Warrant Committee Weighs Budget Recommendations, Slightly Divided on YMCA Funding

School Subsidy Should Be Better Than Expected

The Bar Harbor Story is generously sponsored by Paradis Ace Hardware.

BAR HARBOR—The entire warrant committee went over the recommendations from the public works and public safety subcommittees, two of its four subcommittees, February 10.

Each subcommittee looks at revenue, expenses, and capital projects.

Subcommittee chairs “will either recommend adoption of portions of the budget as presented to us last month or they’ll recommend a difference,” Bar Harbor Warrant Committee Chair Christine Smith said, “and we’ll bring those differences forward to the town council when we have our joint meeting with them.”

It’s a first step in a multi-step recommendation process that refines the budget and allows both the town council and warrant committee to have recommendations on the town documents presented to voters who have final approval in June. That proposed budget will be approved and also can be tweaked in June by the voters at town meeting.

Both subcommittees presented Monday night involved funding from cruise ship revenues, which are currently creating some changes in the town’s budget.

On Tuesday, February 25, the warrant committee is scheduled to present its recommendations to the town council at 6:30 p.m.

Subcommittee meetings continue this week.

PUBLIC SAFETY SUBCOMMITTEE

Public Safety Subcommittee Chair Eben Salvatore said his committee had met twice so far and plans to meet another time.

“We were able to come to terms on most of the budget,” Salvatore said.

