Latest Local Lodging Tax Legislation Fails

Bar Harbor Town Council Workshops Alternative Revenue Possibilities

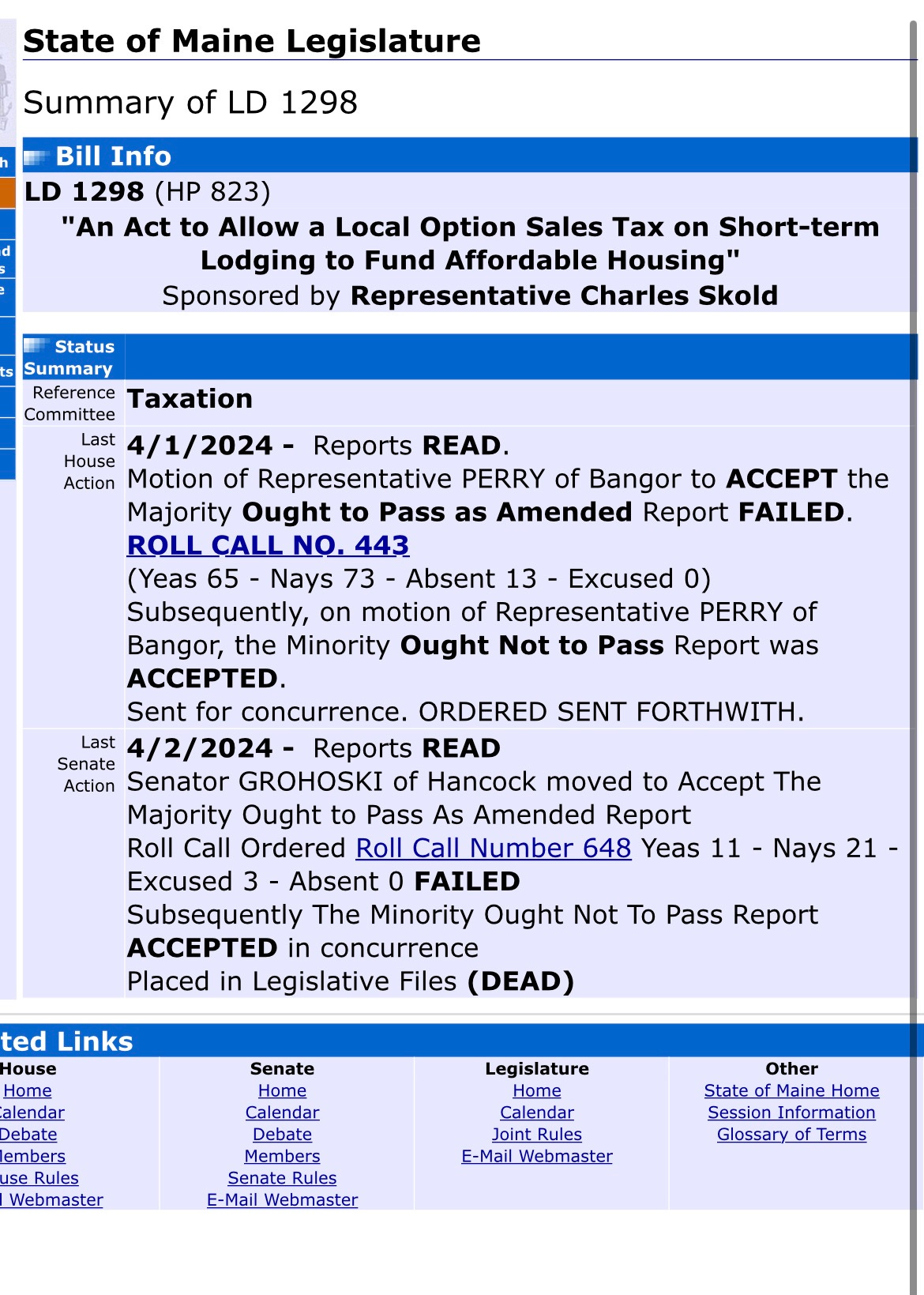

BAR HARBOR—The potential local lodging sales tax, which could have potentially provided tax relief to communities such as Bar Harbor, failed in the state legislature on April 1.

Despite this, the Bar Harbor Town Council at its Tuesday workshop, discussed what efforts it could have at the state level to try to help out the town, which is currently struggling with the current potential 15.7% budget increase for the next fiscal year, which begins in July.

The discussion was part of a larger workshop of the councilors and Town Manager James Smith. Approximately six members of the public attended, including members of the Warrant Committee and Planning Board, as well as the head of the Bar Harbor Chamber of Commerce and reporters. It was the second workshop about alternative revenue and potential tax predictability for tax payers.

Rather than creating bills to go before the state’s legislature, Councilor Maya Caines said she’d prefer it if the state created the bills and then people supported those bills.

“The most recent local sales tax failed,” Caines said. “This is a constant thing that keeps happening.”

Though she loves the enthusiasm, it isn’t that easy to create and pass legislation, she said. “We need to focus our time on something else.”

Councilor Kyle Shank said that he’d also rather focus on what the town can do and support potential legislation for local option taxes when it comes up—unless the goal is for the town to set aside money for lobbying, which he would support.

“I think we need to get serious about it,” Councilor Earl Brechlin said of local option tax lobbying and support. “That’s 1.5 million. We basically need a Marshall Plan going into Augusta.”

Council Chair Valerie Peacock said that there had been an offer from Bar Harbor Chamber of Commerce President Bo Jennings to start the working group about the local options tax. It was suggested that it would have a councilor, Chamber member, and community members. She said no one had yet responded to his email suggesting this.

