The Bar Harbor Story is generously sponsored by First National Bank.

MOUNT DESERT ISLAND—Property tax bills in Bar Harbor arrived in mailboxes last week and caused some confusion on social media about increases.

Property tax bills can be paid in two installments a year in Bar Harbor. They can be paid twice a year with due dates of September 30 and March 31. They are based on the town’s fiscal year, which runs from July 1 through June 30, not the calendar year.

If people have an increase in their property’s assessment through revaluation or because they’ve had new additions, there will be an increase to their taxes. The amount people pay is determined by their property’s valuation (what it’s valued at by the town assessor) and then the amount of taxes the town must raise in a fiscal year.

“The assessed valuations did not go up uniformly across the board,” Bar Harbor Town Manager James Smith said.

In Bar Harbor, property owners’ bills are controlled by the municipal budget and school budget, the high school budget, and the county budget. Bonds taken out for projects, which are voted on as well, are part of these budgets.

Bar Harbor Finance Director Sarah Gilbert spoke to the average increase this year.

“The average residential home with an taxable (assessed less any exemptions), $522,350 reflects a tax of $5,244, which is an increase of 15.7% from previous year or $711,” Gilbert said.

Some residents have said their increase was closer to 28%.

“If folks participated in the 2023 State of Maine Senior Tax Stabilization, their 2023 tax would have been the same as the 2022. Those taxpayers would see a 28% increase,” Gilbert said.

She also gave an example of how that state program’s demise would impact a property owner: If a taxpayer paid $4,160 in 2022 and 2023, they received a credit of $459.

“Then the state discontinued the program and 2024 tax bills for these taxpayers, and tax goes back to current mil rate, 10.04/$1,000,” Gilbert said. “In this case, an increase of $1,182 or 28%.”

There is some hope for seniors who used the state program.

“Hopefully, all residents take advantage of the Homestead Exemption, which was $25,000 reduction in the assessed value of their home,” she said. “The town continues its Senior Taxpayer Assistance Program, and the State of Maine offers a couple of options: Property Tax Deferral Program and Property Tax Fairness Credit.”

In Bar Harbor, the town’s debt service on the Conners Emerson School construction is interest only on this year’s tax bills.

“Next year, will be principal and interest,” Gilbert said that’s an estimated $3.75 million. This tax year, the interest estimate is $1.95 million and factored into taxes.

Both the county and high school have budget meetings, which are open to the public. There are opportunities for public comment there and also during Bar Harbor (or other towns’) Warrant Committee and Town Council meetings. In other towns, these would be select board meetings. In most area towns, that budget process begins in January.