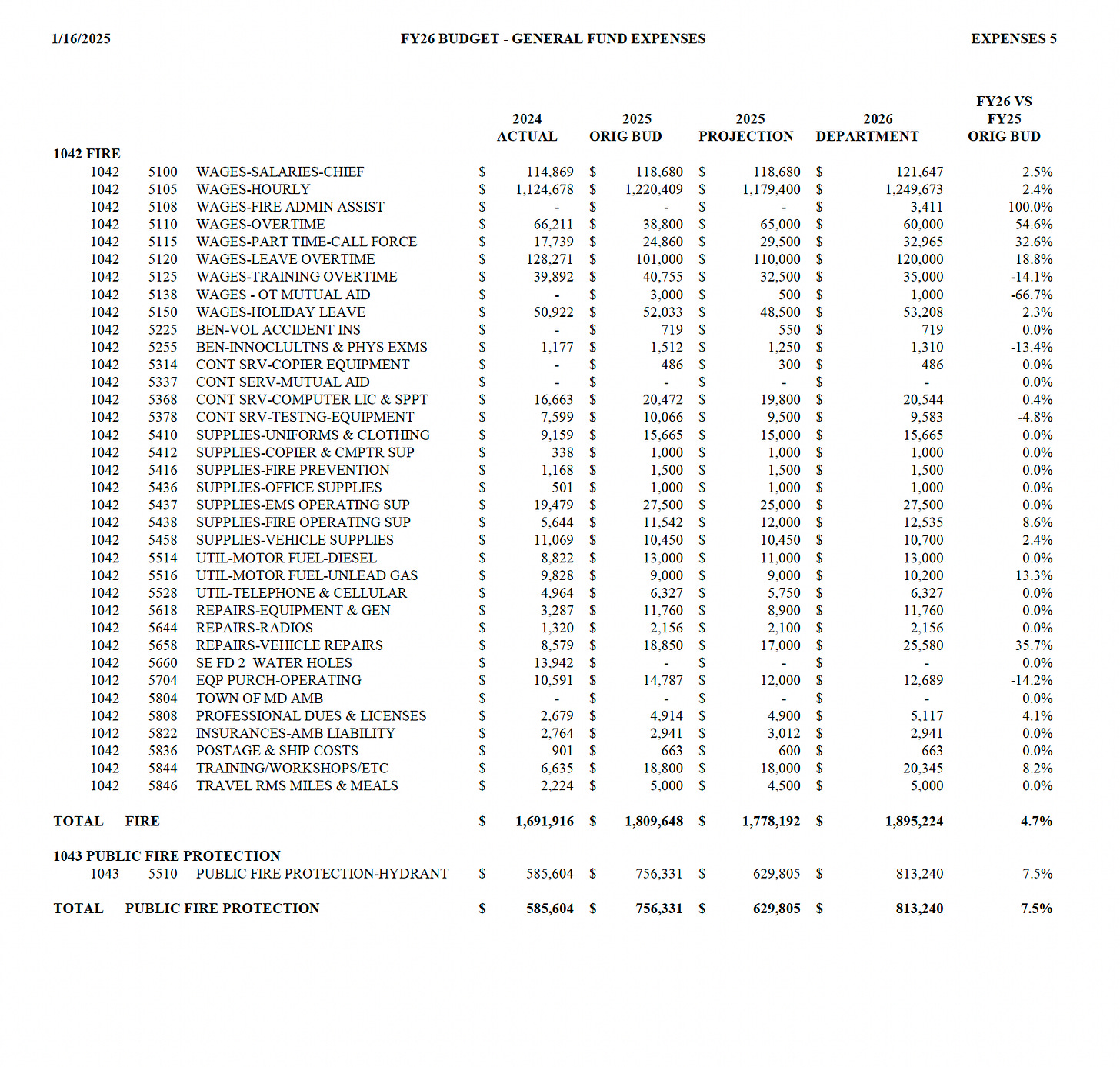

The cruise ship tab and at least one item in police expense were still pending. The group unanimously approved multiple aspects of the expenses for fire, ambulance, and dispatch services.

“We definitely dissected” some of the items, Salvatore said, including budget items impacted by mutual aid agreements with the town of Mount Desert. He also noted that streetlight expenses are down 75% because of the conversion to LED lights.

They do not have the updated cruise ship fund tab, Salvatore said. It is being amended and could potentially change some of the line items. If so, the items may be amended.

“We need to see it to recommend it and you need to see it to vote on it,” Salvatore said of the cruise ship fund section of the proposed budget.

New warrant committee member Vicky Smith asked about the increase in overtime wages and seasonal wages.

Proposed public safety enhancements:

Replacement of turnout gear for the Fire Department ($76,000)

Updated radio equipment for Dispatch ($56,000)

New FD command vehicle ($70,000)

Police Department cruiser replacements with equipment ($146,000)

Maine Public Employees Retirement System 3C funding for PD ($84,000)

PARKING FUND

“A cool million in this budget,” is going right to tax relief, Salvatore said. That million will offset taxes this year.

There is $100,000 in the budget for planning and understanding projects in Bar Harbor prior to going into a project.

“It’s to throughly vet a project before” the taxpayers are asked to take out a bond or something similar. He referenced the Higgins Pit project. That project was meant to offset approximately 25% of the town’s carbon output by building a solar array at Higgins Pit, a town-owned property. That project had a 2021 feasibility study and was approved by voters in 2022. That approval came in the form of a $4.35 million bond.

But since then, costs have risen beyond initial projections, prompting concerns for some. Because of the site of the town-owned property, for the project to go forward, wetland remediation would have to be done, a road would have to be built, and the project itself has been downsized. The council asked for Town Manager James Smith to pursue other options that would achieve the same objective in May 2024.

PUBLIC WORKS SUBCOMMITTEE

Public Works Subcommittee Chair Allison Sasner presented that subcommittee’s recommendations to the warrant committee.

There are many elements in the budget related to Glen Mary (such as cleaning supplies and chemicals) that are still in the budget. If those are not used this year, those moneys will go into the general fund.

The subcommittee recommended the requested amount for multiple agencies rather than the flat-funded amounts recommended by the town manager. It recommended giving the full amount to the Bar Harbor Band, requested amount of Bar Harbor Chamber of Commerce (community events), and the Jesup Memorial Library’s full request of $312,756.

The subcommittee recommended to approve $150,000 for the MDI YMCA, a flat funding.

“The 33% increase seemed steep,” Sasner said of the Y’s ask.

Christine Smith amended the motion to $154,500, a 3% increase. Member Carol Chappell did not feel a 3% increase was enough.

It was passed unanimously. Chappell then moved that the committee recommend $175,000 be given to the YMCA for programming.

“They had no explanation about why they needed more,” Vicky Smith explained about why the subcommittee didn’t support the extra ask.

Eleven members voted against the additional increase for the MDI YMCA, two voted in favor (Chappell and Barbara Dunphey), and two recused (Steven Boucher and Salvatore).

The subcommittee had multiple recusals for votes on non-profit requests. The board discussed recusals and abstentions and looked for definitive answers about when to abstain on boards that are only advisory—such as the warrant committee, a recurring request since this summer.

Because they are board members, Salvatore and Boucher recused themselves in the discussion and vote on the Bar Harbor Chamber request to help fund three events and the MDI YMCA discussion and vote. Because she is a board member, Christine Smith recused herself for the Jesup Memorial Library discussion and vote.

