The Bar Harbor Story is generously sponsored by Edward Jones Financial Advisor: Elise N. Frank.

BAR HARBOR—Many of the approximately 3,800 Bar Harbor property owners had a shock when they opened their mail from the town this week and learned that their property’s value had been reassessed.

When a town reassesses a property, it determines the “assessed value” of a property, which isn’t quite the same as a “market value,” which is the likely price someone will pay for your property if it’s for sale.

A property’s assessment impacts its tax bill. It basically determines your property tax liability.

“The biggest thing I hear is taxes, taxes,” Town Councilor Randell Sprague told his fellow councilors at a meeting, Tuesday night, when talking about what people in Bar Harbor tell him that they are worried about.

For many, the letter didn’t help their fears. The worried social media posts mostly began on Monday.

One property owner thought the change was a typo. It was not.

Now she’s worried that the increase in property taxes caused by the 86% increase in her property’s value could put her out of business. She was not alone.

Another owner posted her reassessment letter from the town on social media. Her previous assessment was $602,300. Her new assessment, determined on April Fool’s Day, 2025, was $712,700.

Town Assessor Steve Weed clarified Tuesday that the new assessments don’t increase the amount of tax money the town collects as a whole for the fiscal year, though it may distribute the individual property owners’ burdens a bit differently.

The mill rate will likely come down because of the changes. If the proposed budget is approved by voters in June, it would be an approximate 10.76 rate. The valuation changes now estimate it to be closer to a 9.38 rate, he said, preliminarily.

“The range of value changes is wide,” he said Thursday morning. “The largest increase was a 289 percent jump for a newly constructed home. The largest decrease was 68 percent, related to a parcel in a state current-use program where the valuation method is set by law. Most properties fall somewhere in between, with value changes driven by new construction, demolition, corrections to property records, or shifts in the local real estate market. Every property responds differently to these factors, which is why the values vary so significantly.”

$377 was the median increase in the proposed budget for the property owners, Weed said.

Now, approximately 60% of properties will be below that bench mark. The remaining will be above that. So, 60% of the properties will be below the middle.

According to the letter sent out to property owners, deadlines to schedule a meeting to discus with the assessor’s office is Friday, May 16, no time specified. They already have 12 appointments scheduled, Weed told town councilors, Tuesday night.

“Part of the reason we are having such a long informal period is” so that people can look at and review the changes, Weed said.

PUBLIC COMMENT AND DISCUSSION

The Mira Monte Inn’s Bruce Ueno spoke to the town council during public comment at the beginning of its May 6 meeting after the councilors amended the meeting’s published agenda to add an assessing staff report.

Ueno said that he’s seldom seen assessments so wildly out of sync with market values. He said he’d like to see the formula the town used to determine those values. He also asked about the timeline before properties’ new values were set in stone and could not be challenged or changed.

“Is it the town’s intention to run out the clock or do we have a say?” he asked.

Weed said that people impacted, and who have concerns, definitely have time to schedule an informal meeting with his office before the official clock starts ticking.

“The town sent out 3,500 assessment change notices last week,” Weed said. “The letters are the first step of the process.”

Generally speaking, Weed said the notices traditionally tend to come right before taxes are due. However, he wanted more time for people to respond, though that wasn’t clearly expressed in the letter, according to Sprague.

The numbers don’t become final until August when taxes are committed. That is when the formal hearing appeal time begins. After that, people have 180 days to prove to the town that its assessment of their property was a mistake.

“We’re just at the discovery phase, trying to get the values as close as we can with the information that we have,” Weed said.

During this phase, people can come in and talk to him about it if they make an appointment.

The state has benchmarks for minimum standards and the assessments must be within 35% of market value, Weed said.

“If we hadn’t done anything this year, our quality rating would have been above that benchmark,” he said. “This was intended to re-equalize things.”

He said the last statistical update was 2021. The last full revalue was 2006.

Sprague said from what he was hearing, the letter hit people hard.

COUNCILOR COMMENTS ABOUT THE ASSESSMENT LETTER AND ASSESSMENT

“It really needed to be better explained. It was an alarming letter to go out,” Sprague said, addressing the assessor.

Council Chair Valerie Peacock stopped Sprague’s comments and said his comments had to be addressed through the town manager instead.

“In particular how they addressed commercial properties and lodging in particular where one property went up over 100%. I think that’s a failure that we hadn’t-that hadn’t happened over more years over a longer period of time because that’s a huge jump,” Councilor Earl Brechlin said, adding that lodging properties have built their rates already, building rates around what they thought the tax rates and structure would be for the year.

Brechlin wondered if that could be taken into account going forward. He hoped to make the appeals period as lengthy as possible.

Weed said he believes that he’s already talked to those property owners Brechlin mentioned and sent them a revised assessment.

“How do you establish equity in a town where every property is unique, right? Sometimes stuff just doesn’t fit in the model,” Weed explained.

Hochman said in 2021 a lot of people saw huge increases becuse of the length of time between revaluations.

“That jump was staggering,” Hochman said.

“I’m trying to give people as much time as I can to make this right,” Weed said. “My goal is to get things right.”

