Legal Fees and Solid Waste Lines in Bar Harbor Budget Running High

Warrant Committee and Town Council Budget Workshops Begin Next Week

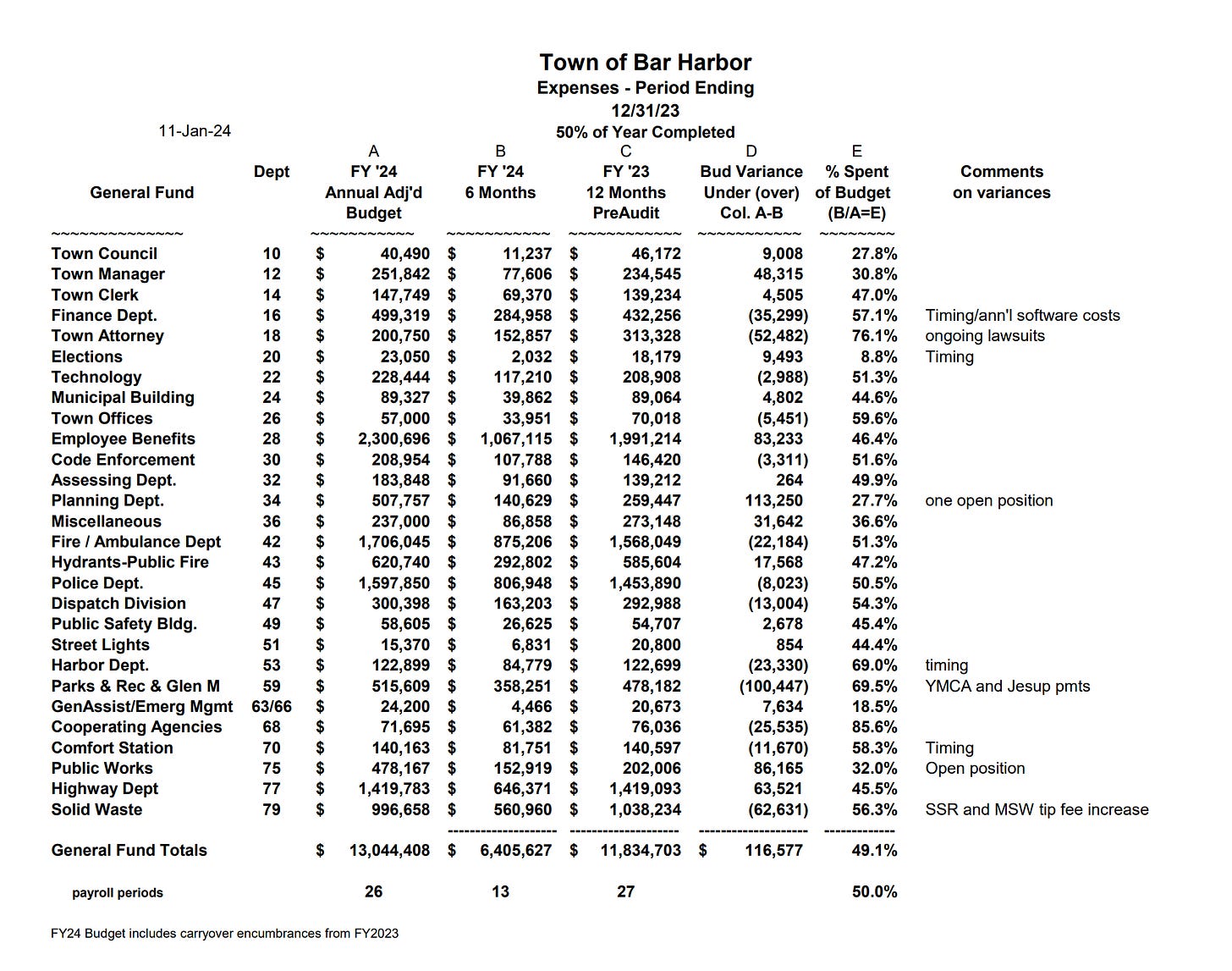

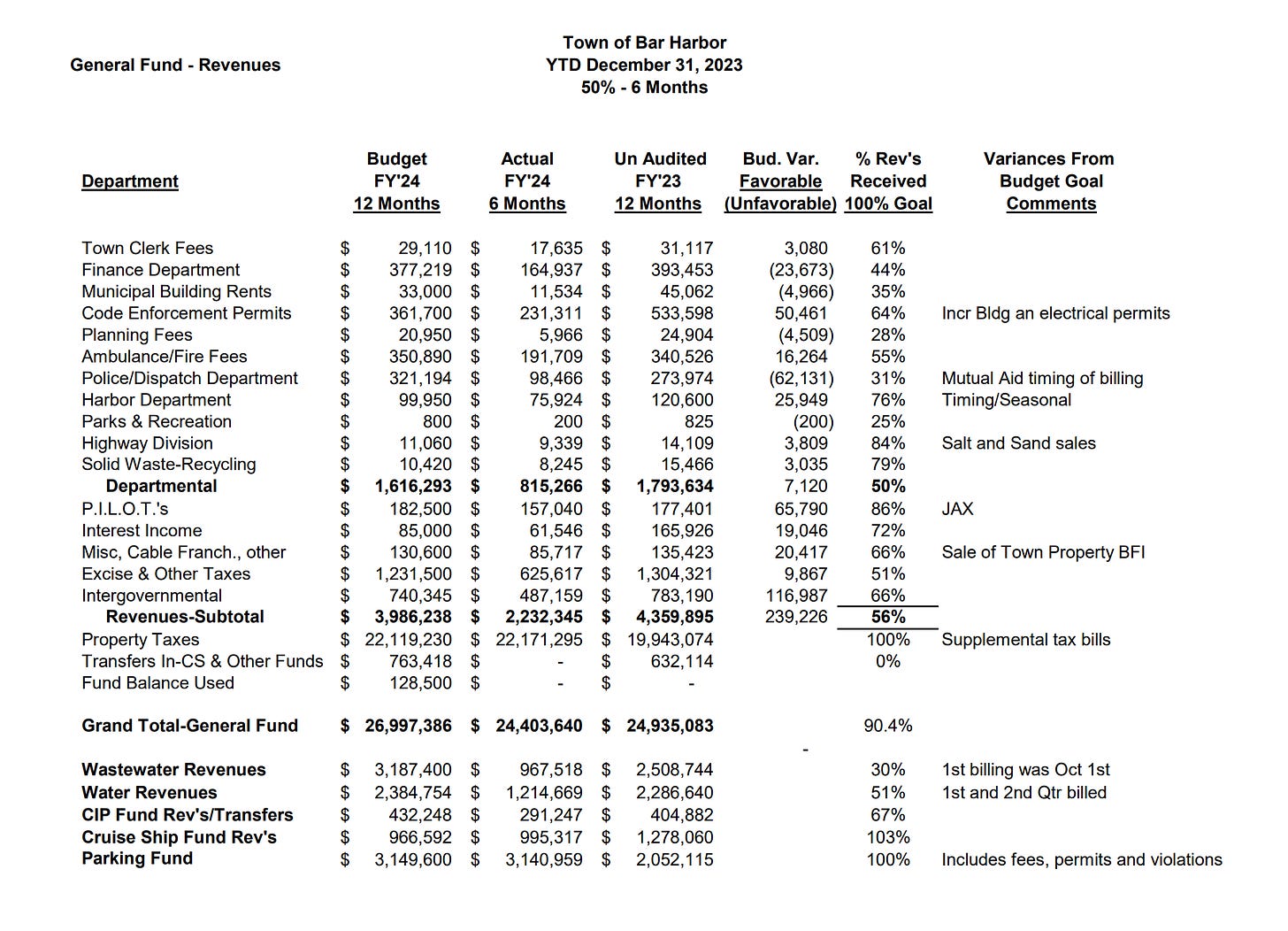

BAR HARBOR—As the town’s months’ long budget process is set to begin, Finance Director Sarah Gilbert told town councilors at their January 16 meeting that for the first half of FY 2024 (July-December), the town is at 49.1% of its expected expenditures in the budget. The only departments ahead of spending expectations are legal fees and solid waste.

