BAR HARBOR—The town may be headed to a new assessment according to Interim Town Manager and Financial Director Sarah Gilbert. She gave the public and Bar Harbor Town Councilors the news during the council’s Tuesday night meeting.

The town’s last full revaluation was in 2006. When the market value on property increases, the sale ratio changes. When those market values change, the compliance also changes. In a 2006 letter to the Mount Desert Islander, Assessor Steven Weed wrote, “The town does not control the real estate market; however, we are required by state law to keep assessments within a certain percentage of “market value.” The minimum allowed ratio is 70 percent; the maximum is 110 percent.”

During her financial report, Gilbert said that Steve Weed is suggesting a reassessment of all town property because it has dropped below 80% of the property value price and that every piece of land (and all dwellings) would be reassessed.

According to Gilbert, in order to receive certain state funding, school money, homestead exemption reimbursement, BETE reimbursement and other funds, the town’s assessments must be at 91% of the state’s valuations.

The was a revaluation in 2021 that included all properties in the Town of Bar Harbor but was a statistical update. This means that the assessor assumes that the base data on the land and buildings that the assessor already had has not changed and the valuations were just updated to market values.

“We start from scratch,” Gilbert said. The town currently has a $2.1 billion assessment. If the town’s assessment changes, it would impact FY 2025

Outgoing Councilor Jill Goldthwait thanked the nonprofits that have been giving payments in lieu of taxes. Nonprofits do not have to pay property taxes though they use town infrastructure and agencies and are on land that would be taxed if not occupied by a nonprofit. Some nonprofits give the town money to help offset this.