After tax commitment, there is 185 days to appeal.

Town Manager James Smith said they hope to come back to the council and have more of a quantitative assessment about the impact. He thinks there is real benefit to have people come in to the assessor’s office and make sure that the assessment is reflective.

HISTORY BEHIND THE NEED

During a financial report back in 2023, Gilbert had said that Steve Weed was suggesting a reassessment of all town property because it has dropped below 80% of the property value price and that every piece of land (and all dwellings) would be reassessed.

According to Gilbert, in order to receive certain state funding, school money, homestead exemption reimbursement, BETE reimbursement, and other funds, the town’s assessments must be at 91% of the state’s valuations.

There was a revaluation in 2021 that included all properties in the Town of Bar Harbor but that was a statistical update. This means that the assessor assumes that the base data on the land and buildings that the assessor already had has not changed and the valuations were just updated to market values.

“This assessment update is part of the Town’s ongoing effort to keep assessed values aligned with current market conditions, as required under Maine law. The law calls for assessments to stay close to full market value, specifically, between 70 and 110 percent. Since 2021, the Town has made regular town-wide updates to maintain that standard,” Weed explained Thursday morning. “This year’s update also marks a significant change: the replacement of base land and building pricing models that had been in place since the 2006 revaluation. While adjustments have been made in the years since, the underlying valuation structure had not been fully updated. This effort ensures that the town is using current models instead of relying on blanket percentage increases. This year’s approach is more precise and tailored to actual property data and market trends and allow for future updates to be performed more easily.”

All 3,816 properties in Bar Harbor were reassessed. Part of this year's adjustment was replacing the outdated pricing models so a reassessment on all properties was necessary to implement this, Weed explained Thursday.

HOW ASSESSMENTS AND MILL RATES WORK

“The mill rate is a dollar per thousand of value that we need to collect to fulfill the town budget,” Southwest Harbor Assessor Matt Caldwell explained to the Southwest Harbor Select Board in September 2023.

A mill rate is another name (used by towns and cities) for a tax rate. It is used to calculate property taxes so that they can be shown as a dollar amount for every $1,000 of assessed property value. It is sometimes spelled with one L, sometimes two.

If a property owner owns a property in a town with a mill rate of 20, then they’d pay $20 in taxes for every $1,000 of the property's assessed value. For a mill rate of 10, they’d pay $10 for every $1,000, and so on.

When a property’s assessment changes, then the taxes for that individual property might change.

If a town’s budget changes, that also impacts how much a property owner might have to pay for the ownership of their property each year. That makes a town’s assessment a foundation for boards, warrant committees, finance directors, and town managers to use as they create the town’s fiscal policies and determine what services to fund.

A property’s assessment, just like a town’s mill rate, influences how much taxes you pay, but also what services you support.

HOW ASSESSMENTS ARE DETERMINED

The assessment process can sometimes depend on what sort of staff and expertise a town has. Some hire outside evaluators. Some use assessing staff.

The assessor or evaluator looks at town properties, inspects them, analyzes them. Things that might impact your property’s assessment include where it is (not just the town, but where in the town), the real estate market, its size, if it has special amenities like a pool, a garage, shorefront, etc.

Bar Harbor’s new page on its website specifies three approaches:

“The sales comparison (market) approach, values a property using recent local sales of similar, comparable properties.

“The cost approach calculates the cost to replace a particular property, then adjusts the cost for age, wear, and condition to determine the value of that property.

“The income approach determines the valuation based on the potential future income of the particular property and is limited to only income-producing properties.”

WHAT TO DO IF YOU DO NOT AGREE WITH YOUR BAR HARBOR PROPERTY’S ASSESSMENT

While throwing the town’s letters into a cauldron or crying might be cathartic, Weed suggested that people make an appointment with his office first to talk about the appraisal. Something might need to be tweaked, he said, adding that he’s already tweaked one assessment.

People can debate the appraisals, in part, by getting appraisals done themselves and meeting with the town’s assessor. They can also go before the town’s board of assessment review and ask for a property abatement.

According to the town’s website, “The fact that a property tax is ‘too high’ is not grounds for abatement. Town and school budgets determine the total amount of taxes that must be paid. The assessor does not establish the budget or collect the taxes. Property tax assessments do, however, determine how that total tax is shared among the property owners. Maintaining equity among taxpayers is a major responsibility of the Assessor's Office. The maintenance and analysis of sales information is important to determine the accuracy of assessments.”

The first step would be to call the assessor’s office and set up an informal discussion at (207) 288-3320 or email assessor@barharbormaine.gov.

LINKS TO LEARN MORE

https://www.barharbormaine.gov/204/Abatement

For questions regarding your assessment, please contact the assessing office at (207) 288-3320 or email assessor@barharbormaine.gov.

To look up your property on the assessor’s database, go here.