“I sound like a broken record,” Gilbert said when referencing that legal fees and solid waste look as if they might go over budget this fiscal year.

The town has spent $152,857 on the town attorney in the first six months of the year, which is 76.1% of the total budgeted. The town is currently embroiled or has recently been embroiled in multiple lawsuits. The town’s attorney also often sits in on meetings, as he did Tuesday night, and advises the town about changes to the town’s ordinances, helps with procedures, and other business. One of those lawsuits (APPLL et al vs Bar Harbor) is about changes to the town’s land use ordinance to allow 1000-a-day passenger cruise ship disembarkation limits and is awaiting its first judgement after a federal trial this July.

Solid waste is ahead of expectations because of fee increases, Gilbert said.

There are three full-time positions currently unfilled. A staff planner will begin in February. The town is currently looking for a construction foreperson and a transfer station foreperson. Mutual aid billings have not yet been captured, Gilbert said.

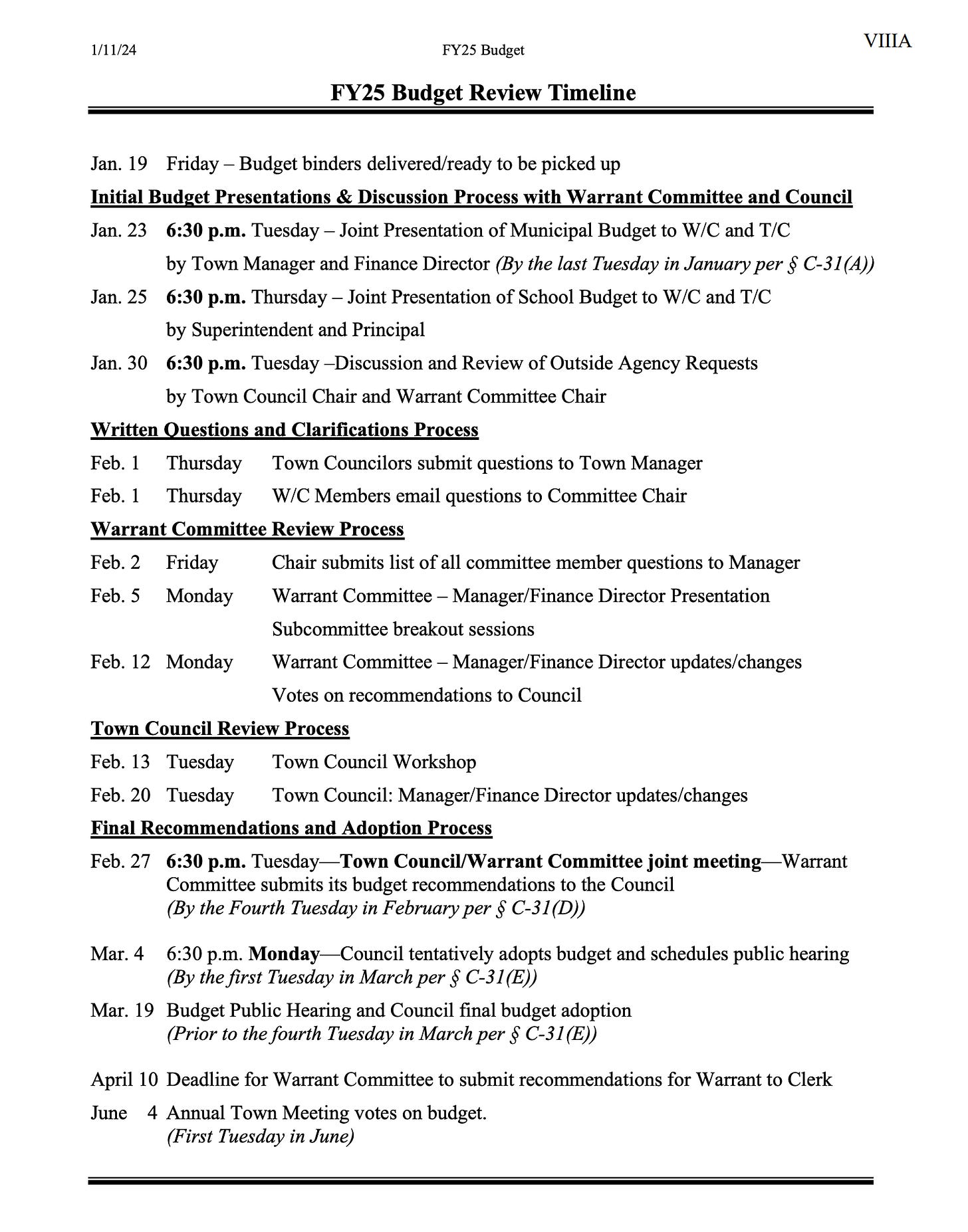

BUDGET REVIEW TIMELINE

Town Manager James Smith presented the councilors with a proposed budget review timeline.

The Bar Harbor budget process involves a presentation to the Town Council and Warrant Committee by the town manager and finance director. That begins January 23. It ends in June at town meeting when the voters decide on the budget’s fate. Voters can change the budget at that meeting.

“We’re into the budget season, not quite as fun as playoff season,” Council Chair Valerie Peacock quipped.

“It’s pretty straight forward,” Smith said. There will be separate meetings to discuss the municipal budget, school budget, and then a discussion and review of outside agency requests.

“We’ve asked for a period of time where we can get some written feedback from members,” Smith said. The Warrant Committee allowed members to send in written feedback to its subcommittee chairs last year. The Council will allow this too this year, Smith said.