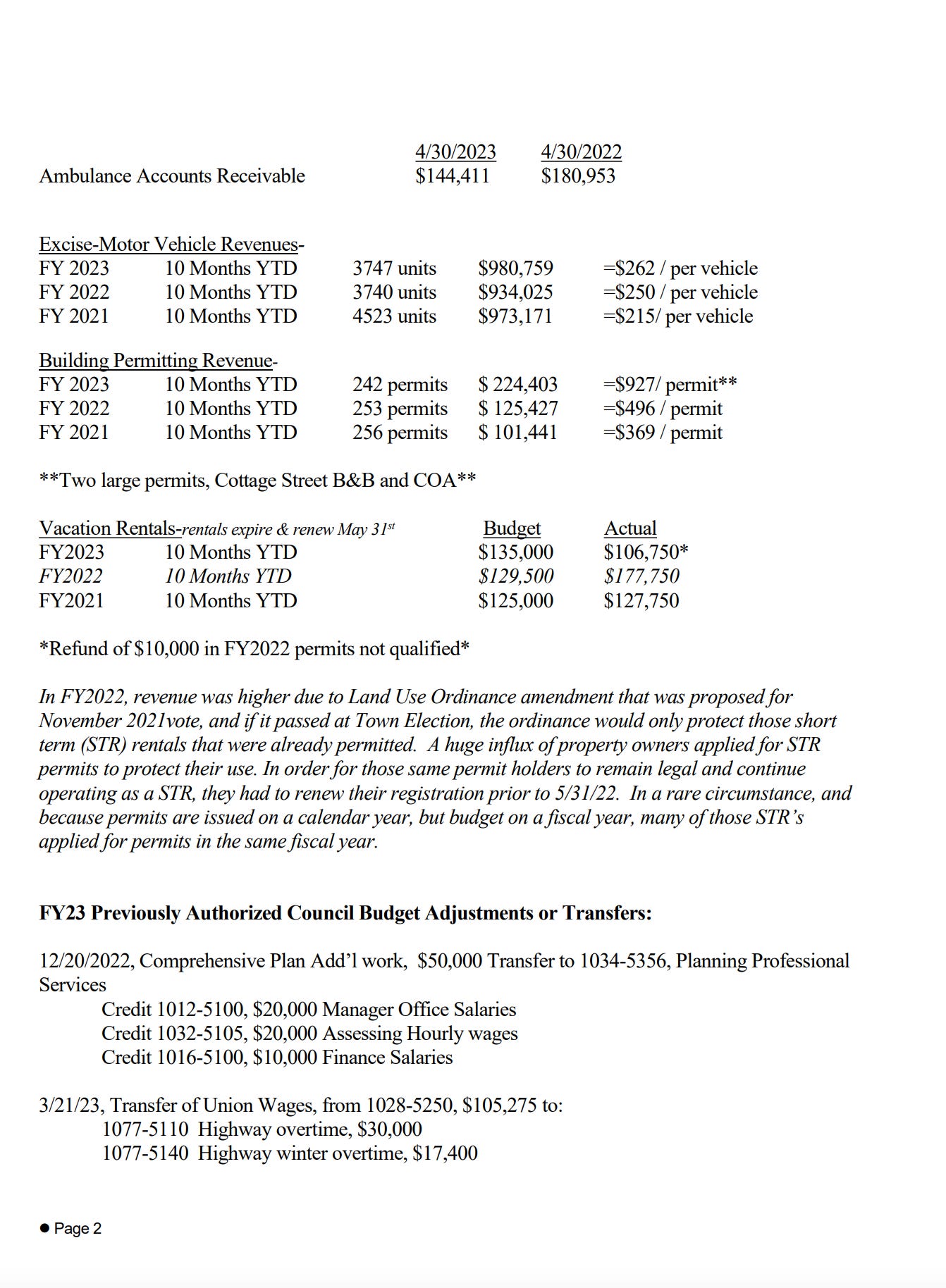

THE REST OF THE FINANCIAL REPORT

Gilbert said that the legal expenditures are three times what was budgeted as of April. This is due to legal consult and lawsuits. The fire department’s overtime line is up because the department wasn’t fully staffed for the summer. According to Fire Chief Matt Bartlett, this is because there were basically three months of overtime to fill shifts and training costs to bring new staff up to speed.

Vehicle excise tax is the second highest revenue source for the town, Gilbert said, coming in at just under $1 million.

There are 13 new dwelling units that have been approved since January.

FINANCIAL AUDIT

James Wadman presented a 108-page audit, which was accepted by the council.

TEN-YEAR COMPARISON

Town meeting is on June 6, 2023, and that is the opportunity for the residents of Bar Harbor to vote on the warrant as presented by the Town Council or to make motions to try and change warrant items before they are voted on.