Brechlin said, “Just reacting to those bills has never gotten us anywhere.”

Councilor Joe Minutolo agreed. “I think there’s potential, but we have to get our ducks in a row.”

THE DISCUSSION:

Peacock focused on the four areas identified at the last workshop: engaging at the state level about things that impact Bar Harbor; internal fee structure and if there are areas in the system where changes could be made away from broad-based tax toward user-based fee systems; the budget itself and understanding it and analyzing debt as well as how the budget is built and reviewed; and federal grants.

As they began, Council Vice Chair Gary Friedmann asked if it was helpful to talk in depth about things that are really more staff driven. Smith said it was helpful because it is valuable for him and the staff to understand what each councilor is focused on.

Peacock said she hoped the focus and prioritization would help the councilors look at how staff reports and other council business relates to the tax goals and having a regular reporting process where things are connected back to those same goals.

ACTIONS TO ENGAGE WITH AT THE STATE LEVEL

Councilor Matt Hochman wanted to see Bar Harbor have a more equitable stance when it came to getting money back from the state. This is related to revenue sharing formulas, where municipalities send the state sales tax and lodging taxes collected and then the state returns a portion of that back to the municipalities. The state has a complicated formula for determining how much each town receives back.

“It’s revenue sharing based on how much value is in the land and how many people live on the land,” said Shank. He added later that changing that formula? “That’s a big hill to climb.”

Friedmann said that trying to change that would likely not go over well in Augusta, where the legislature meets. Instead, he suggested adding new sources rather than taking them from someone else.

Smith agreed.

“If you start tinkering with that (state) formula, there’s going to be a lot of opposition,” Smith said. He suggested lobbying for local tax options and lobbying in communities that generate that income as well as lobbying in other communities where legislators are against it via the constituents in that community.

Minutolo said, “Trying to rewrite or change the whole revenue stream is going to be an incredible hurdle.” He wanted to focus on tourist infrastructure fees, which would be on new development, and lodging fees.

Brechlin advocated for a comprehensive and multi-pronged approach so that people in Augusta understand what’s happening in Bar Harbor. He called for a Marshall Plan approach, which means potentially tinkering with state valuation and other state measures while also lobbying for local option taxes.

The group also delved into the difference between fees and taxes. Smith said he’d work with the town attorney to get comparisons and distinctions between the two so that he could explain them to the councilors. The town currently has parking fees, cruise ship fees, water and sewer fees, permit fees. Typically, with fees you have to demonstrate and quantify how the fee is needed, used, and is tendered.

FINES AND FEES

The council also discussed town fines and fees.

“Fees should be explicitly designed to reduce the actual tax burden by trying to turn cost centers,” Shank said. “The point of adjusting the fee structure,” he said isn’t to create revenue, but to reduce property taxes.

Friedmann said that there’s more to it than that because sewer and water fees are not about property tax reduction. He said these fees in town (such as for those systems) may not be equitable when you adjust and build systems for the capacity needed for larger users. He’d like to see that adjusted.

Minutolo agreed, stating it slightly differently. He said the town systems are impacted by tourism because it has to be built to peak use. Because of that, the town has larger fire and police departments, emergency medical technicians, and three-foot sewer mains that wouldn’t be necessary if there were just 5,000 residents.

“That’s what impact fees are for,” Friedmann said. “The council got rid of them 10 years ago.”

Brechlin said that also with water fees, the more someone uses, the more of a discount they receive.

Friedmann said that typically impact fees are on new development. Smith also said that impact fees have to go back into the development that they are supporting. He said the town has consumption data on water and sewer and is working on quantifying it to see how costs are driven.

“Solid waste is in the works,” Smith said. He mentioned the University of Maine waste audits and getting that data back as we try to examine solid waste. “There may be sunk expenditures in solid waste, costs that aren’t consumer driven,” but there are some that are, and the Council may choose to separate those costs when creating fiscal policy. The councilors quickly mentioned pay-as-you-throw programs. The town is also continuing to look at parking fee revenue.

Peacock also talked about state-level movements on extended producer responsibility bills. Caines suggested a fee structure for those who “have excessive amounts of vacation rentals.”

Smith said the town would need legal guidance to create a policy about that.

GRANTS

The federal grant window (when grants can be applied for) is now.

“Now I have to scramble to see if we have shovel ready stuff,” Smith said. “You have to have a good solid plan. You have to know what you’re going to do.”

The ferry terminal plan might be a possibility for federal money, he said.

Shank said maybe a town goal should be to have two in the chamber for when that grant window is open. “Is that a workable realistic goal?”

“I’d much rather have a plan sitting on the shelf, collecting dust so that when we see the opportunities,” Smith said. “We need to have solid projects that the community is going to stand behind.”

Peacock also talked about how preparing for climate change and sea level rise were also good places to look for federal support. As well as carbon reduction and resiliency.

BUDGET CONVERSATIONS

The councilors only had a few minutes remaining in their hour workshop for the budget evaluation and process.

“There is probably room for conversations from the Warrant Committee and Council,” Smith said.

Hochman said he missed having staff heads come to the council to discuss budget questions immediately. “We used to be able to get that answer pretty quick.” This budget round there were not many department heads other than Finance Director Sarah Gilbert and Smith involved in the discussion and meeting process for the Council or Warrant Committee.

The bill:

https://legislature.maine.gov/legis/bills/display_ps.asp?snum=131&paper=&ld=1298