Radical Shift in Real Estate Market Big Player in Mount Desert Tax Bills

MOUNT DESERT—When it comes to property taxes, the Town of Mount Desert, like many communities in Maine are stuck between a rock and a hard, expensive place. And many of the factors, the Selectboard members heard Tuesday night, are beyond the board’s control.

In a July 4 letter to the Selectboard members, Town Manager Durlin Lunt explained that “tax bills are driven by the budget.” This year’s budget, he said, “was strongly supported by the Selectboard, Warrant Committee, and of course, the Town Meeting.”

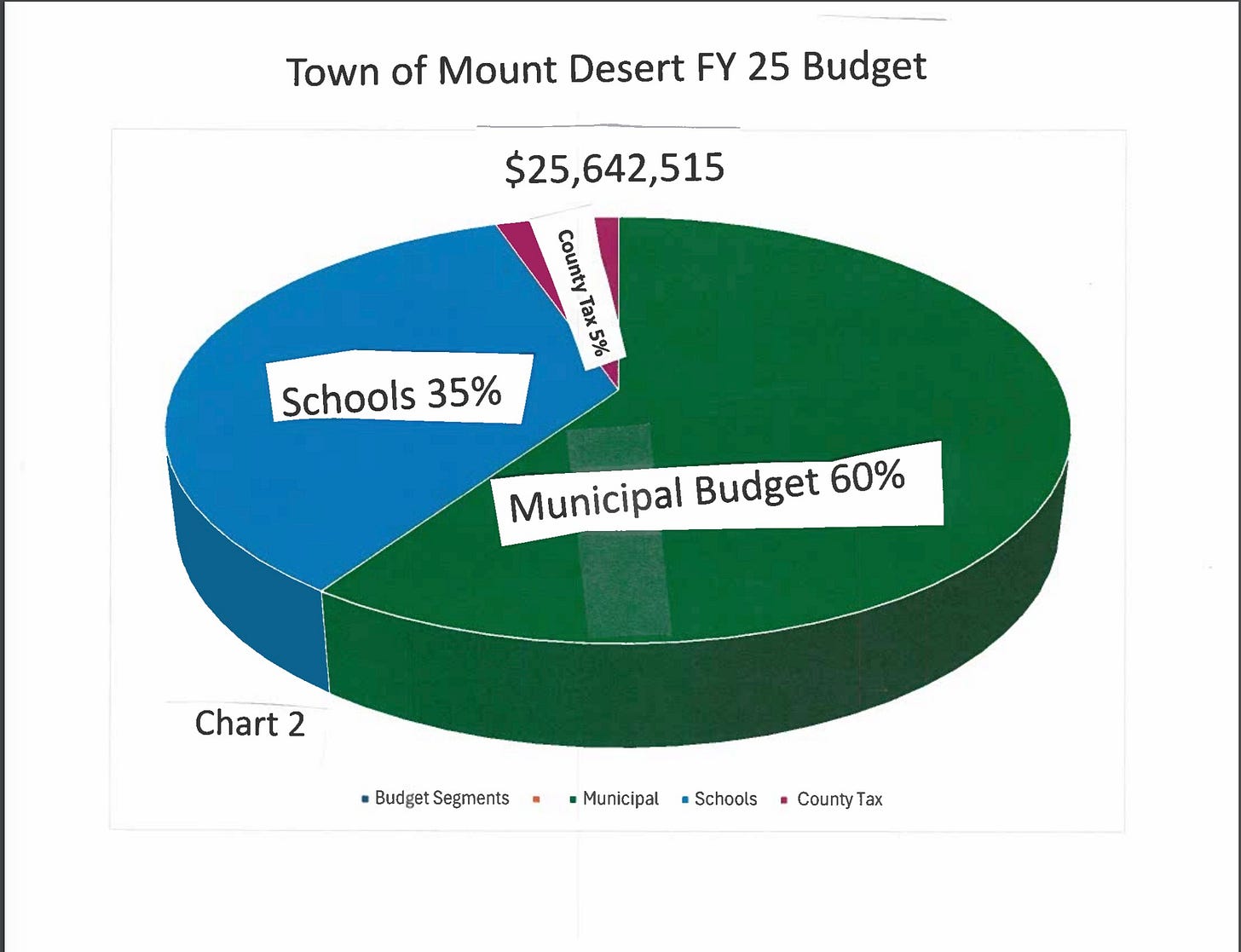

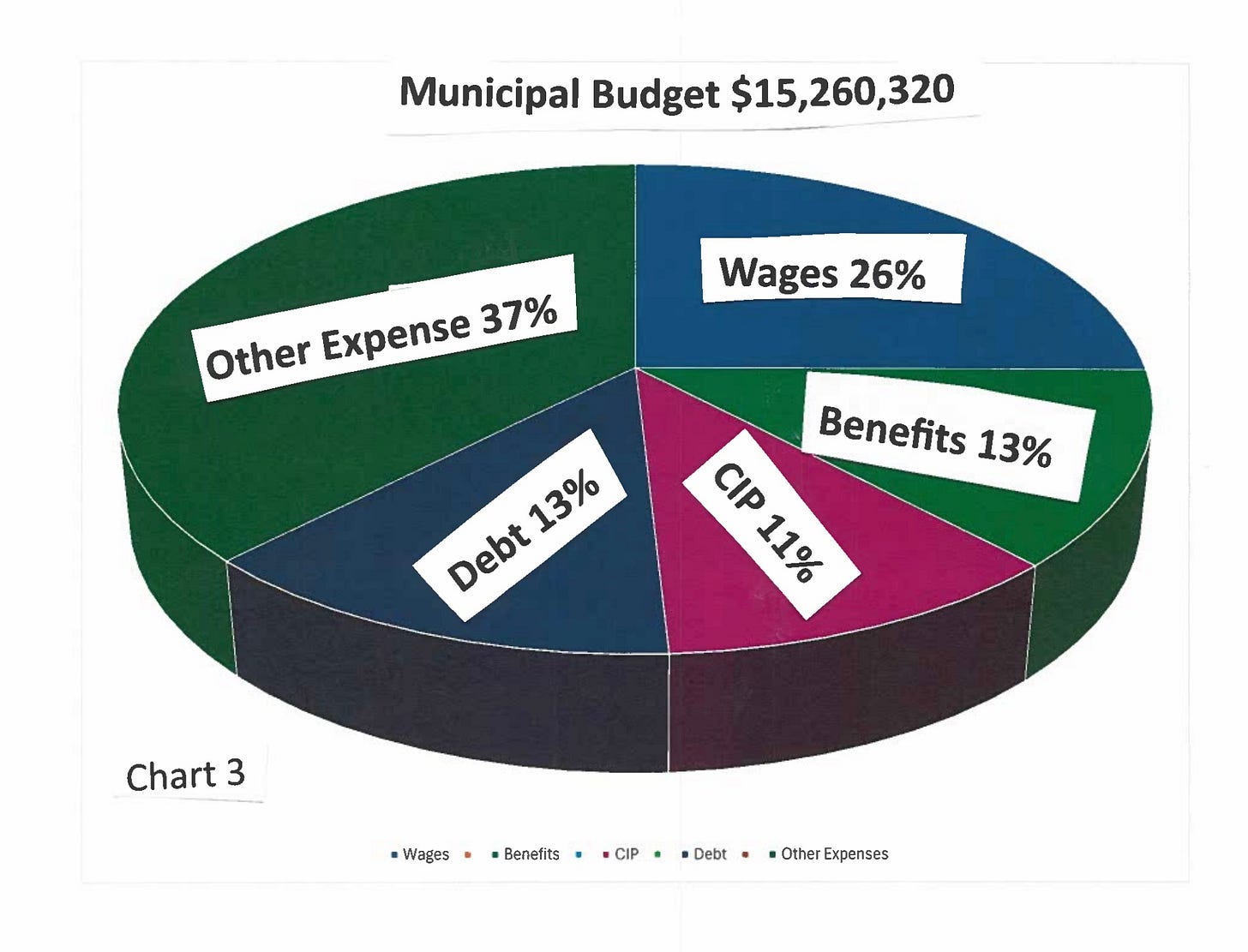

When looking at the budget, he said, the Selectboard only can review 60% of its total. Like other Mount Desert Island towns, the Mount Desert Selectboard can’t control the Hancock County assessment, which increased by close to $200,000 for the town. It can’t control the town’s elementary school budget, which increased by approximately $660,000. It can’t control the Mount Desert Island High School budget, which increased by $240,000 for the town.

Those items equal approximately $1.7 million of the $25 million budget’s $2.2 million increase or 77% of that increase.

The 6.7% increase in the mill rate (the tax rate per $1,000 of a property's assessed value) impacts all the taxpayers, but there are other factors at play, too.

Another aspect to the property tax bills is the value of the property that is taxed.

Mount Desert recently went through a revaluation of some properties.

When the market value on property increases, the sales ratio changes. When those market values change, the compliance to state law also changes for the town.