Proposed infrastructure improvements:

Road Improvements and Repairs ($1,400,000)

Sidewalk construction and maintenance ($300,000)

Heating system replacements highway municipal facilities ($300,000)

Gangway upgrades - half of which is expected to be paid for by a grant ($60,000)

Town pier fisherman’s hoist ($35,000)

Proposed community and recreation investments:

Playground equipment upgrades ($20,000)

Restroom renovations across four facilities ($265,000)

Park fountains ($30,000)

Bikeway and pedestrian connections and improvements ($30,000)

Continuation of Safe Streets for All program ($50,000)

Sustainable tourism & resources planning ($140,000)

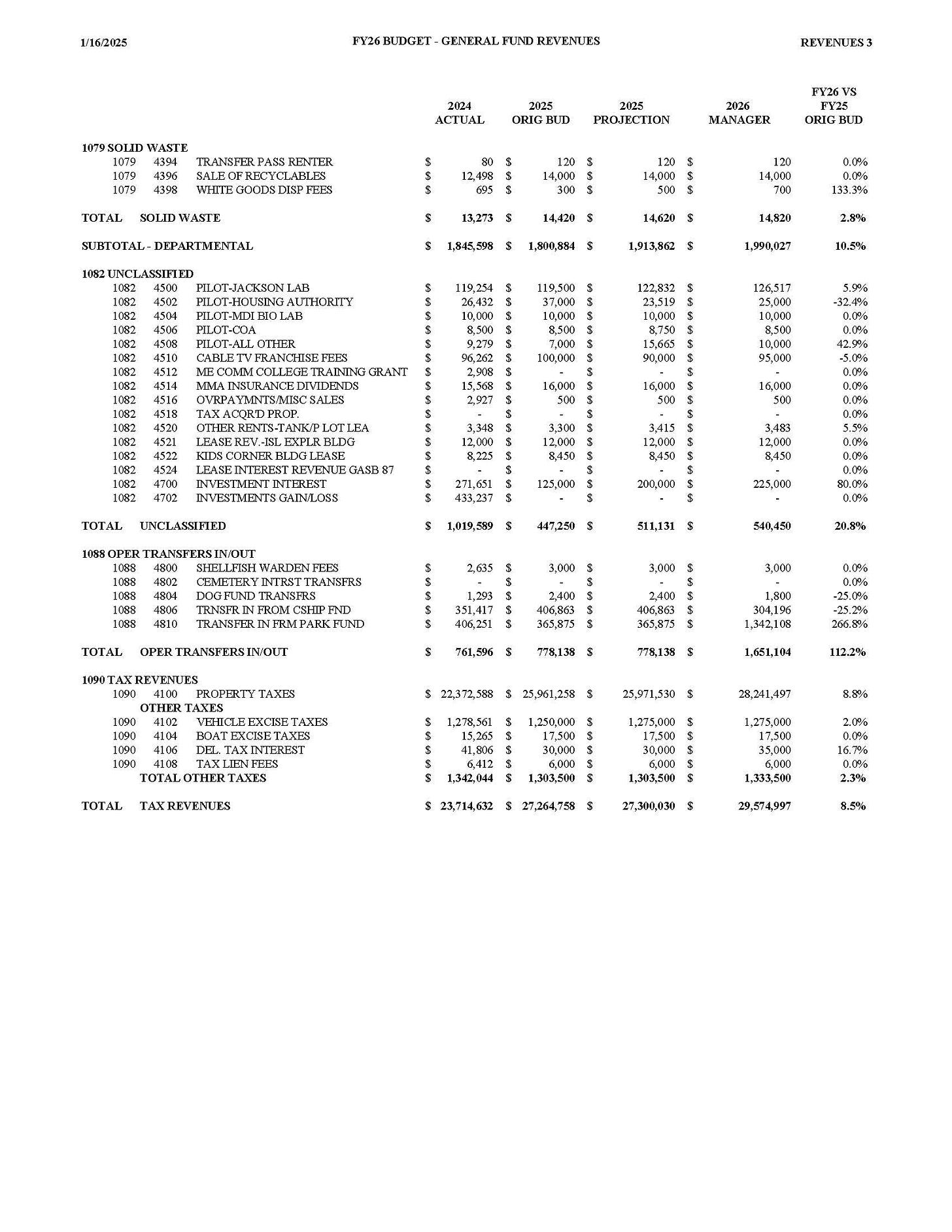

CURRENT TAXES

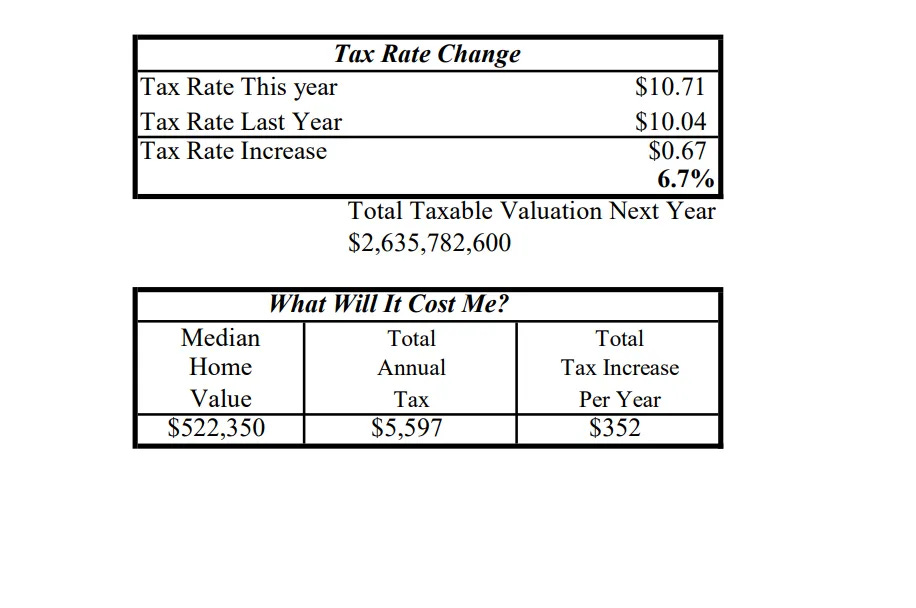

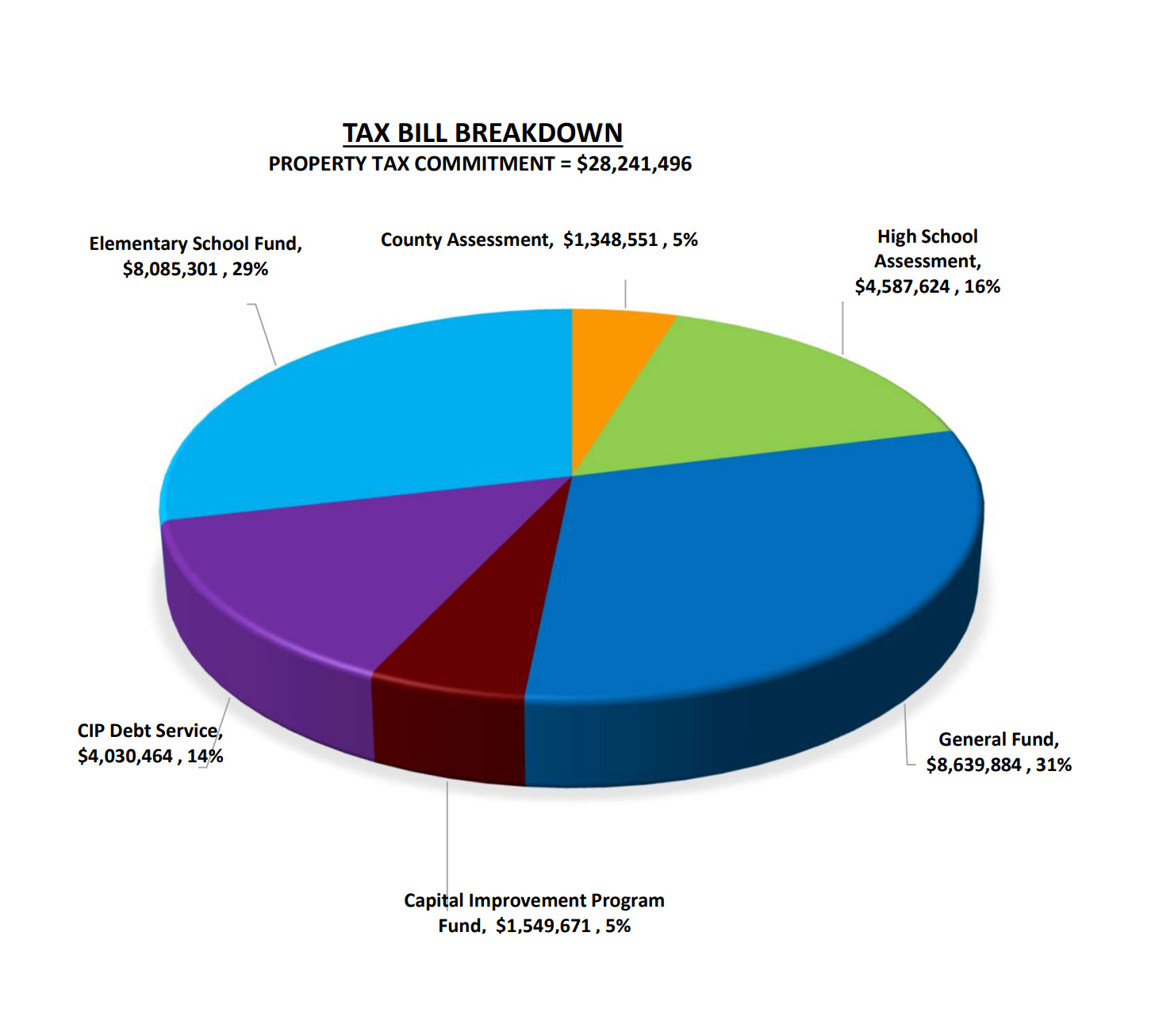

The current tax rate is $10.04. The proposed rate is $10.71. For a property owner with a median home value of $522,350, the total annual tax would be $5,597 a year. That is an increase of $352 this year. The total proposed budget is approximately $28.2 million.

THE BAR HARBOR BUDGET ITSELF

In a January 17 memo addressed only to the town councilors, Smith wrote, “The FY2026 budget reflects the Town of Bar Harbor’s strategic commitment to balancing fiscal responsibility with the delivery of essential services and investment in critical infrastructure.”

It’s a message repeated throughout the budget documents, often called a “binder” because the hard paper copy is presented to councilors and warrant committee members in large plastic binders. The budget is also available online.

The voter-passed school bond and infrastructure bonds are impacting this year’s budget.