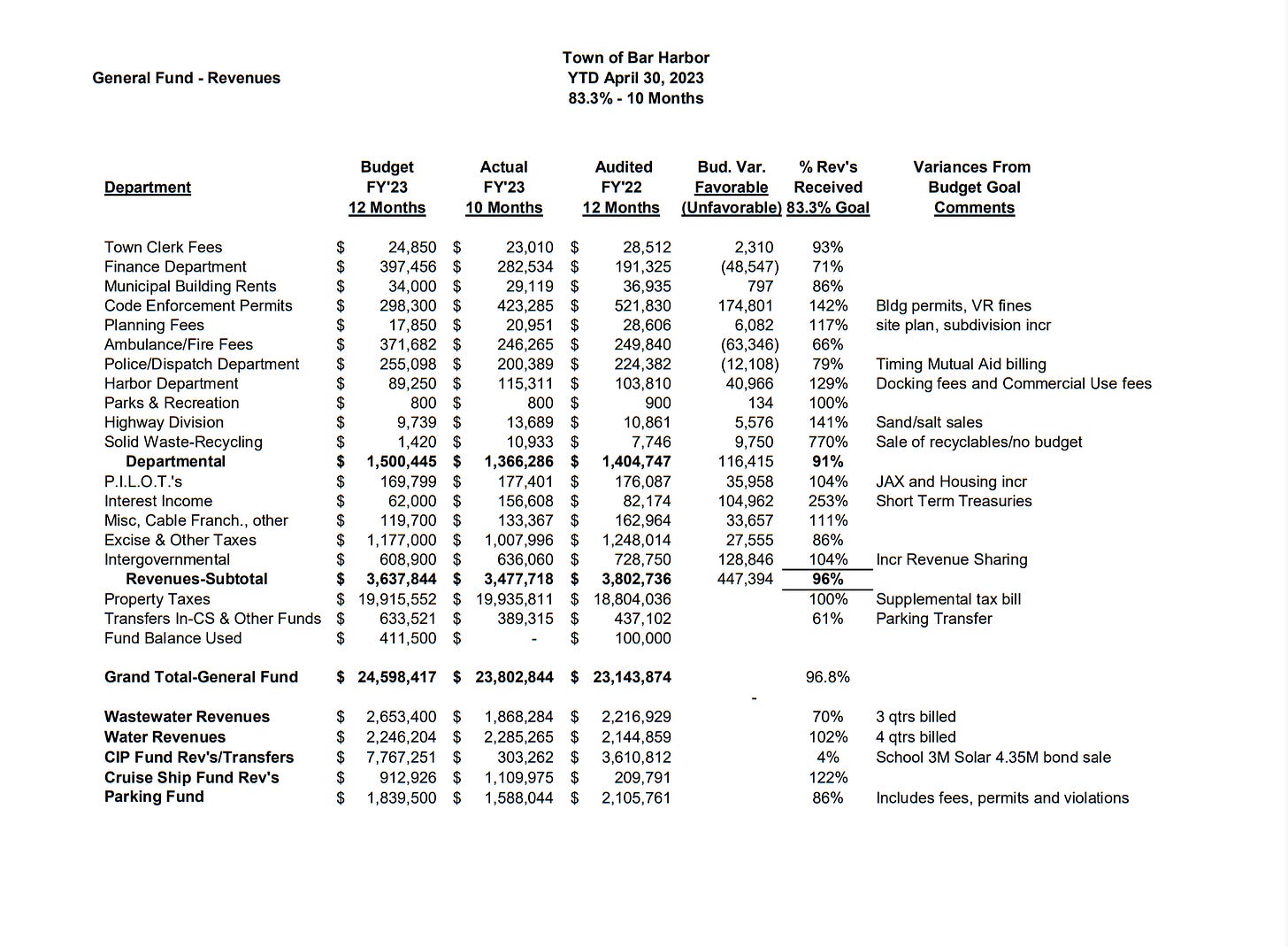

One item on that warrant is the proposed budget for the upcoming fiscal year. In order to better educate the voters of Bar Harbor on how expenses have risen in the last decade, the town’s budget for fiscal year 2014 and the proposed budget for fiscal year 2024 are presented below.

The budgets for each section of the general fund for each of the two years are listed together along with the increase in expenditures (proposed for FY 24) or the decrease in expenditures.

There are two decreases in expenditures. One is for streetlight expenditures which is due to the actual reduction of streetlights and the other is for the use of reserve fund balances. An explanation is required for the reserve fund balances. In 2014, the line item “Reserve Use of Fund Balance One Time Expenditures” did not exist. Therefore, you have to add the amount under “Reserve Use of Fund Balance One Time Expenditures” and “Reserve Use of Fund Balance For CIP” to achieve the total amount of expenditures for the proposed FY24 budget.

Over this 10-year period, the total appropriations has increased by 54% or $9,513,789 while the total revenue has increased by 59% or $1,811,642. Realistically, the increase in revenue is only 19.04% of the increase in expenditures. The balance falls upon taxpayers.

Also, over this 10-year period, the total MILL rate increase is only 2%. However, the town performed a revaluation in 2021 and the total taxable valuation increased by 51%. While this very slight MILL rate increase looks good on tax bills, it is offset by the increased valuation of properties.

FY2014 FY2024 Increase/Decrease

Town Council $32,920 $40,490 23%

Town Manager $131,036 $251,842 92%

Town Clerk $119,475 $147,749 24%

Finance Department $316,215 $499,319 58%

Town Attorney $67,420 $200,750 198%

Elections $10,361 $23,050 122%

Technology $121,486 $228,444 88%

Municipal Building $80,273 $89,327 11%

Town Offices $37,566 $57,000 52%

Employee Benefits $1,345,347 $2,300,696 71%

Code Enforcement $69,142 $208,954 202%

Assessing Department $115,497 $183,848 59%

Planning Department $118,722 $472,997 298%

Miscellaneous $180,505 $237,000 31%

Fire/EMS $708,043 $1,706,045 141%

Public Fire Protection $480,468 $620,740 29%

Police Department $919,922 $1,597,850 74%

Police/Fire Dispatch $201,945 $300,398 49%

Public Safety Building $45,807 $58,605 28%

Streetlights $63,278 $15,370 -76%

Harbor Department $121,891 $122,899 1%

Parks and Recreation $228,873 $515,609 125%

General Assist/COVID 19 $1,445 $24,200 1575%

Cooperating Agencies $39,843 $71,695 80%

Comfort Stations $90,729 $140,163 54%

Public Works $143,623 $314,612 119%

Highway Department $1,059,443 $1,419,783 34%

Solid Waste Department $601,229 $996,658 66%

SUBTOTAL $7,452,504 $12,846,093 72%

Capital Improvements Transfer $1,738,842 $2,195,148 26%

School Local Transfer $5,080,953 $6,898,400 36%

TOTAL EXPENSE TAXABLE $14,272,299 $21,939,641 54%

Hancock County Assessment $553,853 $947,755 71%

MDI High School Assessment $2,606,151 $4,037,317 55%

Overlay Assessment $51,292 $72,671 42%

TOTAL APPROPRIATIONS $17,483,595 $26,997,384 54%

REVENUES

General Revenues $2,360,190 $3,511,238 49%

Reserve Use of Fund Balance

One Time Expenditures N/A. $78,500 N/A

Reserve Use of Fund Balance

For CIP $288,859 $50,000 -83%

Transfers in Cruise Ship, Dog

Licensing, Shellfish Licensing $284,259 $763,418 169%

State Revenue Sharing $133,206 $475,000 257%

TOTAL DEDUCTIONS $3,066,514 $4,878,156 59%

NET COMMITMENT $14,372,104 $22,119,229 54%

TAXABLE VALUATION $1,435,774,620 $2,166,741,800 51%

MILL RATE 10.01 10.21 2%

Below are some of the documents from the meeting. The packet is here.

This article has been updated in that this sentence “Below are some of the documents from the meeting. The packet is here. “ has been moved.