Bar Harbor Council Raises a Few Fees

Parking Fees Were Not Raised by Council, Still Recommended by Warrant Committee

BAR HARBOR—Town Manager James Smith cautioned the Bar Harbor Council to not depend on parking revenue to help alleviate the town’s property owners’ burden on the proposed budget, which is a 15% increase from last year’s. Portions of that increase come from increased budgets from the high school, Hancock County, school system, and bonds. The school system and high school budgets are also voted in and are separate from the town’s own school budget for the Conners Emerson Schools, which the town can tweak.

The Warrant Committee had suggested increasing the parking costs to help pay for some items in the budget, which the state allows that money to pay for. Smith reaffirmed his hesitancy about using parking funds at a Warrant Committee meeting on Monday.

Smith told the Council last Tuesday that he didn’t feel comfortable with the Warrant Committee’s proposal for more parking revenues. If projections aren’t realized, then there can be a fiscal crisis, he said. He was uncomfortable with that. The fees had been increased this last summer after the Parking Solutions Task Force presented a plan to the Town Council, which agreed to increase the fees then.

The Warrant Committee had suggested the Council look into increasing some parking fee revenue by 25% (allowing the parking committee to determine how that should work) to add an additional approximate $718,000 to the town’s coffers, which could be used for things such as reducing the school bond. That effort did not pass the Council. On Monday night, a split Warrant Committee recommended the fee raise again, discussing how any extra revenue could be used to help pay the school construction bond.

“We have to do something. Something has to happen,” Warrant Committee member Jeff Young said of the 15% budget increase, Monday night.

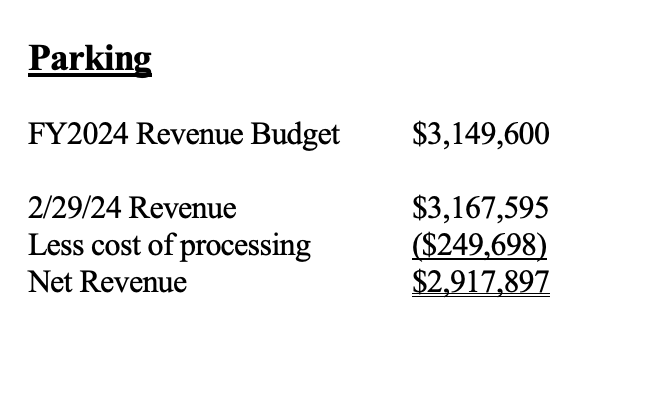

The gross revenue for parking this fiscal year, which ends in June, is $3,149,600, according to the revenue report submitted by Finance Director Sarah Gilbert. The town is currently at just about $3,167,595. Net revenue would be just under $3 million.

Cruise ship revenues were not tweaked for this budget, Smith had told the Council. The town recently won a court case decreasing the amount of cruise ship disembarkations to 1,000, which would also decrease the amount of cruise ships coming to Bar Harbor, and therefore, the fees the town takes in. Warrant Committee member Eben Salvatore, who is an employee of Ocean Properties, which is involved in the lawsuit, said that those fees would be decreasing significantly this year and next.