“In FY2026, the budget accounts for the full financial obligations of both bonds, principal and interest. To stabilize the tax mil rate amid these increased obligations, the FY2026 budget proposes utilizing parking revenues for property tax relief,” Smith wrote.

It’s a bit more than that, too.

“Additionally, we are recommending some use of the parking fund balance as a stopgap measure to further mitigate the tax burden on property owners. These measures are designed to provide immediate tax relief while supporting long-term fiscal sustainability,” Smith wrote.

SCHOOL BUDGET CHANGES POSITIVELY

At the Bar Harbor School Committee meeting the same night, School Superintendent Michael Zboray presented a tweaked school budget to committee members.

“We got more money from state subsidy, so Nancy and I feel comfortable” changing the amount coming from the state, Zboray explained.

It was now a town appropriation of $7,995,301.

“That’s very exciting,” Chair Lilea Simis said.

The proposed school budget had increased by $479,828, or 6.31% to $8,085,301.

Now, it is the more modest increase of $389,828, or 5.13% to $7,995,301.

That state subsidy amount is not yet a sure thing. It could be as high as $847,000. The budget is calculating a more conservative $825,000 which is $90,000 more than the originally figured $735,000. The Conners Emerson School Board has not yet approved the reduced budget due to the higher than expected state subsidy.

BUDGET TERMS TO KNOW

MIL RATE or MILL RATE

“A mill rate is a tax rate used to calculate local property taxes, expressed as a dollar amount per $1,000 of assessed property value. For example, a mill rate of 20 means a property owner pays $20 in taxes for every $1,000 of their property's assessed value,” via Investopedia.

WHAT IS A BOND?