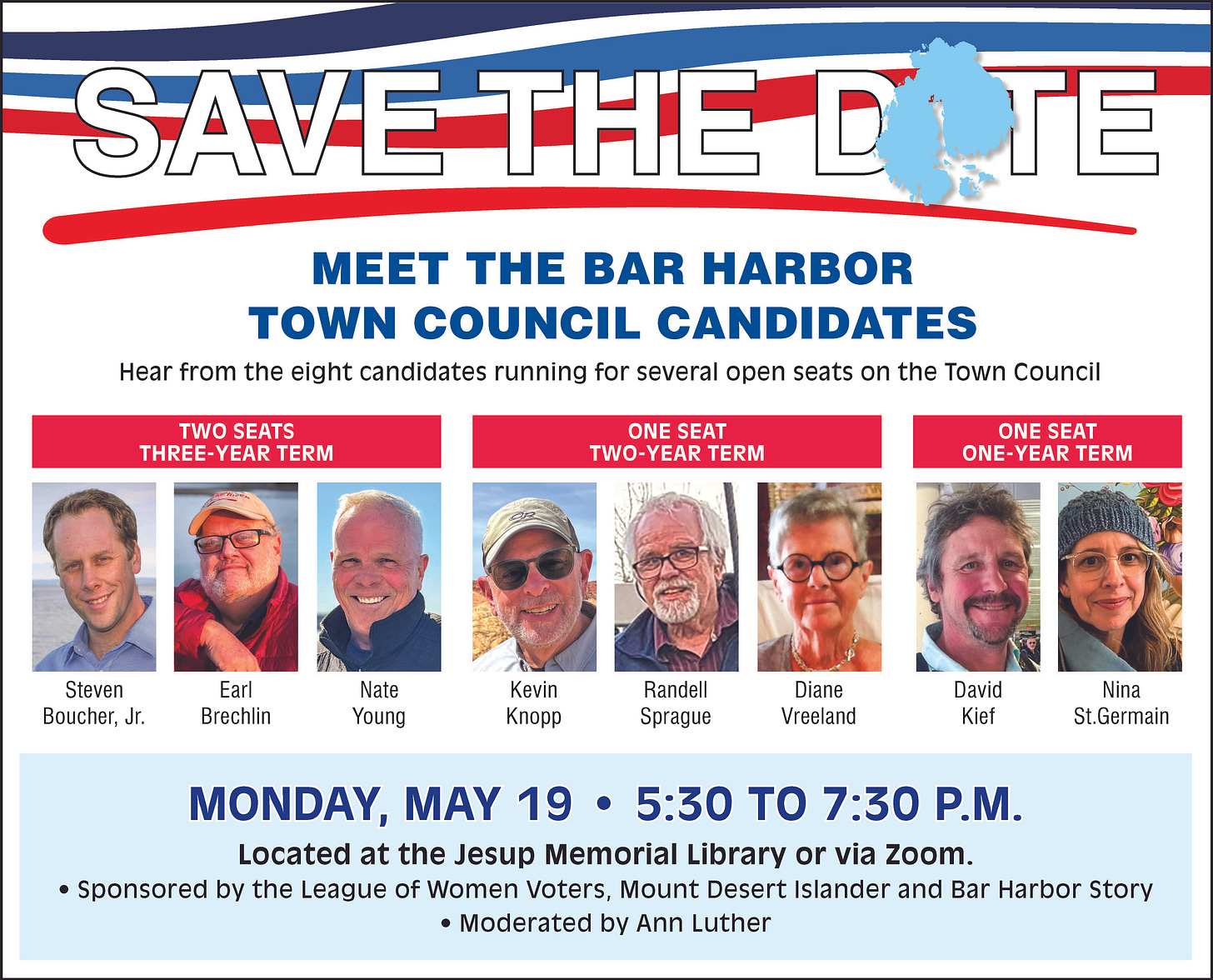

UPCOMING FORUM

UPDATE FOR THE WARRANT COMMITTEE ARTICLE!

Our warrant committee article, which you can find here, has been updated with the final candidate’s response. We hope you’ll check it out again or you can just go to the added candidate’s profile here.

All our local election coverage is here.

All our briefs are on a dedicated tab here.

UPDATE: Immediately after posting this article on Substack, we found a small glitch in the LINKS TO LEARN MORE sections. We’ve cleaned that up immediately because it was ugly. It’s not a real correction, but we thought we’d note it for transparency.

Follow us on Facebook. And as a reminder, you can easily view all our past stories and press releases here.

If you’d like to donate to help support us, you can, but no pressure! Just click here (about how you can give) or here (a direct link), which is the same as the button below.

If you’d like to sponsor the Bar Harbor Story, you can! Learn more here.

Do towns in Maine have any kind of homestead property tax abatement for primary residences? We have a house in Mt Desert where our son lives year round. He works in SWH. But it is a "second home" for us. So I would not expect any kind of abatement. However where our primary home is there is a city ordinance that caps the amount a tax bill can rise in a year to 4% - no matter what the assessment may go up to. It has helped many long time residents afford to stay in their homes.

Yay, my house has tripled in value over 10 years! Boo, now I have to pay taxes on the value... People really need to quit the whining and face reality. Enjoy living in an awesome place where we have one of the best parks in the world and unlimited potential to earn money.