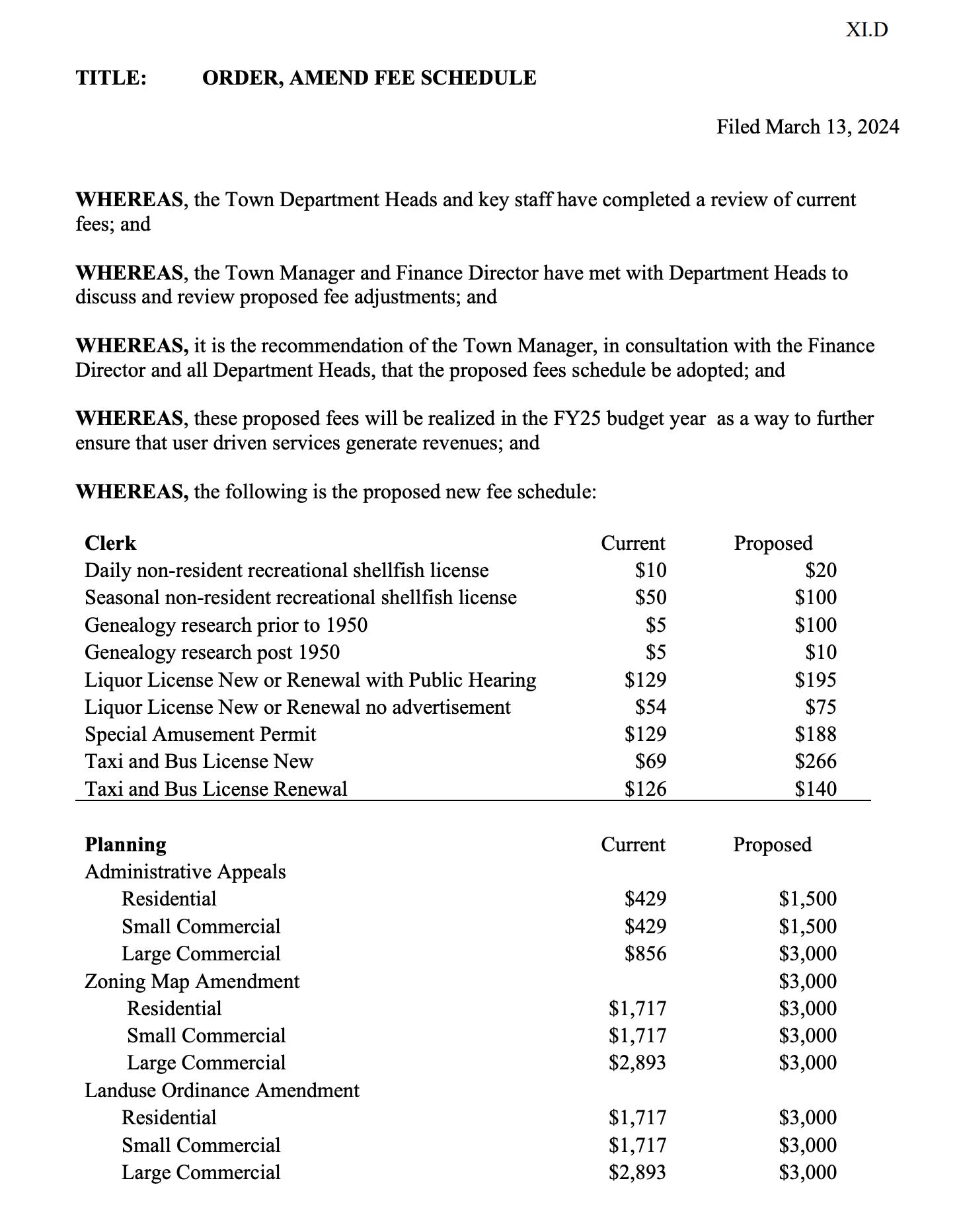

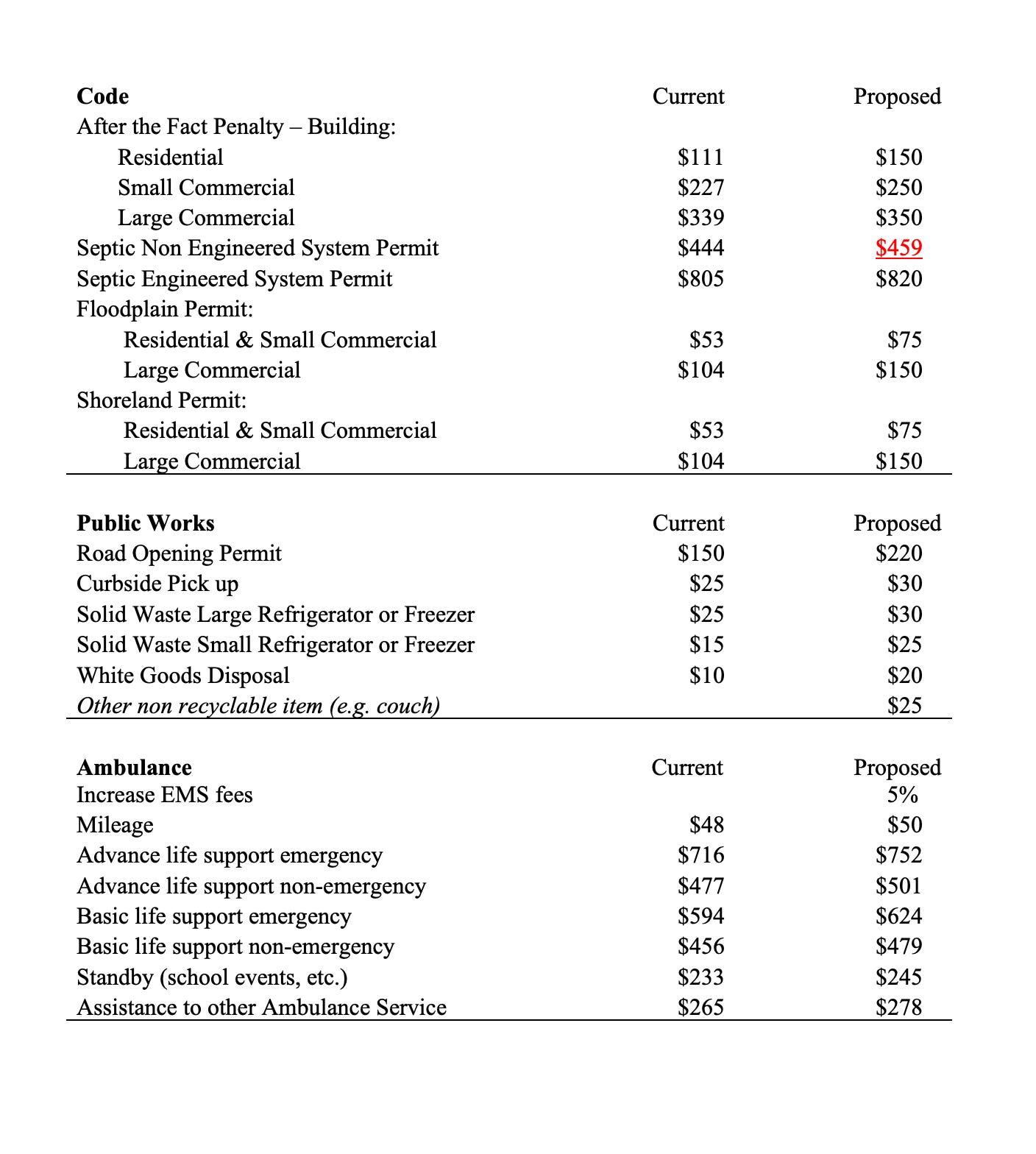

The Council did unanimously amend multiple fees in a fee schedule that Smith presented. The increased fees were created with help from the town staff. Councilors tweaked a few of those fees in motions, discussing residential and small commercial fees for requested changes to zoning maps and land use ordinance amendments, parking violations, and administrative appeals for residences.