“State and local governments issue bonds to pay for large, expensive, and long-lived capital projects, such as roads, bridges, airports, schools, hospitals, water treatment facilities, power plants, courthouses, and other public buildings. Although states and localities can and sometimes do pay for capital investments with current revenues, borrowing allows them to spread the costs across multiple generations. Future project users bear some of the cost through higher taxes or tolls, fares, and other charges that help service the debts,” via Tax Policy Center.

It continues, “General obligation bonds are backed by an issuer’s “full faith and credit,” including its power to tax. Bonds may also be secured by future revenue streams, such as dedicated sales taxes or tolls and other user charges generated by the project being financed.

“General obligation bonds typically require voter approval and are subject to limits on total debt outstanding. Revenue bonds and bonds secured by anticipated legislative appropriations are not subject to these requirements or limits. In 2018, roughly 58 percent of state and local issuances were revenue bonds, 36 percent were general obligation bonds, and 6 percent were private placements.”

WHAT IS A FISCAL YEAR?

“A fiscal year (FY) is a 52- or 53-week (or, alternatively, a 12-month) period that companies and governments use for taxing or accounting purposes. Fiscal years are most commonly used by entities that depend on a cycle that doesn't correspond to the calendar year,” according to Investopedia.

In Bar Harbor, the fiscal year begins on July 1 and ends on the last day of June. The budget being worked on is for fiscal year 2025-2026 and is often referred to as the FY26 budget.

