Residents Worry They'll Be Taxed Out of Bar Harbor Homes

Town Council Recommends Budget With Manager's Tweaks

BAR HARBOR—Two men stood before the Bar Harbor Town Council Monday night and one after the other pled for tax relief. They were the only people to speak at the public hearing.

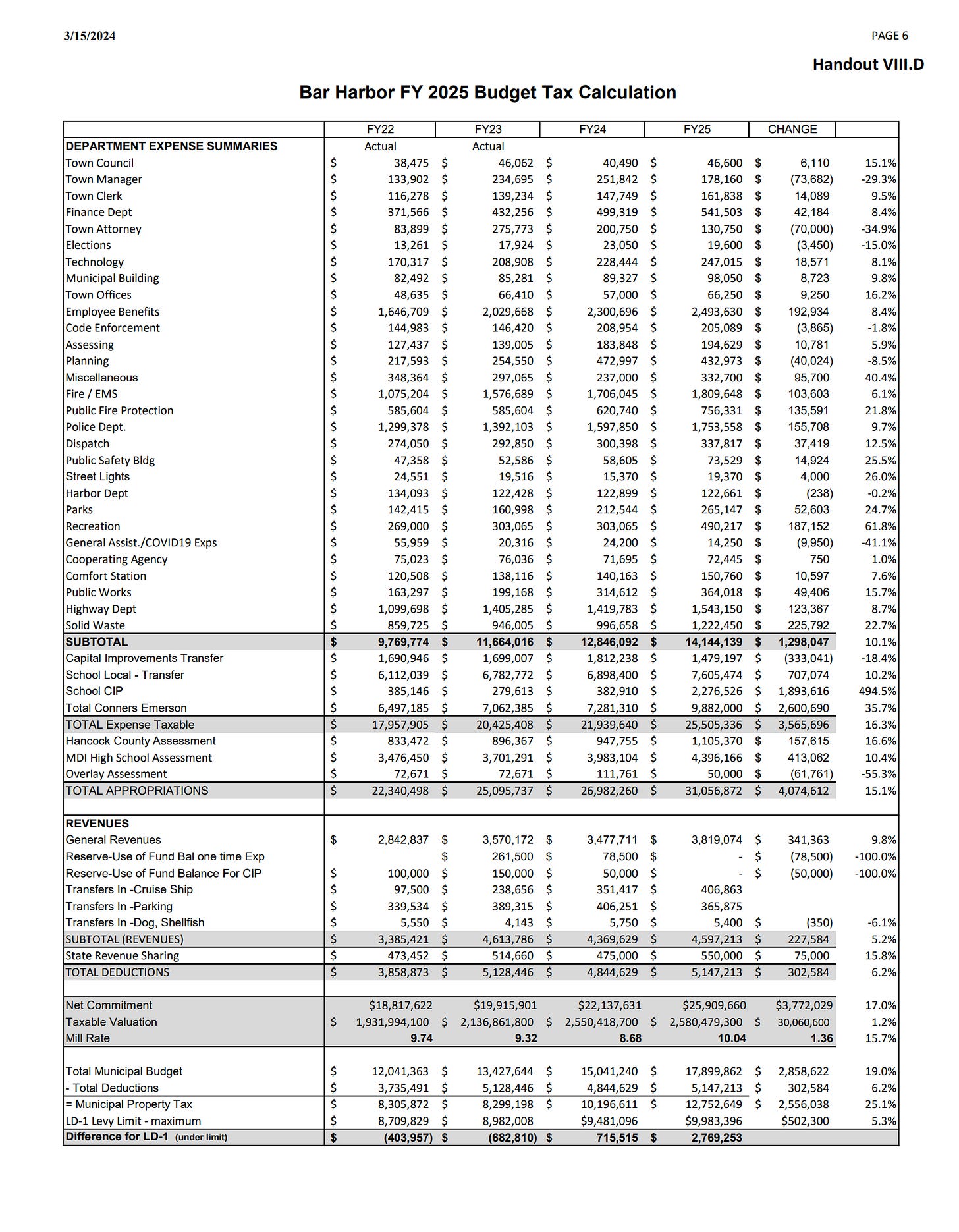

The Council unanimously adopted Town Manager James Smith’s suggestions, which tweak the 20% increase in appropriations this year down to approximately a 15.1% increase.

But those are percentages.

In more concrete terms, if the voters pass the $27 million municipal budget and $8.8 million school budget as is in June, the median home’s tax bill will increase an additional $711 this year rather than $935. According to the town, a median home in Bar Harbor has a value of $522,350.

Kevin Knopp stood before councilors during the public hearing and said, “My wife and I got out a lot of our old property tax statements. I thought I’d throw some numbers at you. It’s easy to talk in percentages.”

In 2020-2021, they paid $2,290. This year they paid $6,400.

“That’s a 115% increase in three years,” Knopp said.

Those numbers were the property tax on the couple’s downtown Bar Harbor home, which had been assessed to a higher value.

“That’s the biggest percent increase I’ve ever heard of any town anywhere,” Knopp said. “If you had gone up at 20%, my base keeps growing. Twenty percent would have put me at $7,680. Okay, 15% might put me at $7,400. That’s a lot of money from four years ago.”