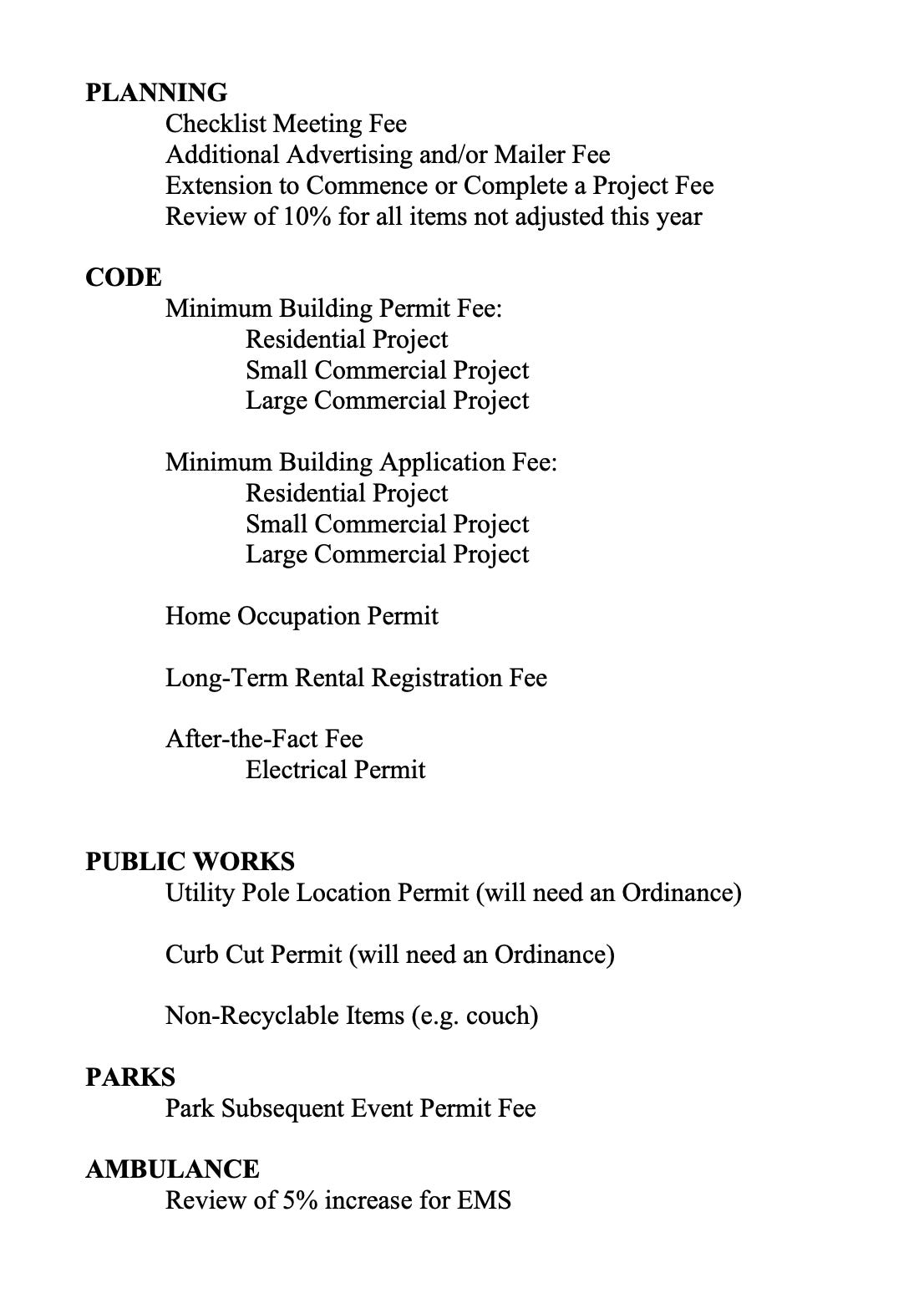

Smith also said that in review, staff recognized other areas that the Council might add to the fee schedules. Those are listed in the image below.

