR PRIMARY RESULTS

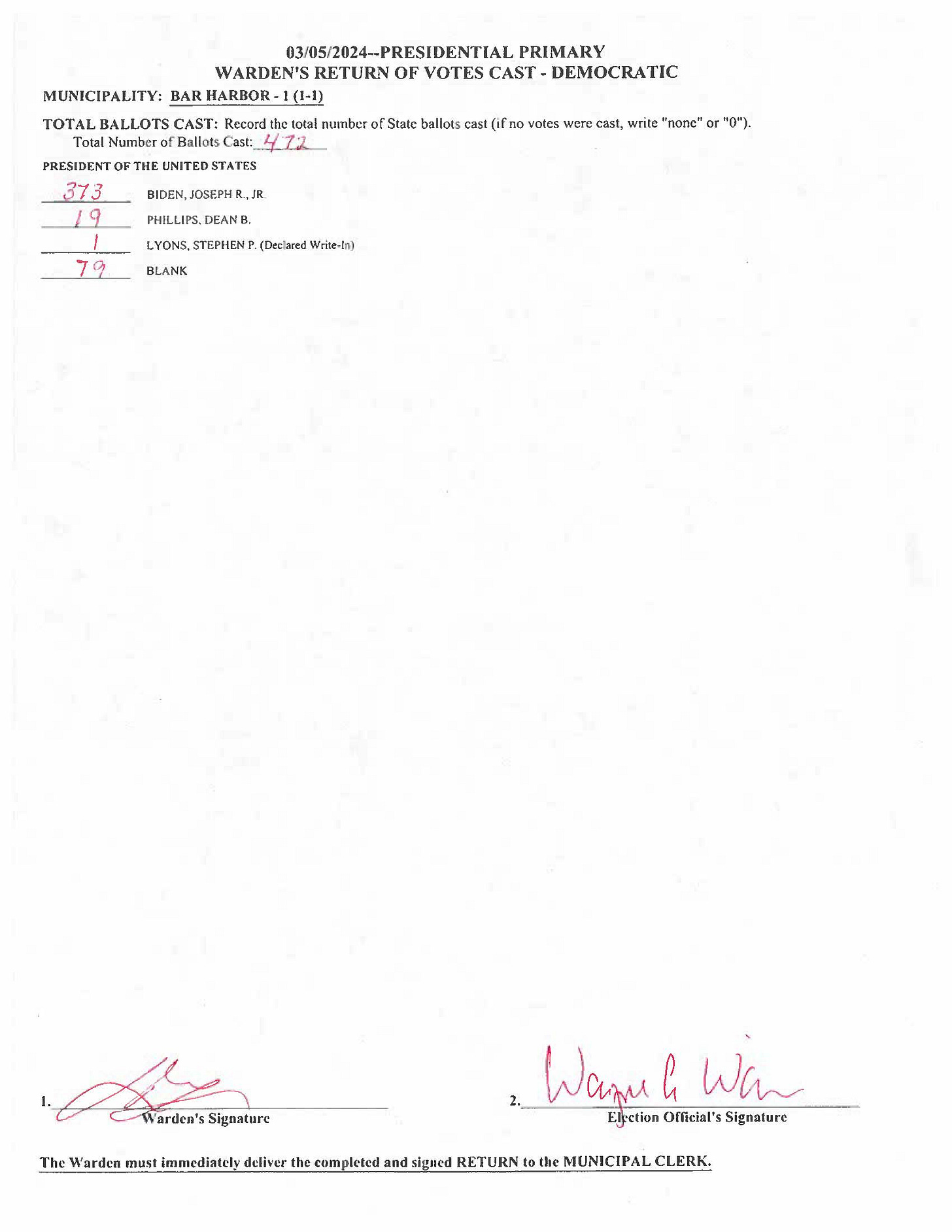

Town Clerk Liz Graves released the warden’s return of votes cast for the Bar Harbor presidential primaries, which were yesterday.

Bar Harbor currently has 5,148 registered voters. Of those voters, 472 Democrats and 232 Republicans participated. Joseph Biden received 373 Democratic votes. Donald Trump received 132 Republican votes. Those results are similar to the results statewide where President Biden and former President Trump both handily won their respective primaries. There were 79 blanks on the Democratic ballot and 1 on the Republican ballot.

LINKS TO LEARN MORE

Here’s a link to learn more about what is a nonprofit.

Here’s a bit more about payments in lieu of taxes, which are voluntary payments. A town cannot require them. The federal government program is here.

The List: How Much Property in Bar Harbor Is Tax Exempt?

BAR HARBOR—Budget season always seems to spur conversations about nonprofits and the potential property taxes that they do not pay. Nonprofits have the legal option not to pay property taxes unless the property is used for certain purposes. It is not an automatic process and applications must be completed to gain the exempt status.

"people who are consuming the majority of town resources are paying their share.”

THIS is what I have been trying to formulate in my head for years. THANK YOU for covering this!