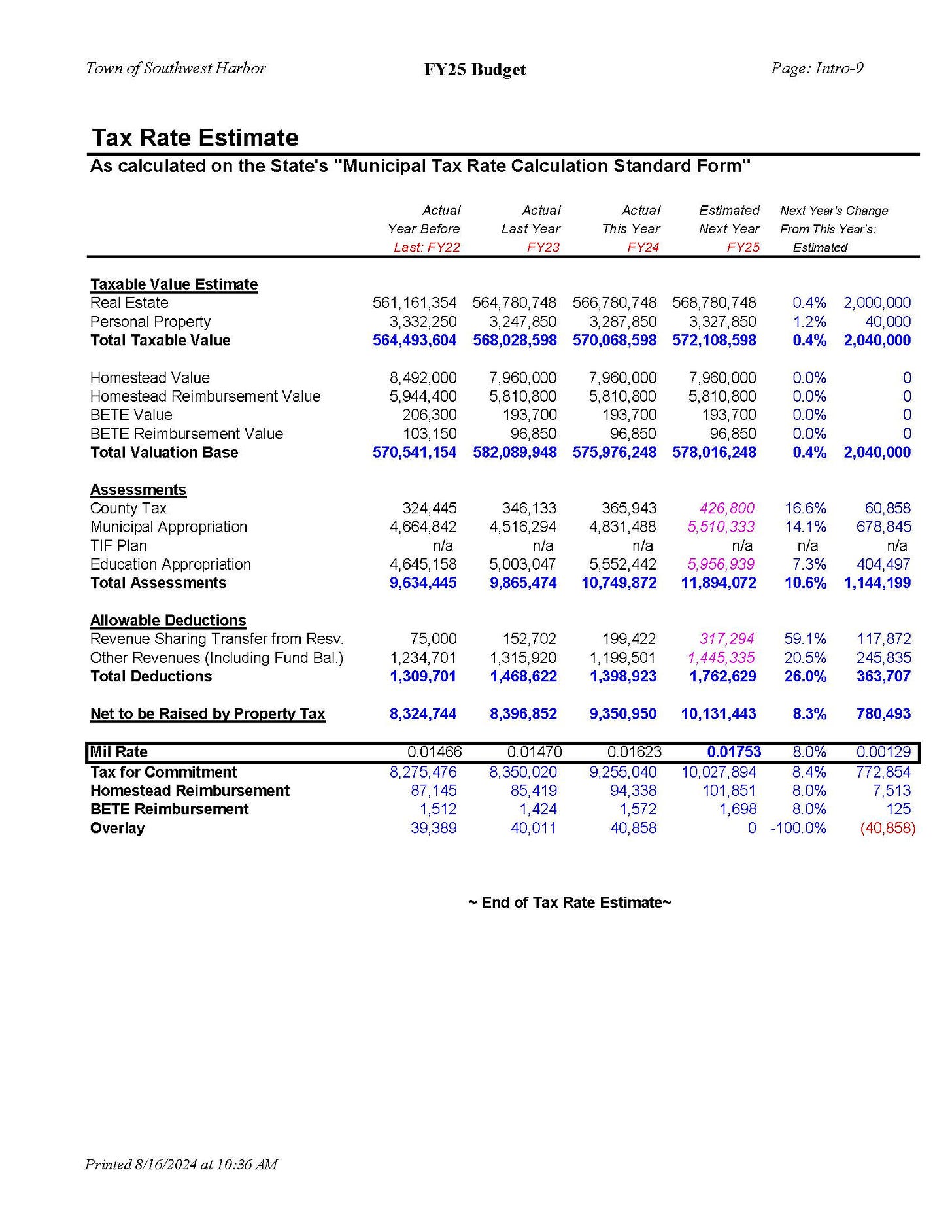

SOUTHWEST HARBOR/MOUNT DESERT/TREMONT/TRENTON

In Southwest Harbor the net to be raised by property tax increased approximately $780k from last year to this year. Southwest also had a revaluation this year. It hadn’t been done for over ten years, but that revaluation also impacted the town’s property values and residents’ tax bills.

“This means that, despite our net to be raised by property tax increasing, our mill rate has decreased substantially from 16.26% in the 23/24FY to 9.02% in the 24/25FY,” said Becky Gatcomb, Southwest Harbor’s bookkeeper and deputy treasurer.

Southwest Harbor does not currently have a senior tax program nor does Mount Desert.

In Mount Desert, the tax rate this year is $9.30, a 6.7% increase over last year's rate of $8.72.

“Many taxpayers saw a 10-20% increase in their assessed values due to market adjustments, so tax increases were variable across town,” said Kyle Avila, the town’s tax assessor/IT coordinator/E911 addressing officer. “Regardless of assessed valuation changes, a home assessed for $500,000 saw their tax bill go to $4,650, up $290 over the last year due to the budget increase. Participants in the senior tax stabilization program saw an increase of 15.2% (8.5% increase last year).”

Tremont’s amount to be raised by taxpayers increased 10.4% this year. Its revaluation was not uniform for all taxpayers according to Town Manager Jesse Dunbar. Some property value assessments increased and others decreased.

Tremont does have its own senior reimbursement program that was voted in at this year’s town meeting. The maximum amount of reduction is $750. Dunbar said the vast majority of qualified applicants received the maximum amount.

Trenton’s Town Office did not respond to our specific questions about property tax increases, however, according to its last town report, “The Selectmen voted to have the Assessor’s Agent perform a valuation adjustment this year. This will bring the Town nearer to the State Valuation in compliance with State Statute. The current Town valuation is $309,275,880.0. The State valuation is $504,100,000.00. The Assessor’s Agent have yet to determine how much to increase the valuations to get closer to 100%. While you will see an increase in your valuation, you will see a reduction in the mill rate. We still need to raise $5,337,134 or a $685,625.00 increase in taxation.”

LINK TO LEARN MORE

Below is a link to Bar Harbor’s website which discusses both of the state’s programs and town’s program:

https://www.barharbormaine.gov/203/Property-Tax-Relief

If you’d like to donate to help support us, you can, but no pressure! Just click here.

If you’d like to sponsor the Bar Harbor Story, you can! Learn more here.

Businesses like restaurants and stores that stay open year round should get a tax break - for services to the community. We year round residents put up with the jam packed crowds, the traffic, hopeless searches for parking, the outrageous parking fees, the lack of housing, the empty shelves in grocery stores etc etc. Possibly a nice break for the businesses stay open for US would be great. We appreciate you.