FINANCIAL REPORT UPDATE

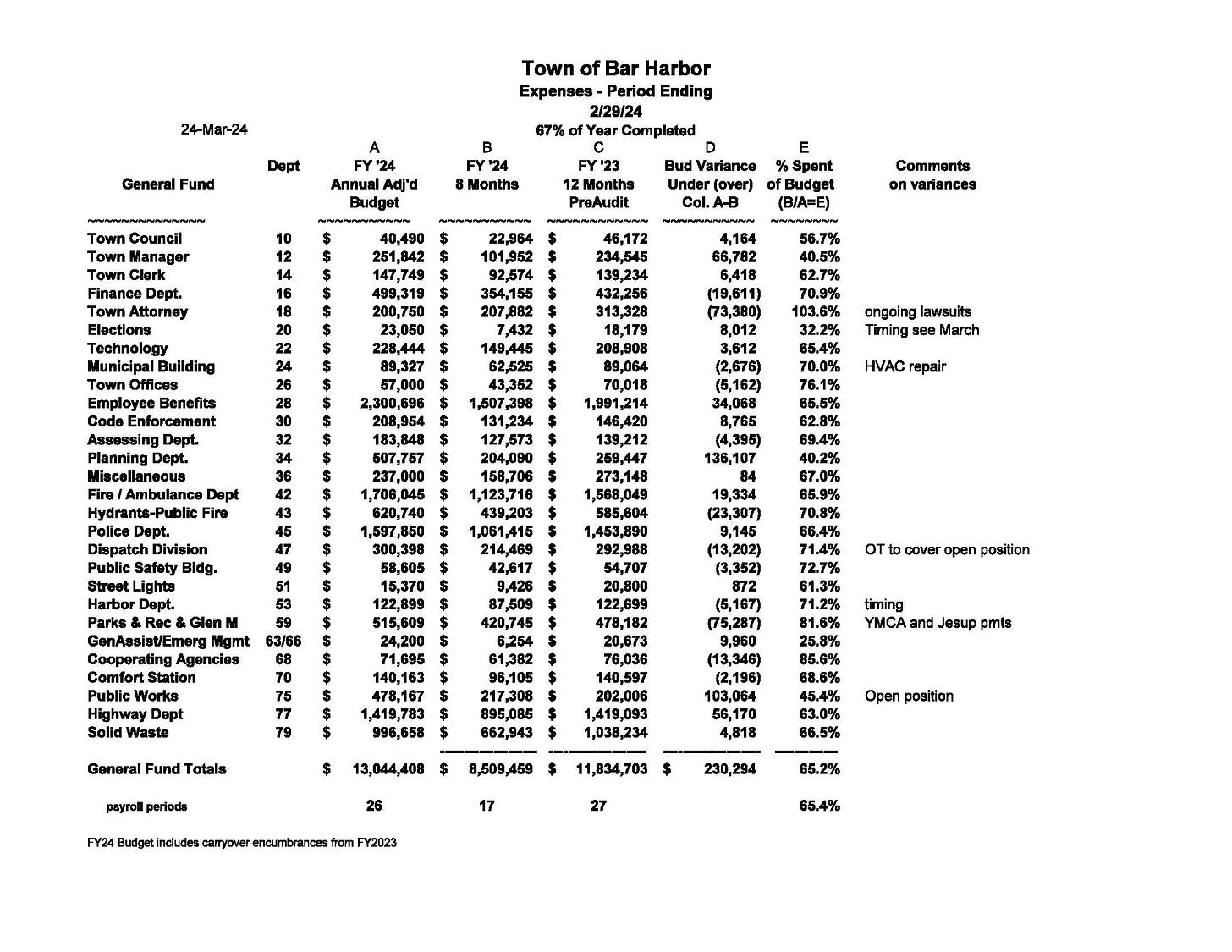

Finance Director Sarah Gilbert presented eight months of the fiscal year to councilors.

“For expenditures, as we all know, our legal is—We’re already over budget unfortunately and there are four months remaining,” she said.

Town attorney fees are currently at $207,882, which means it’s at 103% of the allocated budget.

The Finance Department is also over budget because of licenses paid in August, she said. For the town’s dispatch services (ambulance, fire, police), the open position has caused overtime expenditures.

Public works’ two open positions are making those items come in under budget. Ambulance revenues are favorable and at 76%, which is almost 10% higher than the target for this time of the year. Interest income, thanks to purchasing registries, is also making a higher return.

“Expenditures (67% goal) The February summary statements show 65.2% spent versus 69% of the budget spent last year, a bit under the target goal. 63.7 % of the $6.1 million in budgeted municipal wages are spent year-to-date compared to 71.4% in February 2023,” she wrote in a town memo. “Legal/Town Attorney is the only evident over spent department at this point of the fiscal year.”

Councilor Earl Brechlin asked if more people were splitting their property tax payments than paying in full in the beginning of the fiscal year.

Most people pay 50% by the last day in September and then 50% by the last day in March.

LINKS TO LEARN MORE

Town Council order passed March 4 tentatively adopting the budget and scheduling the public hearing

Video of February 26 Warrant Committee meeting on the budget Part I Part II

Video of February 27 joint Warrant Committee/Town Council meeting on the budget

To view the detailed budget, visit the Budget page or contact the Town Clerk’s office at 207-288-4098.

Town Manager Proposes $1 Million in Tweaks to $28 Million Draft Budget Read full story

Disclosure: Shaun Farrar of the Bar Harbor Story was elected to the Warrant Committee last year. We are married. We do not always agree on everything, which makes life a bit more fun sometimes. And sometimes not so fun.

Couple of points: 1) My math skills are not at all impressive but when the total take of parking meters is divided into the fees paid for processing it seems to come out to .0788%!!!! Wow when Covid forced the closing of my tiny business in Bar Harbor I think I was paying 4 or 5% to Visa/Mastercard. One would certainly expect that an account generating $3,000,000 + would certainly qualify for a much lower rate than nearly 8%. Am I missing something here? 2) Proposed license fee increases also seem a bit out of whack. What would be the justification for charging a tiny taxi company making a few thousand dollars a year a renewal fee of $140 while charging a mere $75 for the renewal of a liquor license potentially generating tens of thousand of dollars?