In a 2006 letter to the Mount Desert Islander, Bar Harbor Assessor Steven Weed wrote, “The town does not control the real estate market; however, we are required by state law to keep assessments within a certain percentage of ‘market value.’ The minimum allowed ratio is 70 percent; the maximum is 110 percent.”

The same thing happens in towns across the state.

In order to receive certain state funding, school money, homestead exemption reimbursement, BETE reimbursement, and other funds, the town’s assessments must be at 91% of the state’s valuations.

Mount Desert Assessor Kyle Avila said there were variable increases during the revaluation. About 1,300 parcels were reassessed and their values increased. Those adjustments on land values tended to be between 10-20% depending on the sales in those villages.

The third factor is that the senior stabilization property tax freeze for seniors that was created by the state no longer exists. So, those 160 seniors in Mount Desert whose taxes had been frozen saw an increase.

“That really hit our most vulnerable seniors,” Avila said of the changes.

“I’m trying to hold the line. Part of the impetus for doing the reval (sic. revaluation) was the radical shift in the real estate market in the last 3 to 4 years,” Avila said. “We’ve seen close to 30% appreciation in the last handful of years.”

In his fifteen years working for the town, Avila said, in a good year that appreciation typically, had been between 1 to 2%.

There are currently only two homes for sale for less than $400,000 in Mount Desert. There are two more for sale (with contingencies) for less than $600,000.

LINKS TO LEARN MORE

The assessor’s page and ways to contact him.

If you’d like to donate to help support us, you can, but no pressure! Just click here.