Another home on Ledgelawn Avenue, currently assessed at $546,400, increased from an annual property tax of $4,084 in 2020 to $4,743 in 2023. A home on School Street, currently assessed at $755,600 increased from an annual property tax of $5,660 in 2020 to $6,559 in 2023. Those years represent fiscal years. If the voters approve the budget with no changes at the June town meeting, the School Street home would increase by approximately $1,000 to $7,586, and the Ledgelawn home would increase by $743 to $5,486.

“If it goes from 20% from here on, I’d be paying, by 2026-2027, $11,000,” Knopp said. “At a time when we’re trying to make housing affordable. If I owned my house and I was renting it out, I’d have to cover those expenses to the renters”

For Knopp, he said he hears that the justification for the budget as it is is that the community expects the services.

“Who expects it? Me? The community? Or the tourists?” Knopp asked of the services. “We’re subsidizing all these people’s vacations. We’re a small community. We can’t keep doing this to ourselves. Do you want to make it better for the visitors at the same time you’re killing the community?”

Taxes on homes in Bar Harbor are dependent on assessment of the homes, which is determined by the town and has to be tweaked when the market value of the properties within the town change. Coastal communities, tourist communities, and communities abutting national parks often have homes that are assessed at higher values. Bar Harbor’s last assessment was in 2023.

When the market value on property increases, the sale ratio changes. When those market values change, the compliance also changes. In a 2006 letter to the Mount Desert Islander, Assessor Steven Weed wrote, “The town does not control the real estate market; however, we are required by state law to keep assessments within a certain percentage of ‘market value.’ The minimum allowed ratio is 70 percent; the maximum is 110 percent.”

Later in the Council meeting, Vice Chair Gary Friedmann blamed short-term rentals and employee housing for driving up housing costs in Bar Harbor. Home prices throughout the country saw double-digit price growths from 2019 to 2022.

Knopp was not the only member of the public who spoke to the Council.

John Norwood, a lifelong resident of Bar Harbor, gave an ominous warning. “I realize that you need to raise this budget, but is this going to be something that’s going to go on every year from now on?”

“At this rate, you’re driving out people like me who has lived here all their life and has a regular job,” Norwood said. “There’s a lot of people who can really not afford these huge increases.”

Smith’s million-dollar proposal to lessen the total increased burden on Bar Harbor tax payers for the next budget, which begins in July 2024, was detailed Tuesday night as well as in the packet of materials for the Town Council.

Smith suggested eliminating a proposed technology position, reducing a line item that has to do with fire hydrants and reducing the Jesup Library funding request to $304,000. During the Council meeting, many councilors expressed their concerns about not funding the library at its full request, which was an increase from $280,000 to $330,000.

Last year, a split Town Council approved the Jesup Memorial Library’s service enhancement request of an additional $119,320 on top of its yearly funding, which raised that level to $280,000. The Council used ARPA money to fund that request. ARPA funds were part of the March 2021 COVID-19 relief passed by Congress.

Like the town’s Warrant Committee, which will make formal recommendations to voters about the proposed budget, Smith targeted multiple capital improvement line items for a reduction of almost $600,000. By bringing interest from sold bonds into the budget, the town “reduce(s) the dependency on property taxes to service these debts.” That idea came from Finance Director Sarah Gilbert, he said Tuesday night. He also suggested $56,000 in reductions to the Conners Emerson School budget.

Many elements of the budget can’t be tweaked. Those include the MDI High School budget allocation, once that is passed April 3, the Hancock County Commissioner’s budget, and the AOS 91 budget. Those elements also include bonds for the town’s new school, solar project, and infrastructure projects. However, Smith, said, they are trying to find ways to postpone the bulk of some of those bond payments.

Councilor Kyle Shank asked Smith and Gilbert about the specific increase in bond payments for the next budget FY2026, which starts in July 2025.

Currently, principal and interest for the 25-year bond would be just under $4 million for FY2026. Fiscal year 2025 is just under $2 million, which is just interest, Smith said. Those are rough estimates because the bond has not yet been sold. Once the bond is sold and the town is into its second year, it typically is the last increase.

Because the bond market is not favorable currently, town staff is looking at ways to get into the higher cost bond at a more competitive rate.

“Sarah’s watching that very closely. I think she’s having daily conversations with the bond manager,” Smith said.

This is our first in a series of stories from last night’s Council meeting.

LINKS TO LEARN MORE

Town Council order passed March 4 tentatively adopting the budget and scheduling the public hearing

Video of February 26 Warrant Committee meeting on the budget Part I Part II

Video of February 27 joint Warrant Committee/Town Council meeting on the budget

To view the detailed budget, visit the Budget page or contact the Town Clerk’s office at 207-288-4098.

Disclosure: Shaun Farrar of the Bar Harbor Story was elected to the Warrant Committee last year. We are married. We do not always agree on everything, which makes life a bit more fun sometimes.

Has the town council placed the spending cart before the revenue horse?

Why is the town investing in a costly new elementary school when enrollments have declined over the past decade and young people cannot find affordable housing in town? Does the town council's budget assume the older town residents plan to start new families?

Shouldn't the town first focus on developing affordable housing for young families before building a new school? That would increase the tax base, help pay for a new school, generate enrollments for a new school and alleviate pressure to raise property taxes on current residents.

Unlike the premise in the movie "Field of Dreams," if you build it they will come, elementary age children will not come to a new school in Bar Harbor if young parents can't find affordable housing.

More cruise ships and freedom to AirB&B would fix the high taxes right?