There is also a day set aside for Smith and Gilbert to be available to the Warrant Committee for break-out sessions. The Warrant Committee will have a draft recommendation for Council. Council and staff will make adjustments.

“It’s all new for me, too,” Smith said of the town’s specific budget process, and he said the timeline hopefully works for the Council and the Warrant Committee.

“So, we’re looking at budget binders on Friday,” Peacock said.

The binders are large hard copy print-outs of the budget. They are available online each year, but a hard copy version is given to councilors, Warrant Committee members, and a few others. There are 44 of these printed and collated by the town clerk’s office. Smith commended Town Clerk Liz Graves for her work.

“We’re pleased that we’ve been able to roll this out for you and the Warrant Committee,” Smith said.

SENIOR TAXPAYER ASSISTANCE PROGRAM

At the end of December, the program’s deadline, 55 Bar Harbor taxpaying seniors had applied to the Senior Taxpayer Assistance Program. Last fiscal year there were seven approved applications out of 10 for the new program. This year there were 38 applications approved.

“It’s great to see that folks within the community are taking advantage of this program,” Gilbert said.

The increased use means the town’s Assessing Department would like $17,200 for that assistance. Last year, the cost was $3,000.

That money would come from contingency items in the budget since it wasn’t budgeted for FY2024, but it will be budgeted for in the future, Gilbert said.

Applicants have to reapply each year. They must be 65 prior to April 1 of the program year, be Bar Harbor resident for at least five continuous years, and have received a tax credit under the provisions of the State of Maine Residents Property Tax Fairness Credit Program for the Income Tax filing of the preceding calendar year. Property owning applicants have to have applied for and received the homestead exemption for the current program year and have no past property taxes due. There are different qualifications for renters.

Re: The Towns Legal Fees

With residents paying the town's legal fees, shouldn't we be allowed to know who is running up how many billable hours and for what? A full detailed accounting.