WHAT IS THE STATE SUBSIDY REFERRING TO IN MAINE?

“Essential Programs and Services are defined as the programs and resources that are essential for students to have an equitable opportunity to achieve Maine's Learning Results. The EPS formula determines both the state and local share of funding needed for each School Administrative Unit (SAU) to have Essential Programs and Services. The funding formula is designed to respond to student needs and is based on years of research and information gleaned from high-performing, cost-effective school units,” according to the State of Maine.

Factors that determine the local share (how much a town might receive for its school budget) are influenced by the town’s valuation, “percentage of students by town within a combined district used to determine the distribution of total allocation by town,” and the “mil expectation set by calculated recommended funding level each year.”

“The determined Essential Programs and Services for the SAU (minus) the required Local Share* of those costs (equals) the State Share,” the state writes.

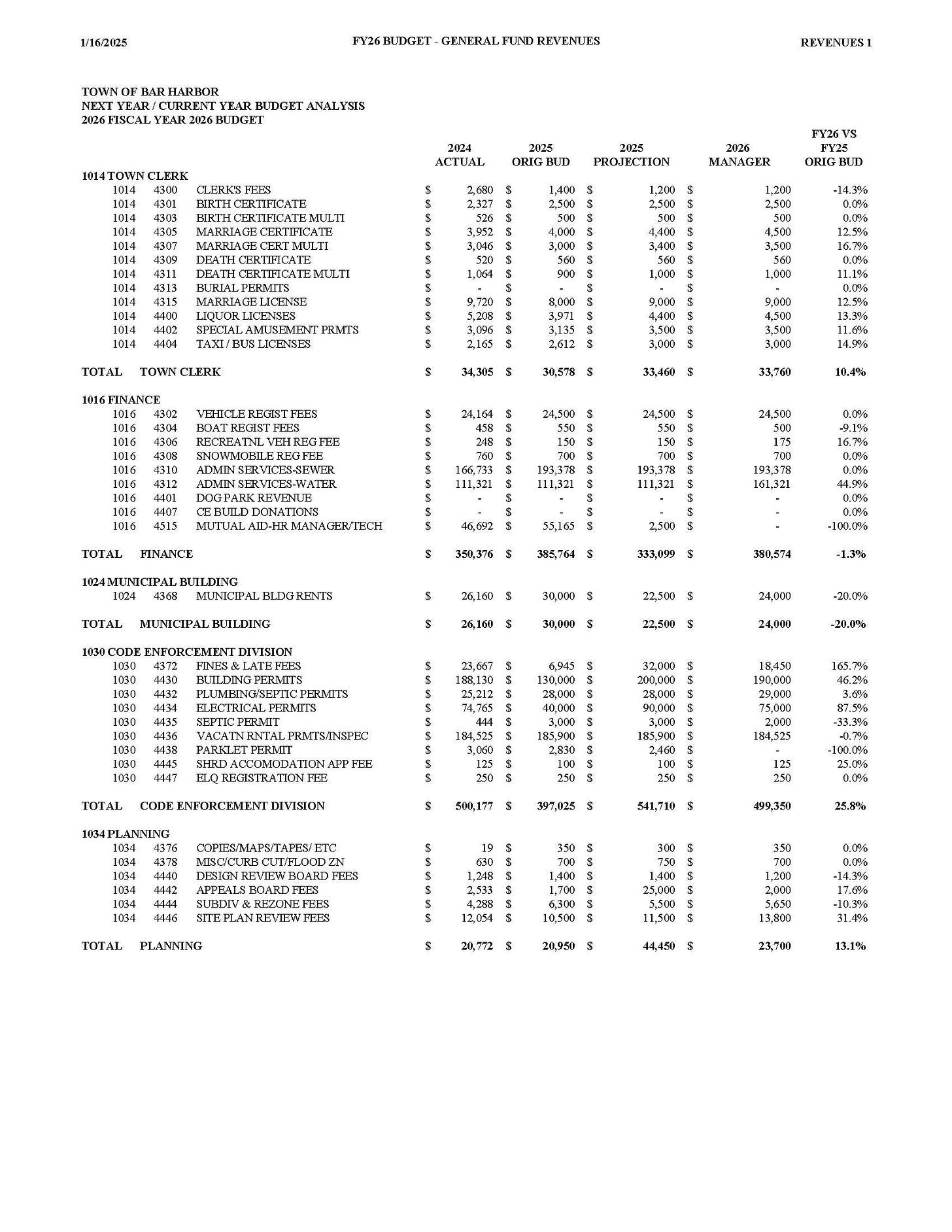

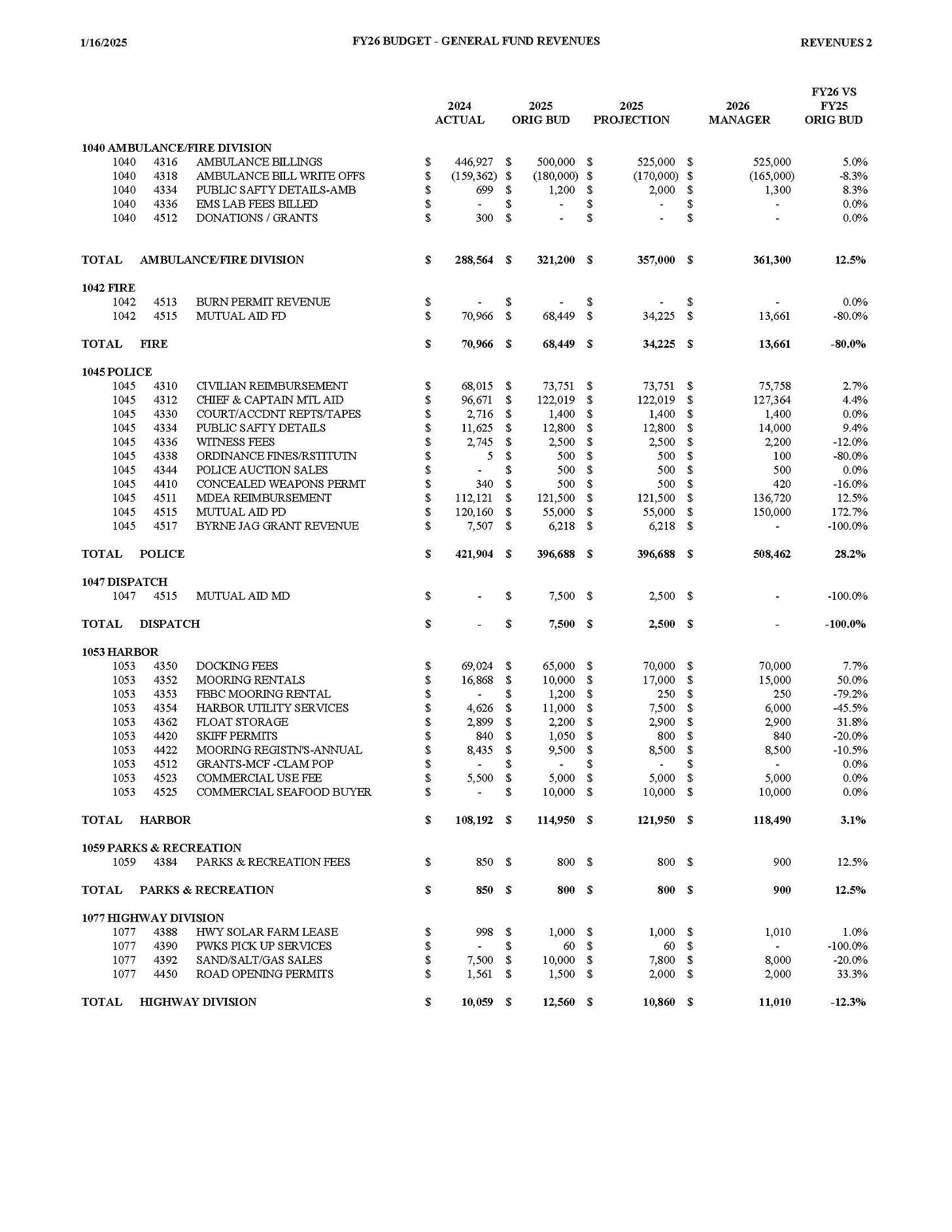

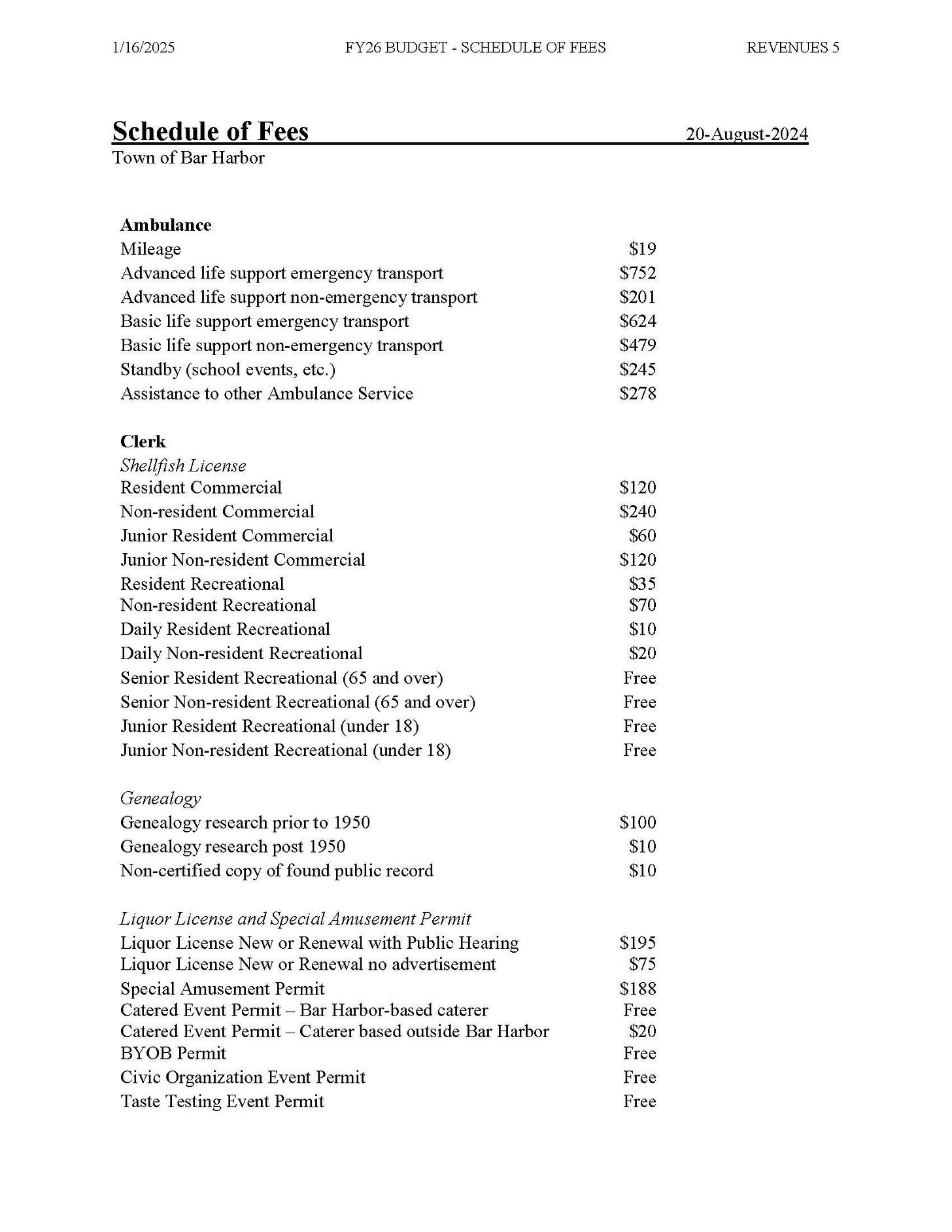

AMBULANCE FEES, CLERK FEES, POLICE FEES, HARBOR FEES, PARKS AND RECREATION FEES AND OTHER REVENUES

EXPENSES DISCUSSED AT THE MEETING

WARRANT COMMITTEE MEETINGS SCHEDULED

Warrant Committee General Government Subcommittee, February 12, 2025, 9:00 a.m. - 11:00 a.m.

Warrant Committee Education Subcommittee February 12, 2025, 4:30 p.m. - 5:30 p.m.

Warrant Committee, February 13, 2025, 6:30 p.m. - 8:30 p.m.

Potential meeting (tentative and not noticed as of press time): Warrant Committee Public Safety Subcommittee, February 14, 10 a.m.

All meetings are on the top floor of the municipal building on Cottage Street.

LINKS TO LEARN MORE

For a deeper dive to the budget as a while via the first presentation, check out the article below:

https://www.barharbormaine.gov/273/Warrant-Committee

https://www.townhallstreams.com/stream.php?location_id=37&id=64396

FY26 Budget

Presented by the Town Manager and Finance Director January 23, 2025

Disclosure: Shaun Farrar is an elected member of the warrant committee. Because of that, he hasn’t proofread this article. Please be kind if I have a lot of typos. We are just a team of two over here on the best of days. Also, let me add the disclosure that I did last year: Although we are married, we do not always think the same way on all things and we have entirely different brains.

If you’d like to donate to help support us, you can, but no pressure! Just click here (about how you can give) or here (a direct link), which is the same as the button below.

If you’d like to sponsor the Bar Harbor Story, you can! Learn more here.